Nvidia shares have been on a rollercoaster ride, soaring nearly 30% in May and wiping out April’s losses while adding a jaw-dropping $700 billion to its market cap. This catapulted the AI giant to the third spot globally, nipping at the heels of Apple with a mere $250 billion gap.

Unlocking Potential with AI in June

A new month dawns, offering a potential goldmine for investors eyeing undervalued stocks on the cusp of explosive growth. But how does one sift through the noise to uncover these hidden treasures before the crowd catches on?

Dive into ProPicks: Leverage cutting-edge AI to sift through oceans of data and pinpoint high-flyers before the market catches on.

For less than $9 monthly, receive a tailored selection of stocks with massive growth potential, handpicked by our advanced AI system.

Don’t lag behind – subscribe to ProPicks now and:

- Spot hidden gems: Harness AI for uncovering undervalued stocks primed for exponential growth.

- Stay on the front foot: Secure a monthly rundown of AI-analyzed buys and sells ahead of the crowd.

- Gain a competitive edge: Make sound investment decisions backed by robust data and insights.

Subscribe to ProPicks today and kickstart your journey to financial prosperity!

Nvidia Speeding Towards the Pinnacle, Fueled by AI Surge

Nvidia is racing towards clinching the title of the second most valuable company globally, riding high on the escalating thirst for artificial intelligence. While rivals grapple with hurdles, Nvidia has seized the moment with its state-of-the-art AI chipsets.

The company has outshone its adversaries, becoming the top choice for tech behemoths like Alphabet, Microsoft, Tesla, and OpenAI, the brains behind ChatGPT.

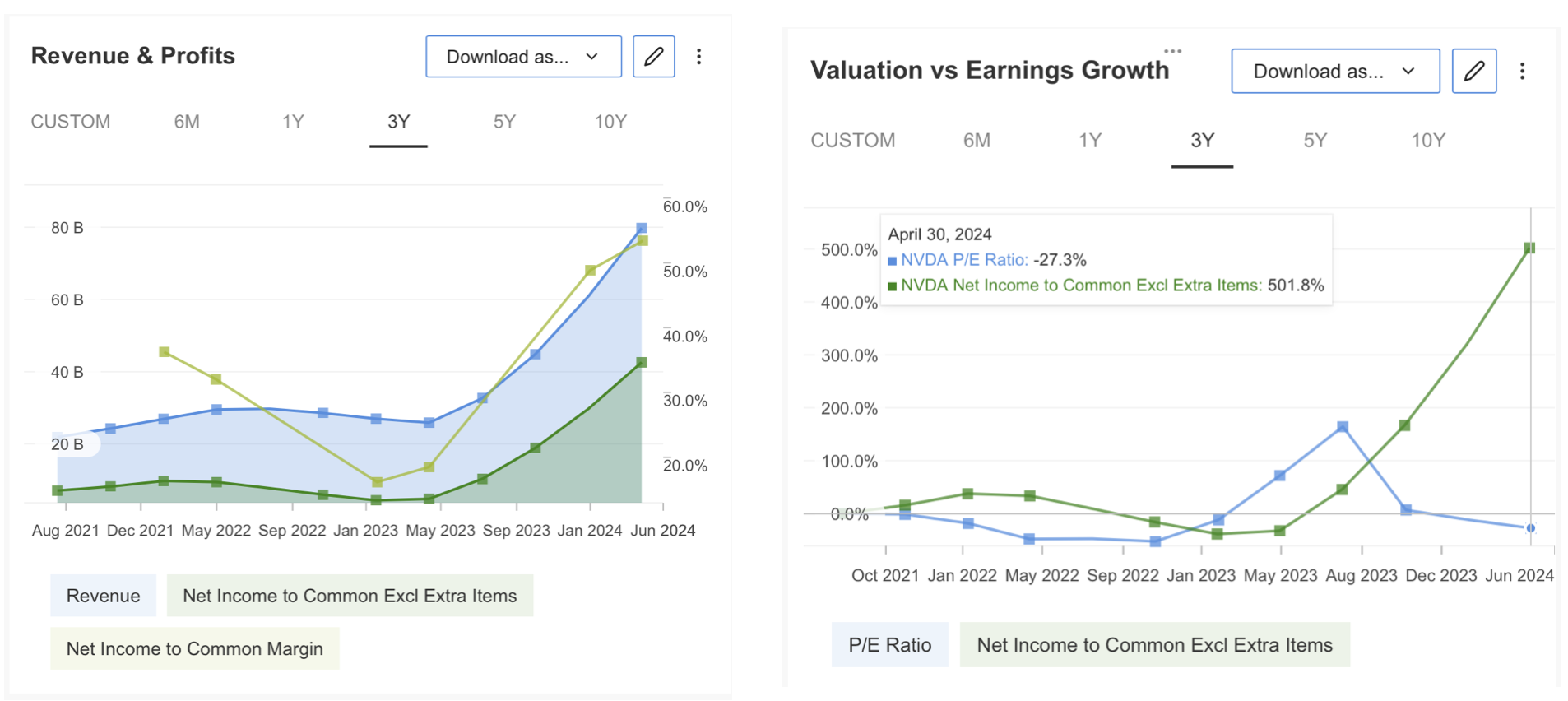

This strategic positioning has turbocharged Nvidia’s profitability, witnessing a remarkable upswing in recent years.

Insights from InvestingPro shed light on Nvidia’s upward trajectory in terms of revenue and profitability. Let’s delve deeper into these remarkable figures.

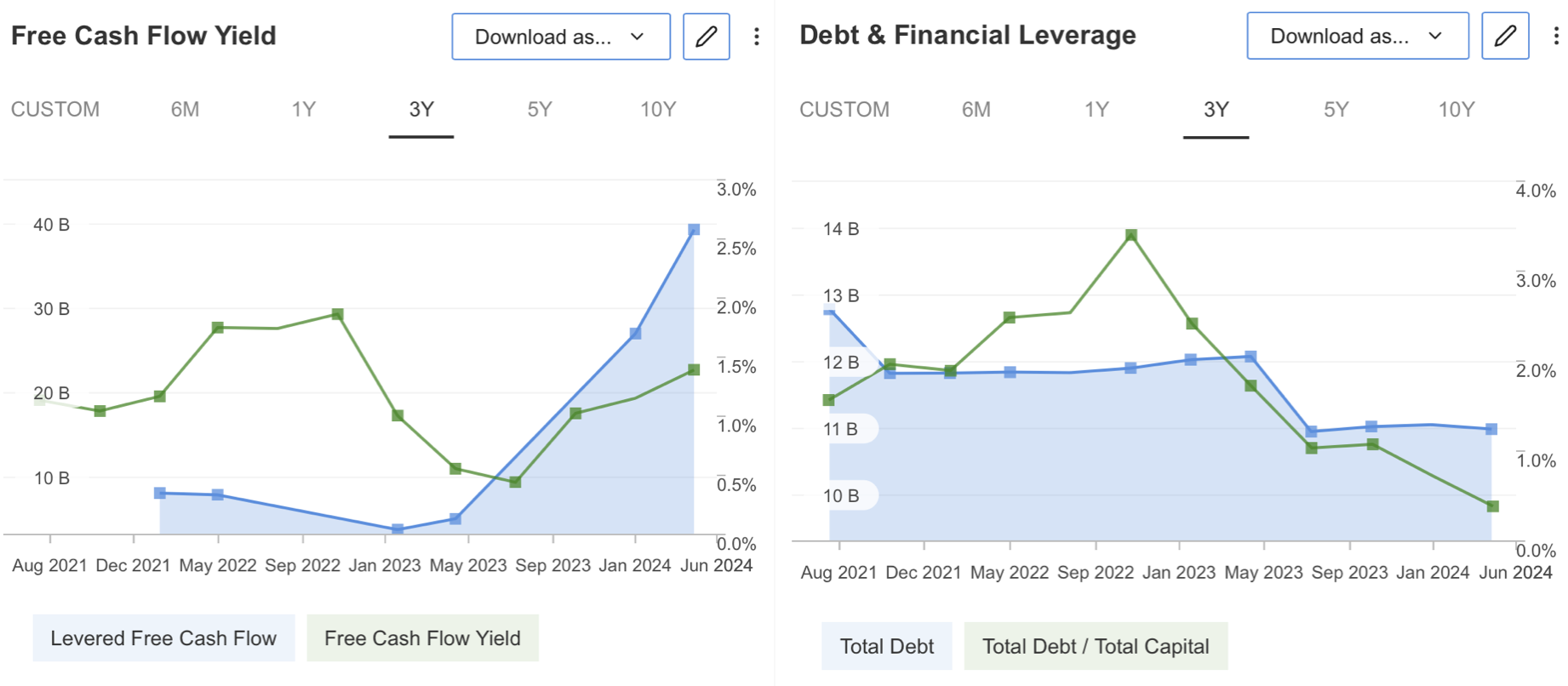

The company slashed its total debt while witnessing a significant surge in cash flow over the past year. Hence, as total debt to total capital ratio dwindled amid accelerating capital growth, investors found solace in Nvidia’s financial robustness.

Thanks to Nvidia’s leap in the last year, the company’s financial health report earned top marks in InvestingPro’s evaluation.

Nvidia’s Growth Trajectory: Sailing Smooth or Stormy Weather Ahead?

Nvidia’s journey is peppered with bursts of extraordinary growth, but can this momentum persist? To unravel this puzzle, let’s dissect analyst predictions surrounding the company’s financial landscape.

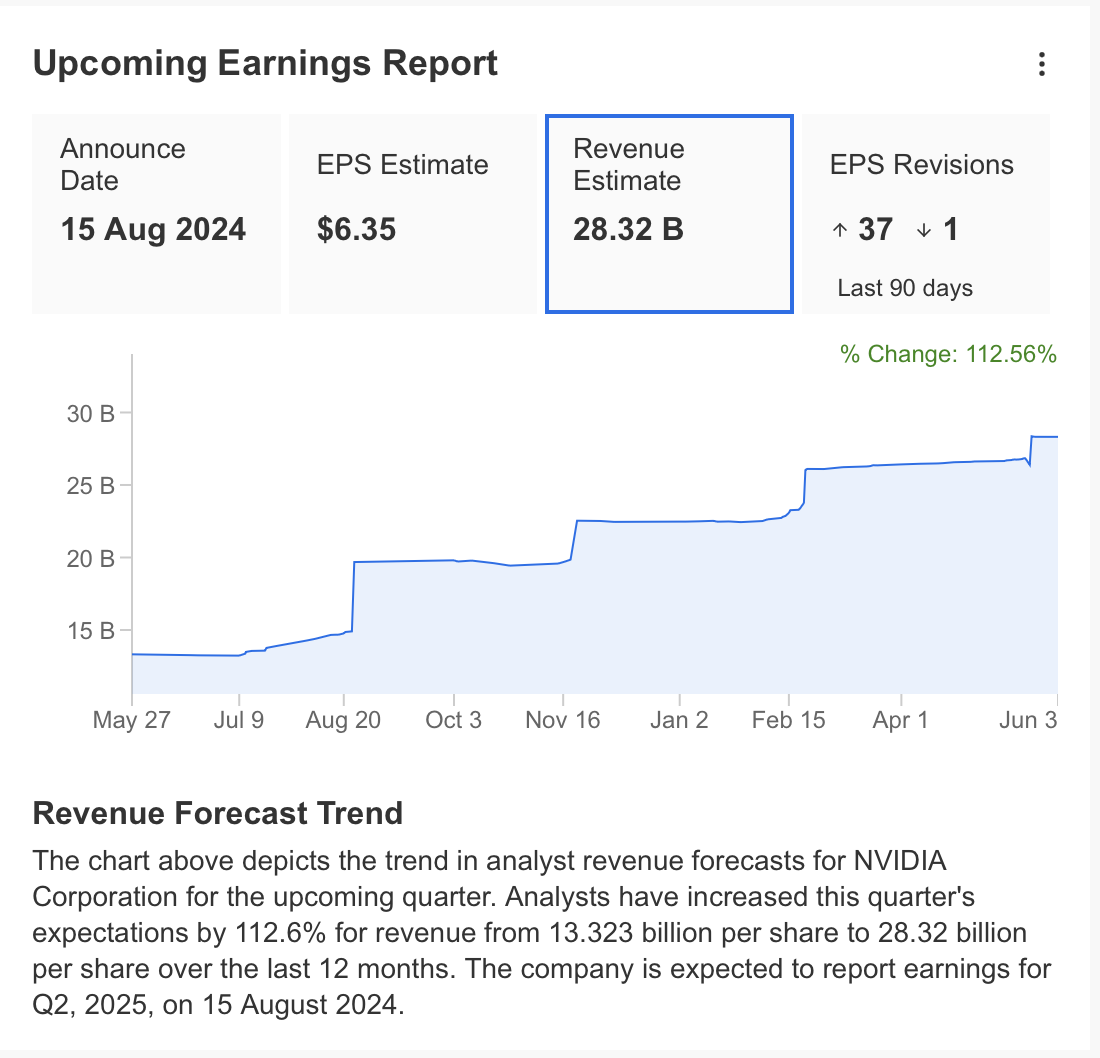

An optimistic aura envelops the future horizon. 37 analysts have revised their forecasts upwards for Nvidia’s forthcoming August earnings announcement.

The consensus estimate foresees a whopping 159% surge in net profit per share, hitting $6.35. Revenue is also poised for a massive 112% year-on-year rise, potentially touching $28.32 billion.

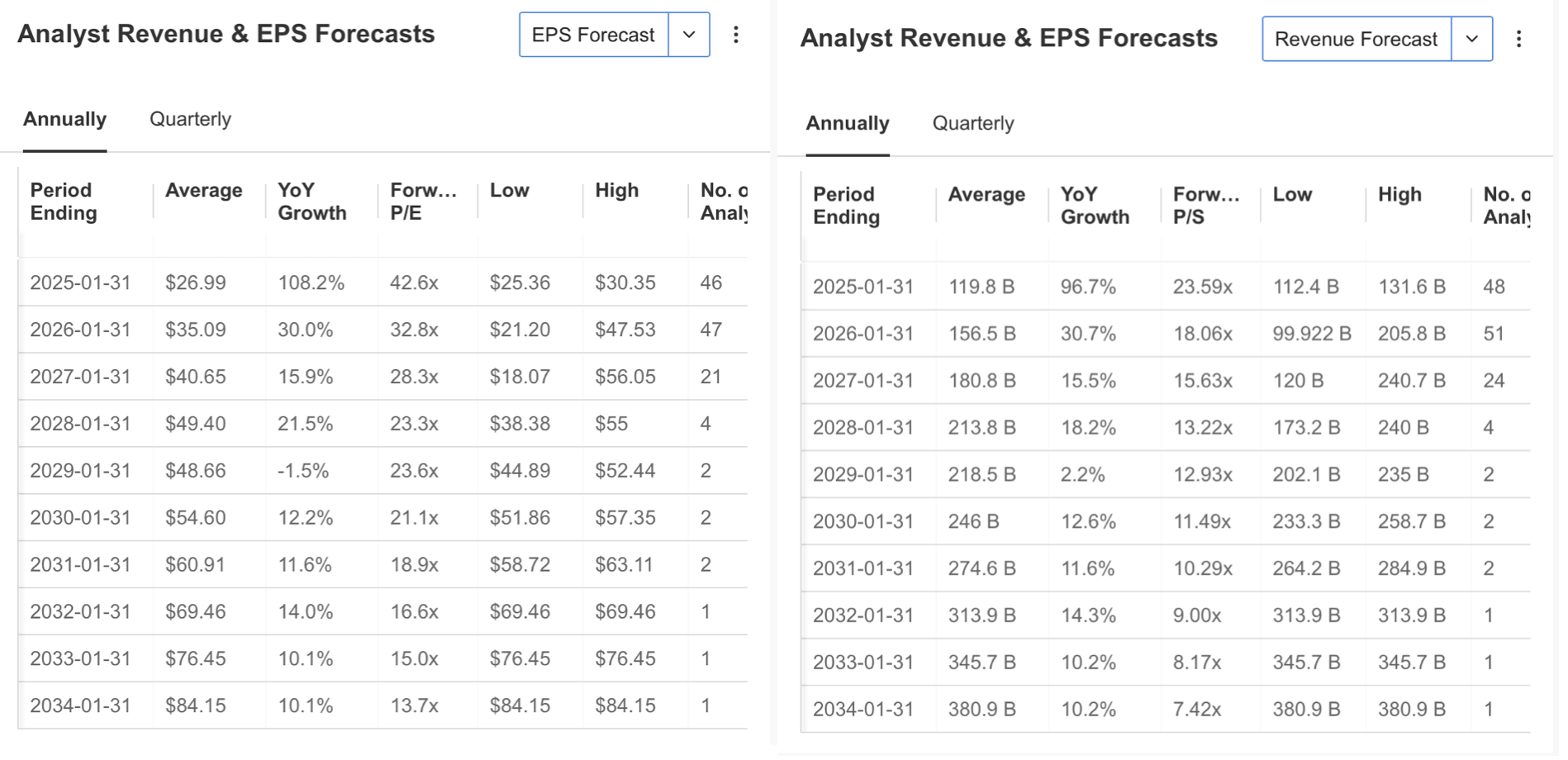

The long-term outlook continues to gleam brightly for Nvidia. Analysts project a robust 108% year-on-year EPS surge, aiming for $27 by early 2025.

While the growth pace might temper in the approaching years, the outlook remains positive. By the close of 2024, annual revenue is anticipated to hover around $120 billion, marking a phenomenal near-100% escalation.

Nvidia Stock: Technical Tea Leaves Bode a Bumpy Ride

Nvidia has basked in a splendid rally, catapulting 130% this year and an astounding 720% since the outset of 2023. However, notwithstanding sturdy financials and lofty valuation ratios, certain technical signals hint at a potential correction looming on the horizon.

Both the RSI (Relative Strength Index) and elevated volatility levels hint at NVDA possibly being overbought. This implies a potential retracement from its current price point of approximately $1,150.

InvestingPro’s analysis, incorporating 13 financial models, anticipates a probable 16% pullback, pegging a fair value closer to $950. Nevertheless, 49 analysts remain bullish, with a consensus price objective of $1,200.

Despite NVDA notching notable gains, it’s worth noting the absence of significant pullbacks in the past year. The most substantial retreat occurred in April, swiftly followed by a rebound.

The Stochastic RSI recently reversed course from oversold turf, signaling a potential short-term uptick toward $1,250. A more intermediate target could be $1,430.

However, intensified profit-taking might find initial support at $1,060. Weekly closures beneath this threshold might herald an extended correction, potentially dragging the price down to $910, aligning with the long-term trend.

While Nvidia’s future shines bright, technical gauges whisper of a looming pullback. Investors should heed these signs and contemplate risk management strategies.

***

Elevate your investment acumen in 2024 with ProPicks

Institutions and billionaire investors worldwide have embraced AI-powered investing, customizing and optimizing it to bulk up their returns and minimize losses significantly.

Now, InvestingPro users can join the ranks from the comfort of their homes with our cutting-edge AI-powered stock-picking tool: ProPicks.

With six strategy options, including the flagship “Tech Titans” that outpaced the market by a remarkable 1,745% over the past decade, investors gain access to the cream of the crop in the market every month at their fingertips.

Subscribe now and never miss a bull market again!

Don’t miss your complimentary gift! Use coupon codes OAPRO1 and OAPRO2 at checkout for an extra 10% discount on the Pro annual and bi-annual plans.

Disclaimer: This content is crafted for informational purposes solely; it doesn’t constitute a solicitation, offer, advice, or recommendation for investing. Remember, all investments entail hazards and are subject to multiple evaluations; thus, every investment decision and associated risks rest with the investor.