Shares of graphics processor manufacturer Nvidia (NASDAQ:NVDA) grew by over 200% in 2023 as interest in artificial intelligence (AI) skyrocketed. Nvidia’s dominant position in the AI chip market has attracted the attention of investors seeking to understand the company’s potential to sustain this growth.

Analysts unanimously foresee a bright future for Nvidia, given the ever-expanding landscape of AI and its insatiable demand for high-performance computing. With an enviable brand reputation and a strategic market positioning, Nvidia is poised to capitalize on the burgeoning market for AI chips.

Nvidia and AI

By the year 2026, it is estimated that over 80% of companies worldwide will adopt generative AI, propelling the AI semiconductor market to nearly $120 billion by 2027. Nvidia is well-equipped to leverage this surge in demand, with projections indicating an 85% market share in AI chips through 2024.

Nvidia’s enterprise-grade GPUs, primarily utilized by tech giants due to their high cost, are now being made more accessible to individuals exploring AI. The recent introduction of budget-friendly GPUs tailored for personal computers expands Nvidia’s reach into the consumer market, enhancing its AI chip portfolio.

Intense Competition, but Nvidia Has the Advantage

While competition in the AI market intensifies, with rivals such as Intel (NASDAQ:INTC) and AMD vying for a share, Nvidia holds a distinct edge. Its launch of AI-capable GPUs at a competitive price point amplifies the company’s standing. Moreover, Nvidia’s strategic focus on custom-designed chips tailored for the lucrative Chinese market further bolsters its position.

Free Cash Flow Plans

Nvidia’s robust revenue growth is anticipated to fuel a substantial surge in free cash flow, with projections exceeding $100 billion in the next two years. This financial flexibility might be channeled into innovative product development or potential acquisitions to diversify Nvidia’s offerings beyond its core business.

Reasons for Caution

Despite its promising prospects, Nvidia’s reliance on hardware sales presents a concentrated revenue profile vulnerable to material shortages or disruptions. Additionally, while the company endeavors to comply with export regulations for the Chinese market, some leading tech firms in China have displayed tepid interest due to potential performance disparities compared to Nvidia’s standard offerings.

What is the Price Target for NVDA Stock?

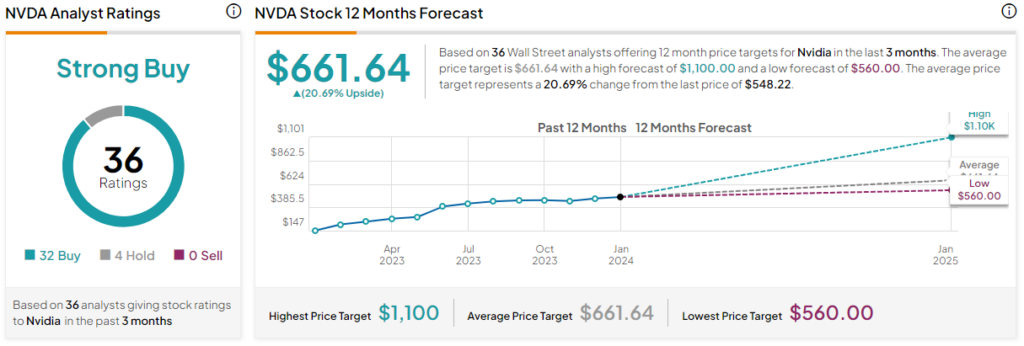

Nvidia currently holds a Strong Buy consensus rating among analysts, signifying a favorable sentiment based on 32 Buy ratings and a projected upside of nearly 21% from the average stock price target.

Conclusion: There’s Still Room for Growth

Nvidia’s position in the global AI landscape remains robust, with a promising lineup of new products and substantial financial resources to drive innovation. This optimistic outlook is reflected in analysts’ Strong Buy rating, underscoring the market’s confidence in Nvidia’s continued success. The company’s exceptional performance in 2023 is a testament to its potential for further growth in the foreseeable future.