Netflix NFLX, the streaming giant, has proven itself as a standout performer in the market with its stock skyrocketing by an impressive 40.5% year to date. This meteoric rise has outpaced not only the broader Zacks Consumer Discretionary sector but also many of its competitors in the entertainment industry. Such a triumphant march forward, however, faces headwinds in the form of concerns surrounding slowing user growth, a pivotal metric for investors in recent years. As the company braces for a potential slowdown, the burning question on everyone’s mind is whether Netflix can sustain its current momentum.

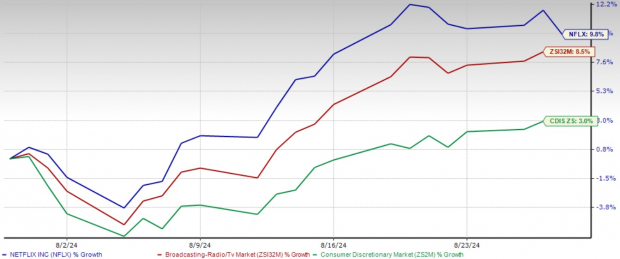

Year-to-date Performance

Image Source: Zacks Investment Research

Netflix Adapts to Overcome Growth Hurdles in Streaming

Netflix has employed a multifaceted strategy to bolster its market dominance despite concerns about sluggish user growth. By heavily investing in original content, the company has churned out a string of hit shows and movies that have captivated audiences and fostered customer loyalty. This commitment to top-notch programming has set Netflix apart in a crowded industry and justified its periodic price hikes to its loyal subscriber base.

Moreover, Netflix’s venture into ad-supported tiers has not only attracted cost-conscious consumers but also paved the way for new revenue channels. This strategic move has not only swelled subscriber numbers but also diversified the company’s revenue streams, potentially leading to more secure and predictable earnings in the future.

The company’s aggressive international expansion into untapped markets has yielded encouraging results. With significant investments in local content production across regions like India, South Korea, and Europe, international subscribers now constitute a significant portion of Netflix’s user base, propelling much of its recent growth.

Furthermore, Netflix is set to introduce a plethora of exciting new content to its viewers. From thrilling Danish series to a diverse range of Filipino and Thai productions, the company’s content library continues to expand, covering various genres and formats. With new additions on the horizon, including gaming and animated series, Netflix aims to keep its subscribers engaged and entertained.

Challenges Persist for NFLX

Despite its stellar performance, Netflix faces stiff competition from industry heavyweights like Disney+, HBO Max, Apple TV+, and others, along with traditional TV, social media platforms, and the gaming industry. This intense rivalry could potentially dent Netflix’s growth trajectory and profit margins, necessitating a strategic response to maintain its leadership position in a hyper-competitive landscape.

Financially, Netflix’s surging stock price has elevated its valuation multiples, raising concerns about future returns for investors. With a forward sales multiple that exceeds its historical average and that of its industry peers, the company may be trading at a premium. This valuation discrepancy implies a need for caution among investors, wary of potential downside risk.

Price-to-Sales (Forward 12 Months)

Image Source: Zacks Investment Research

Final Thoughts

As Netflix continues its remarkable journey in the market, the company must navigate the challenges of moderating user growth by innovating content offerings, expanding globally, and diversifying revenue streams. Given its strong position in the streaming landscape, abandoning ship prematurely may not be wise. New investors are advised to exercise patience and prudence in assessing Netflix’s potential amid a turbulent sea of competition.

The Oscillation of Netflix Stock: A Deep Dive

Investors are often on a rollercoaster ride when it comes to the ebb and flow of the stock market. Whether they are clutching their metaphorical safety bars with fervor as the prices rise, or bracing themselves for the inevitable dips, the stock game is a wild adventure. One such intriguing player in this financial odyssey is Netflix, a company that has captivated the masses with its on-demand streaming content.

The Analyst Forecast for Netflix

As financial analysts attempt to gaze into their crystal balls and predict the trajectory of Netflix stock, the Zacks Rank #3 (Hold) suggests a nuanced perspective. This ranking intimates a cautious stance, urging investors to tread lightly in the swirling waters of the stock market.

The Allure of High-Growth Stocks

With tantalizing promises of exponential growth, high-growth stocks often tempt investors with the siren song of lucrative returns. The Zacks expert’s selection of the top 5 stocks poised to double their value showcases the allure of such opportunities. While these picks may not always hit the mark, historical data reveals staggering success stories, with previous recommendations soaring to remarkable heights.

Most notably, the enticing notion of flying under the Wall Street radar presents a compelling chance for investors to seize potentially rewarding prospects at their inception.

On the Ground Floor of Opportunity

In the ever-shifting landscape of the stock market, identifying ripe opportunities is akin to discovering hidden gems waiting to be unearthed. Providing a pathway to join the ranks of early investors, these obscured stocks offer a chance to delve into the roots of burgeoning success stories.

Uncovering the Netflix Story

Against the backdrop of the financial market’s relentless undulations, Netflix has emerged as a standout figure. With an impressive 40.5% year-to-date surge, the company has garnered both attention and skepticism in equal measure.

However, as concerns loom regarding a potential slowdown in user growth, the question arises: will this impending deceleration act as an anchor, dragging down the buoyant trajectory of Netflix stock?

To gain further insights into this enthralling saga, investors are encouraged to delve into the complete article on Zacks.com, offering a comprehensive analysis of Netflix’s tumultuous journey in the stock market.

As investors navigate the unpredictable waves of the stock market, strategic foresight and prudent decision-making are paramount in steering the course towards financial success and stability.