Artificial intelligence (AI) propelled NVIDIA Corporation NVDA and Palantir Technologies Inc. PLTR to the top spots on Wall Street. NVIDIA led the Dow Jones Industrial Average last year, while Palantir topped the S&P 500.

With the AI market in early expansion phases, a lot more growth potential lies ahead for both stocks. This justifies considering both stocks for investment. However, which is the superior AI choice right now? Let’s see –

The Bullish Case for NVDA Stock

NVIDIA’s shares recently took a beating when a Chinese company launched a low-cost AI chatbot, DeepSeek. Despite the sell-off, chip demand for NVIDIA should improve due to DeepSeek’s affordable model driving up AI usage. Anyhow, the strong demand for the high-end new Blackwell architecture would increase NVIDIA’s revenues and boost the stock price.

The likes of Alphabet Inc. GOOGL and Microsoft Corporation MSFT are choosing Blackwell chips for their improved energy efficiency and faster AI interface. Having said that, the demand for NVIDIA’s old Hopper chips also remains steady due to their superior quality in comparison to rival Intel Corporation INTC.

Despite DeepSeek’s potential to disrupt AI infrastructure spending with its low-cost model, major companies like Microsoft Corporation MSFT and Meta Platforms, Inc. META continue to invest substantially in NVIDIA’s products, projecting massive outlays of over $300 billion on AI infrastructure and highlighting the semiconductor behemoth’s strong growth potential.

Another reason in favor of NVIDIA’s growth is its strong presence in the graphic processing units (GPU) market, which provides the company with a competitive edge. The GPU market is projected to reach $1,414.39 billion by 2034 from $101.54 billion in 2025, at a CAGR of 13.8%, according to Precedence Research (read more: Buy NVIDIA Stock, DeepSeek’s Threat is Exaggerated).

The Bullish Case for PLTR Stock

In the growing generative AI market, Palantir’s leadership in AI-powered process mining indicates strong growth potential. Palantir aims to boost growth by integrating ground-breaking AI with machine learning functionalities. An increase in fourth-quarter revenues from both U.S. commercial and government clients points to strong growth likelihoods.

Palantir’s fourth-quarter revenues reached $828 million, reflecting a 36% year-over-year increase, with an estimated revenue guidance of $3.75 billion for 2025, indicating a 31% rise from a year ago. Palantir’s Artificial Intelligence Platform (AIP) is in high demand, raising expectations by automating tasks beyond human capabilities.

Moreover, the company’s sales not recorded as revenues in the last reported quarter exceeded current revenue growth, signifying potential expansion (read more: Is It Too Late to Buy Palantir Stock Post Blockbuster Quarter?).

Why NVIDIA Is a Better Buy Than Palantir Now

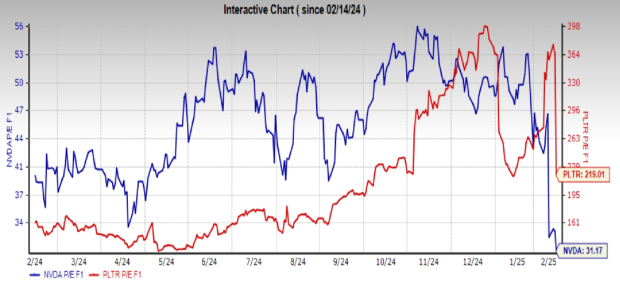

Despite the temporary DeepSeek threat, NVIDIA’s stock is poised for new highs in 2025 due to increasing demand for its new chips. At the same time, Palantir’s AI advancements may boost its stock price. Both NVIDIA and Palantir stocks are currently trading above the 200-day moving average, indicating a long-term bullish trend.

NVIDIA, however, appears to be a superior investment compared to Palantir due to its GPU market dominance and its varied AI products reducing risks, whereas Palantir may face challenges if AI investments diminish. Additionally, investing in NVIDIA’s shares is more cost-effective than Palantir’s due to NVDA’s lower price/earnings ratio of 31.17 compared to PLTR’s 219.01. This gives NVIDIA an investment advantage.

Image Source: Zacks Investment Research

Both NVIDIA and Palantir have a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Intel Corporation (INTC) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Palantir Technologies Inc. (PLTR) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report