Navitas Semiconductor NVTS is a key player in the next generation of power semiconductors, driving innovation in GaN (gallium nitride) technologies. Its GaN business — branded as GaNFast, GaNSafe and GaNSense — is now a major growth engine. Investors are increasingly eyeing the GaN semiconductor device market, which is expected to grow at a compound annual rate of 6.1% from 2023 to 2028 (according to MarketsandMarkets). Leading tech firms like NVIDIA Corporation NVDA and Tesla TSLA are actively investing in GaN to power their fast chargers, servers and electric vehicle (EV) platforms. This validates GaN’s potential and encourages adoption.

With strong year-over-year growth, a widening footprint across mobile, EV, energy sectors and strategic global partnerships, Navitas is well-positioned to benefit from the accelerating demand for GaN semiconductor devices.

The company’s GaN business revenues grew over 50% year over year in 2024 amid broader semiconductor sector softness. The business is gaining strong momentum across multiple high-growth markets. In the Mobile & Consumer segment, it has achieved over 180 GaN charger design wins in 2024 and currently supplies all top 10 global smartphone manufacturers. Strategic partnerships with Transsion in Africa (potential) and Jio in India highlight Navitas’ expansion into emerging markets.

The company is ramping up new 80 – 120V GaN devices in 2025 to target the 48V DC-DC converter market. Within the Electric Vehicle sector, in 2024, Navitas secured its first design win with Changan Auto’s onboard charger, boasting 6kW/L power density and 96% efficiency. In Solar & Energy Storage, it launched its bidirectional GaN ICs – GaN BDS, in early 2025, whose first use case will be in solar microinverters (expected to ramp up in late 2025).

Navitas’ Global Competitors

Power Integrations’ POWI GaN business is gaining strong momentum, which contributed 15% year-over-year total revenue growth in first-quarter 2025. The company’s GaN portfolio includes InnoSwitch3, InnoMux-2 ICs, HiperPFS and Scale-2 Gate Drivers. Power Integrations is the only GaN supplier offering devices rated at 900V, 1250V and 1700V, giving it an advantage in grid-tolerant and high-voltage applications. In the automotive sector, the company achieved a significant milestone with its first-ever 900V GaN design win for a drivetrain emergency power supply at a major United States EV OEM. Power Integrations already has more than two dozen automotive designs in production, primarily in China, with broader traction expected in Japan and Europe.

STMicroelectronics STM is actively expanding its GaN technology as part of its broader power and discrete semiconductor portfolio. In first-quarter 2025, STMicroelectronics signed a development and manufacturing agreement with Innoscience to accelerate GaN development. This includes joint R&D and reciprocal use of front-end manufacturing capacity. The collaboration is designed to fast-track STMicroelectronics’ GaN power roadmap. Its GaN product line is still in the early commercialization and co-development phase.

NVTS’ Stock Price Performance

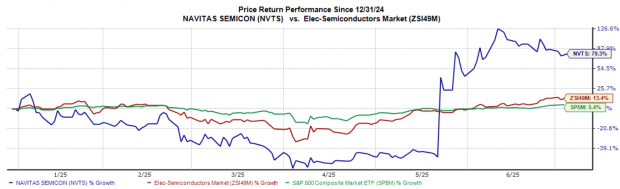

Year to date, shares of Navitas have surged 79.3%, outperforming the industry’s and S&P 500 composite’s growth of 13.4% and 5.4%, respectively.

Image Source: Zacks Investment Research

Navitas’ Valuation

NVTS stock trades at a forward 12-month price-to-sales (P/S) of 15.0X, significantly higher than the industry average of 7.5X.

Image Source: Zacks Investment Research

NVTS Consensus Estimate Trend

The Zacks Consensus Estimate for NVTS’ loss per share has moved south over the past 60 days.

Image Source: Zacks Investment Research

NVTS’ Zacks Rank

NVTS stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.5% per year. So be sure to give these hand picked 7 your immediate attention.

STMicroelectronics N.V. (STM) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Power Integrations, Inc. (POWI) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Navitas Semiconductor Corporation (NVTS) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).