Investors in the Pittsburgh-based company, Westinghouse Air Brake Technologies Corporation, commonly known as Wabtec Corporation, have been reaping the benefits of its consistent shareholder-friendly strategies and robust performances in its Freight and Transit segments. Positive projections for earnings growth in 2024 have engendered a wave of optimism among stakeholders.

An upward revision in the Zacks Consensus Estimate for third quarter and full-year 2024 earnings over the past 60 days underscores the bullish sentiment surrounding WAB stock. Forecasts point to an anticipated growth of 9.4% and 26% in earnings per share for the third quarter and full-year 2024, respectively, over the 2023 figures.

Image Source: Zacks Investment Research

With a long-term earnings growth rate of 16.1%, exceeding its industry’s 13.4%, Wabtec demonstrates a solid foundation for sustainable growth.

Evident Value in Financial Returns

Underscoring its investor-friendly ethos, Wabtec announced a 17.6% dividend increment on February 14, 2024. This raise elevated the quarterly cash dividend from 17 cents per share to 20 cents, yielding a favorable 0.47% at the current stock price. With a commendable payout ratio of 11% and a five-year dividend growth rate of 12.34%, Wabtec’s commitment to rewarding shareholders shines through.

Dividend-paying stocks like WAB provide a stable income stream and offer a shield against market volatility. The company’s proactive approach to nurturing investors’ confidence warrants attention in times of economic uncertainty.

Strategic Segmental Growth

Wabtec’s revenue streams have surged thanks to robust sales in its Freight and Transit segments. The Freight segment benefits from service and component growth, while the Transit segment thrives on aftermarket and original equipment sales.

The company’s trajectory appears promising, buoyed by strong underlying demand and a substantial backlog. Projections for the third and fourth quarters of 2024 hint at revenue increments, with estimates at $2.64 billion and $2.61 billion, respectively, showcasing a year-over-year improvement.

Notably, management’s upward revision of the 2024 EPS guidance, now at $7.20-$7.50, reflects a positive outlook. The full-year revenue guidance remains steady between $10.25 billion-$10.55 billion, with estimates aligning well with the guided range.

Rising Tide of WAB Stock Performance

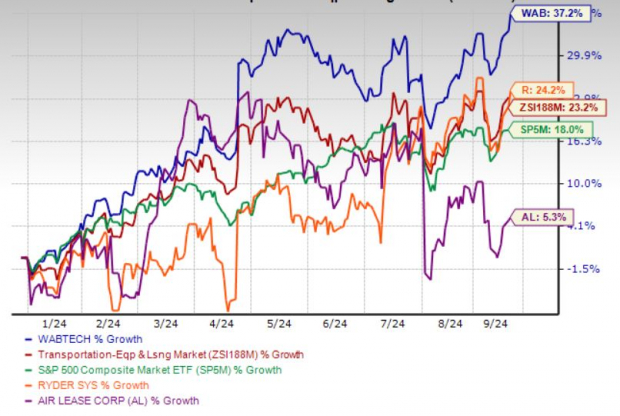

With a strong track record of beating earnings estimates, Wabtec has outperformed the Zacks Consensus Estimate in three of the last four quarters. A remarkable earnings surprise average of 11.83% has fueled a 37.2% surge in WAB shares this year, overshadowing both industry peers and the S&P 500, wherein Wabtec features prominently.

Furthermore, WAB’s performance compares favorably with competitors like Ryder Corporation (R) and Air Lease Corporation (AL) in the same period.

Year-to-Date Price Progression

Image Source: Zacks Investment Research

Additional Tailwinds Propelling WAB

WAB’s robust balance sheet depicts a healthy financial stance, with cash and equivalents rising to $595 million by the end of the second quarter of 2024, coupled with a reduction in long-term debt to $3.5 billion for the same period. These factors reflect a sound financial footing.

Navigating the Investment Horizon

Given the optimistic outlook surrounding WAB stock, as outlined throughout this analysis, investors might consider adding Wabtec to their portfolio to reap potential returns. Supported by a Zacks Rank #2 (Buy), WAB stock presents a promising prospect for growth.