With the arrival of artificial intelligence (AI) and the inclination toward digital and online services picking up, shares of magnificent 7 stocks popped up for most of the year.

Their weightage in the S&P 500 more than doubled from a decade ago, with shares of Alphabet Inc. GOOGL, Amazon.com, Inc. AMZN, Apple Inc. AAPL, Meta Platforms, Inc. META, Microsoft Corporation MSFT, NVIDIA Corporation NVDA and Tesla, Inc. TSLA soaring 40%, 49.4%, 34.5%, 70.5%, 182.6%, and 82.8%, respectively, this year.

Alphabet’s dominance in search market share, Amazon’s unmatched AWS cloud infrastructure, Apple’s strong growth in service revenues, Meta’s increase in worldwide user growth, Microsoft’s robust Azure performance, Tesla’s cost-efficient vehicles and Donald Trump’s election win helped their shares scale upward.

However, NVIDIA stole the limelight due to the insane demand for AI chips. But can its shares outperform in the next year, and is the stock worth buying? Let’s find out.

Blackwell Chips’ Demand to Boost NVDA Stock

NVIDIA’s new graphics processing unit (GPU) architecture, Blackwell, is in high demand because it can run large language models with 25 times less energy consumption than the current Hopper GPU platform. That’s why Alphabet, Oracle and Microsoft have ordered the next-generation Blackwell chips.

Morgan Stanley noted that NVIDIA is estimated to ship a whopping 300,000 Blackwell chips in the final quarter of 2024 and another 800,000 units in the first quarter of 2025. In the last quarter, the semiconductor giant shipped 13,000 Blackwell chips.

The demand for Hopper chips also continues to surpass Intel Corporation INTC and Advanced Micro Devices, Inc.’s AMD products due to their superior quality. Such consistent demand for NVIDIA’s AI chips will surely drive its share price higher.

Competitive Advantage a Good Omen for NVDA Stock

NVIDIA has a competitive edge over its rivals due to its dominant market position in the GPU space. It accounts for almost 80% of the GPU market, which is projected to grow from $75.77 billion this year to nearly $1,414.39 billion by 2034 at a CAGR of 13.8%, according to Precedence Research.

The majority of developers prefer NVIDIA’s CUDA software platform to AMD’s ROCm software platform. Strong demand for NVIDIA’s CUDA X, which are domain-specific microservices and libraries to enhance AI optimization, has created a wide moat, a boon for its stock price.

Sound Fundamentals to Lift NVDA Stock

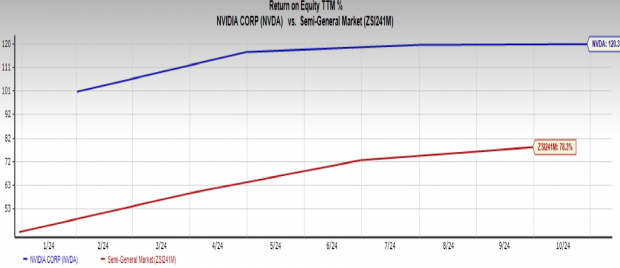

NVIDIA’s efficiency in profit generation and cost management is expected to boost its future share price, supported by its strong return on equity (ROE) and net profit margin.

NVIDIA’s ROE at 120.4% exceeds the Semiconductor – General industry average of 78.3%, reflecting that its net income surpasses its equity.

Image Source: Zacks Investment Research

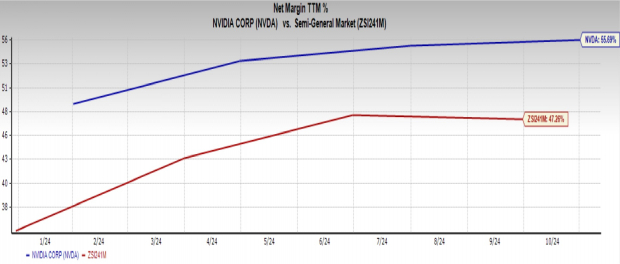

NVIDIA’s net profit margin of 55.7% outdoes the industry’s 47.3%, which is a high margin because the threshold is more than 20%.

Image Source: Zacks Investment Research

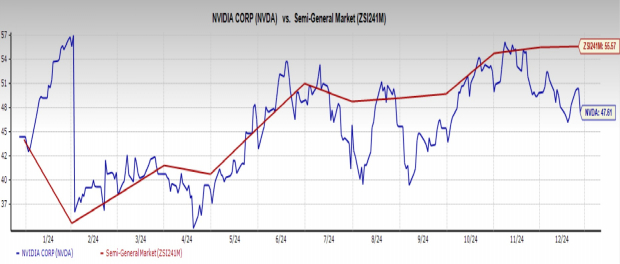

NVDA Stock a Must Buy for 2025

With shares of NVIDIA expected to scale northward, banking on staggering demand for AI chips, dominance in the GPU market and strong fundamentals, the stock certainly is the best among the magnificent 7 for the next year. Moreover, the stock is affordable and a safer bet.

Buying the stock will burn a smaller hole in your wallet than its peers. This is because NVDA stock’s price/earnings ratio is 47.6, lower than the industry average of 55.5.

Image Source: Zacks Investment Research

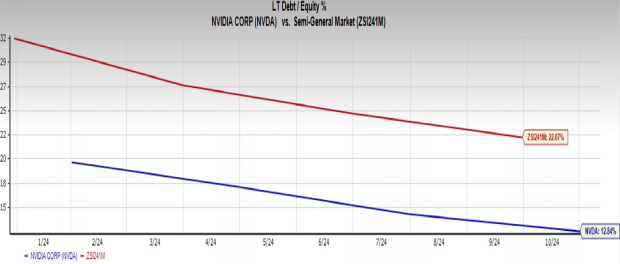

Additionally, NVDA’s debt-to-equity ratio of 12.8% is lower than the industry average of 22.1%, indicating lower investment risk due to less debt compared to competitors.

Image Source: Zacks Investment Research

NVIDIA rightfully has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Naming Top 10 Stocks for 2025

Want to be tipped off early to our 10 top picks for the entirety of 2025?

History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2024, the Zacks Top 10 Stocks gained +2,112.6%, more than QUADRUPLING the S&P 500’s +475.6%. Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2025. Don’t miss your chance to get in on these stocks when they’re released on January 2.

Be First to New Top 10 Stocks >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Intel Corporation (INTC) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report