AI juggernaut NVIDIA (NVDA) will unveil its Q2 2025 results post-market close on Aug. 28th. The company’s stock has surged by 18.7% in the last three months, outpacing the industry growth of 14.9%. Investors eagerly anticipate NVIDIA surpassing earnings projections to sustain this ascendant trend.

ETFs heavily invested in NVIDIA are in the spotlight as the earnings release approaches. Notably, these ETFs encompass Strive U.S. Semiconductor ETF, VanEck Vectors Semiconductor ETF, Technology Select Sector SPDR Fund, Grizzle Growth ETF, and TrueShares Technology, AI, and Deep Learning ETF.

Insider Insights into Earnings

NVIDIA presently boasts an Earnings ESP of -2.25% and holds a Zacks Rank #3 (Hold). A favorable combination, such as a positive Earnings ESP along with a Zacks Rank of #1 (Strong Buy), 2 (Buy), or 3 enhances the likelihood of surpassing earnings estimates. This revelation is pivotal for investors looking to make well-informed decisions.

With impressive triple-digit earnings (33.3%) and revenue (109%) growth projected for the upcoming quarter, NVIDIA is poised for success. The company’s solid track record of earnings surprises, averaging 18.43% in the last four quarters, bolsters investor confidence.

Market Analysts’ Take on NVDA Shares

Market analysts exhibit bullish sentiments towards NVIDIA ahead of the earnings reveal. Wedbush predicts a stellar performance, attributing it to surging demand for enterprise AI and investments by tech giants like Amazon and Google. Projections by Raymond James and KeyBanc echo positivity amidst concerns over any potential delays in NVIDIA’s Blackwell AI chip launch.

The current average brokerage recommendation for NVIDIA stands at 1.20 on a scale of 1 to 5. This rating reflects consistent investor confidence, with 87.5% Strong Buy and 5% Buy ratings among 40 analyst recommendations.

Powering Data Center Growth

NVIDIA’s prominence in integrating AI technology into products and services underscores its industry leadership. With a strong foothold in AI processor development through advanced GPUs, NVIDIA’s technology is vital for powering AI systems across various applications.

Major cloud service providers rely on NVIDIA’s GPUs to facilitate AI-infused operations. The company’s client base includes numerous tech startups and industry giants like Microsoft, Alphabet, and Amazon. Boasting an 80% market share in AI chips for data centers, NVIDIA stands tall in this competitive landscape.

Stay tuned for updates on the H100 accelerators and the anticipated impact of the company’s next-generation GPU chip on growth prospects. NVIDIA forecasts revenues around $28 billion, plus or minus 2%, for the Q2 of 2025.

NVIDIA’s Valuation Metrics

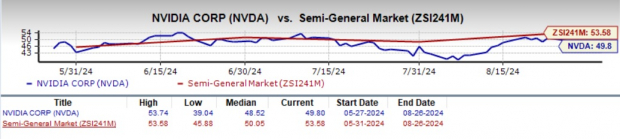

While concerns over NVIDIA’s lofty valuation have emerged, its current P/E ratio of 49.8, compared to the industry’s 53.58, suggests a justifiable valuation. Additionally, a PEG ratio of 1.25, significantly lower than the industry average of 4.13, reinforces NVIDIA’s position as a value stock in the market.

Image Source: Zacks Investment Research

Given its current valuation metrics, NVIDIA emerges as a compelling investment opportunity amidst the ongoing market dynamics.

Implications for ETFs

Strive U.S. Semiconductor ETF (SHOC), VanEck Vectors Semiconductor ETF (SMH), and Technology Select Sector SPDR Fund (XLK) are among the prominent ETFs significantly exposed to NVIDIA, with the tech giant occupying top positions in their respective portfolios.

Investors tracking these ETFs closely anticipate the impact of NVIDIA’s earnings performance on their overall returns.

Exploring Single Stock ETFs

T-REX 2X Long NVIDIA Daily Target ETF (NVDX) and GraniteShares 2x Long NVDA Daily ETF (NVDL) provide direct exposure to NVIDIA, amplifying the potential returns or losses based on the stock’s performance.

Receive Key ETF Insights

For the latest ETF news and analyses delivered direct to your inbox, subscribe to Zacks’ free Fund Newsletter. Stay informed about market trends, top-performing ETFs, and expert analysis every week.