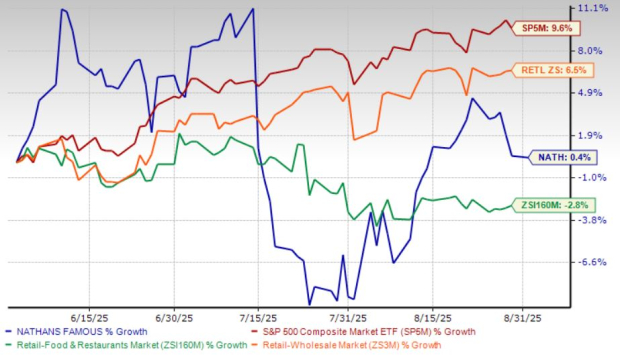

Nathan’s Famous, Inc.’s NATH investors have been experiencing some short-term gains from the stock of late. Shares of the branded licensor, wholesaler and retailer of products, which is currently operating from Jericho, NY, have gained 0.4% in the past three months against the industry’s 2.8% decline. However, in the same time frame, the stock underperformed the sector and the S&P 500’s 6.5% and 9.6% gains, respectively.

A major development of NATH in recent months includes the announcement of its promising first-quarter fiscal 2026 results in August. The company reported a robust improvement of the top line in the fiscal first quarter. However, the bottom-line results and performance of most of its segments were disappointing.

Per management, the quarterly results reflected strength in the Branded Product Program, where higher average selling prices drove revenue growth despite elevated beef costs. Franchise operations also benefited from new openings and higher sales across key venues. However, management noted weather-related softness at certain company-owned restaurants. NATH reiterated its focus on disciplined operations and leveraging brand strength to support long-term expansion.

NATH’s Three Months Price Comparison

Image Source: Zacks Investment Research

Over the past three months, the stock’s performance has remained strong, outperforming that of its peers like Ark Restaurants Corp. ARKR. However, it underperformed its other peer, Flanigan’s Enterprises, Inc. BDL. ARKR’s shares have plunged 35.1%, while BDL’s shares have gained 3.3% in the same time frame.

Despite several challenges within the restaurant industry, including rising food and labor costs, the favorable share price movement indicates that the company might be able to maintain the positive market momentum at present.

Nathan’s Famous specializes in marketing its Nathan’s brand via various channels, including company-owned and franchised restaurants, a product licensing program and a Branded Product Program. These multiple growth drivers reflect robust growth potential.

NATH’s Strong Fundamentals Weigh In

Nathan’s Famous continues to see strength in its Branded Product Program, which involves selling hot dogs and related products to the foodservice industry. In first-quarter fiscal 2026, this segment experienced notable sales growth, supported by both higher volumes and increased average selling prices that are partially correlated with beef markets. This demonstrates strong demand from foodservice partners and validates NATH’s ability to expand its brand reach beyond its owned restaurants. Importantly, this segment provides scalability as it leverages third-party distribution rather than being limited to company-operated stores.

Another tailwind for Nathan’s Famous is the steady progress in franchise development. Franchise restaurant sales increased year over year, royalties rose modestly, and eight new franchised locations were opened during the quarter. This expansion adds to recurring, asset-light revenue streams with relatively low operating costs for the company. Franchising strengthens NATH’s market penetration both domestically and internationally, while also diversifying its revenue base away from reliance on company-owned stores, which can be more vulnerable to local factors like weather or traffic fluctuations.

Nathan’s Famous maintains a stable and profitable operating structure, supported by consistent EBITDA and adjusted EBITDA performance. The company demonstrates the ability to manage cost pressures, such as fluctuations in beef input prices, while still delivering strong operating income across segments. This stable profitability provides a buffer against external headwinds and underpins NATH’s ability to invest in growth areas, such as franchising and product expansion.

Challenges Ahead for Nathan’s Famous

Nathan’s Famous continues to face two notable challenges that could weigh on its performance. The company remains highly dependent on Smithfield Foods for both supply and licensing revenues, creating concentration risk if that partnership were disrupted. At the same time, inflationary pressures and volatility in beef and other commodity costs, along with rising labor expenses, present ongoing margin risks that may not always be fully offset by price adjustments.

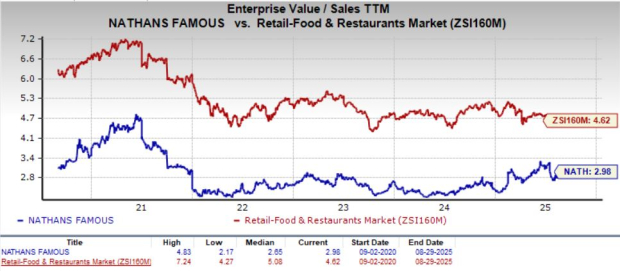

NATH Stock’s Valuation

Nathan’s Famous’ trailing 12-month EV/Sales of 2.9X is lower than the industry’s average of 4.6X but higher than its five-year median of 2.7X.

Image Source: Zacks Investment Research

Ark Restaurants and Flanigan’s Enterprises’ trailing 12-month EV/Sales currently stand at 0.1X and 0.3X, respectively, in the same time frame.

Our Final Take on Nathan’s Famous

There is no denying that Nathan’s Famous sits favorably in terms of core business strength, earnings prowess, robust financial footing and global opportunities. The stock’s strong core growth prospects present a good reason for existing investors to retain shares for potential future gains. New investors are also likely to be motivated to add the stock following the current uptrend in share prices.

For those exploring to make new additions to their portfolios, the valuation indicates superior performance expectations compared with its industry peers. It is still valued lower than the industry, which suggests potential room for growth if it can align more closely with overall market performance. However, if investors are already holding the stock, it would be prudent to hold on to it at present.

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is a little-known satellite-based communications firm. Space is projected to become a trillion dollar industry, and this company’s customer base is growing fast. Analysts have forecasted a major revenue breakout in 2025. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Hims & Hers Health, which shot up +209%.

Free: See Our Top Stock And 4 Runners Up

Ark Restaurants Corp. (ARKR): Free Stock Analysis Report

Nathan’s Famous, Inc. (NATH): Free Stock Analysis Report

Flanigan’s Enterprises, Inc. (BDL): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).