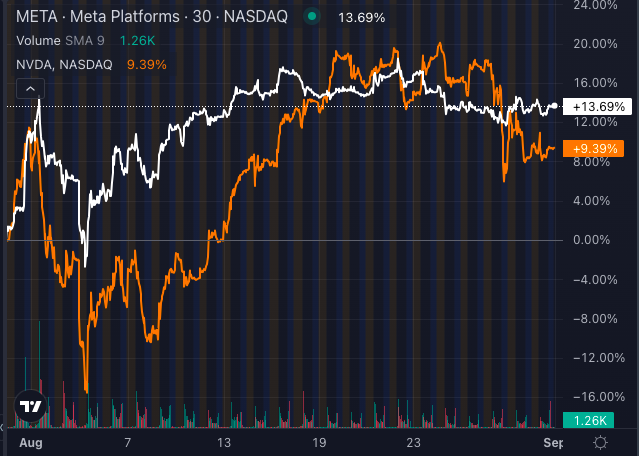

Meta Platforms Inc META outpaced Nvidia Corp NVDA in August, with Meta stock gaining 13.69% versus Nvidia’s 9.39% rise.

Nvidia’s High-Flying Act: Is The Bubble Bursting?

Nvidia, a dominant force in AI chips and GPU technology, has enjoyed a meteoric rise, driven by the booming demand for AI and data center solutions. However, its high valuation — currently trading at a price-to earnings multiple (P/E) of 55.13 — a significant premium to its peers — raises questions about the sustainability of its growth.

The modest stock gain in August suggests that investors might be re-evaluating Nvidia’s lofty price tag.

Meta’s AI Magic: New Kid On The Block Shines

Meanwhile, Meta is reaping the rewards of its strategic pivot towards AI. The company has been leveraging AI to enhance its advertising efficiency and user experience, driving a resurgence in its stock. Meta’s investments in AI technology are beginning to bear fruit, providing a more diversified play in the tech sector.

Valuation Showdown: Is Nvidia’s Crown Slipping?

The recent performance disparity could reflect a broader market sentiment shift, signaling that investors are becoming more cautious about overvalued tech stocks. While Nvidia remains a leader in AI innovation, its slowing stock momentum may suggest that the market is looking for more balanced, less risky AI investments.

As the debate continues, investors must weigh Nvidia’s high growth potential against its valuation risks. With Meta proving its capability to capitalize on AI without the same premium pricing (trading at a P/E of 26.51), the question remains: Is Nvidia experiencing a temporary cooling-off period, or is it a sign of a longer-term trend?

Only time will tell if Nvidia can regain its sheen, or if Meta’s diversified AI strategy will continue to outshine its tech rival.