While some publicly traded companies are either distinctly a long-term investment or a near-term trading opportunity, a select few offer strong signals for both attributes. One such idea may be CyberArk Software Ltd CYBR. A specialist in privileged access management (PAM), CyberArk offers fundamental relevance. After all, cybercriminals never rest because of economic challenges. As such, CYBR stock makes for an intriguing discount.

In February, CyberArk disclosed its results for the fourth quarter of fiscal 2024, posting revenue of $314.4 million. This figure represented a 41% year-over-year lift and also beat the consensus view of $301.31 million. On the bottom line, the cybersecurity specialist delivered adjusted earnings per share of 80 cents, exceeding the consensus target of 72 cents.

Of particular note was the company’s annual recurring revenue (ARR) line item, which increased 51% from the prior year to $1.17 billion. Further, the subscription portion of ARR clocked in at $977 million, implying 68% growth from the year-ago quarter.

During the conference call, CyberArk CEO Matt Cohen highlighted strong demand for the company’s identity security solutions as a major catalyst. This statement tracks with outside sources. According to Grand View Research, the global PAM market generated revenue of over $3.28 billion last year. By 2030, the sector could be worth over $9.38 billion, implying a compound annual growth rate of 19.7%.

Nevertheless, CYBR stock was not immune to wider economic concerns that impacted the market, particularly the technology sector. With President Donald Trump engaging in high-tempo diplomatic measures — particularly through the use of tariffs — the S&P 500 technically fell into correction territory on Thursday.

Put another way, CyberArk appears to be a good company that just happens to encounter bad circumstances outside its control. This setup makes CYBR stock intriguing for bullish speculators.

Several Signs Point to a Possible Recovery

For risk-tolerant investors, several signs point to a possible recovery in CYBR stock. First and foremost is the underlying company’s “permanent” relevance. Yes, CYBR popped higher due to easing fears regarding a government shutdown. Irrespective of Washington politics, however, CyberArk’s importance to the tech ecosystem will not be impugned.

Again, whatever happens in the political or economic front, nefarious actors will continue to look for and exploit vulnerabilities. In fact, some research indicates that economic pressures could raise cybersecurity risks. Such a dynamic would likely contribute positive sentiment to CYBR stock.

Another sign to consider is Wall Street’s assessment of CyberArk’s business. Back when CYBR stock traded hands for around $355, Bank of America Securities analyst Madeline Brooks increased the price target for the equity to $500. At the time of this writing, CYBR is trading at an approximately 5% discount to Brooks’ original starting point.

More importantly, the analyst’s reasoning for the bullish call remains as pertinent as ever. As Brooks stated in a research note to clients, identity security has evolved to become a “foundational pillar in cybersecurity.”

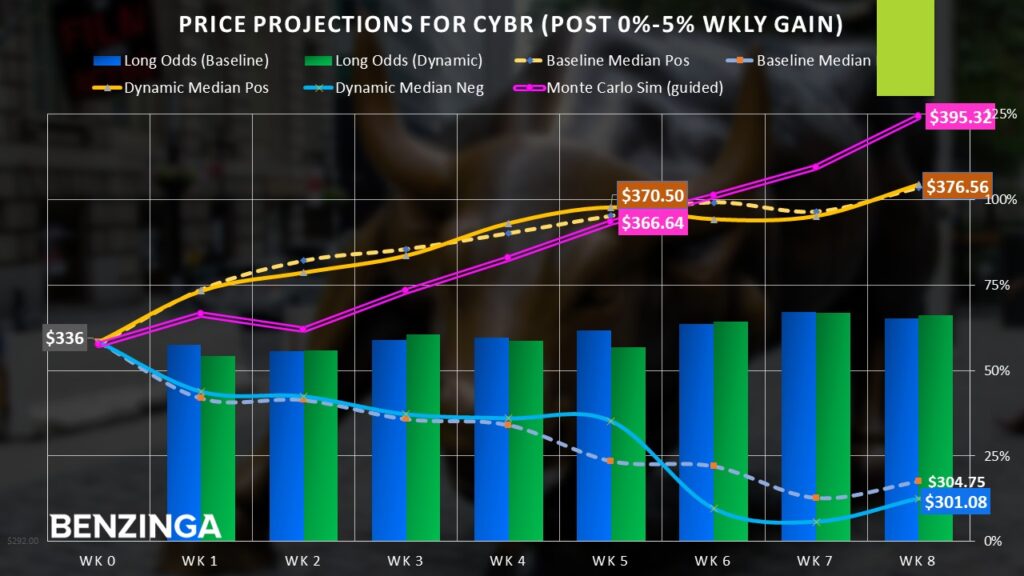

Finally, for traders specifically, the statistical backdrop appears compelling. Using pricing data from January 2019, CYBR stock has demonstrated an upward bias. As a baseline, a long position held for any given eight-week stretch has a 65.19% chance of rising.

At the moment, CYBR stock is on pace to rise around 3% this week. Modest momentum like this does little to change the equity’s behavioral dynamics — such parameters statistically yield a similar magnitude of upward mobility.

Two Ways To Approach CyberArk Software

With the above market intelligence in mind, there are two basic approaches available for CYBR stock. First, one could simply acquire shares in the open market. This is the most straightforward approach and it’s quite intriguing. Currently, the consensus price target stands at $402.81, implying about 19% or 20% upside.

That said, the more exciting — though significantly riskier — pathway is to deploy the leverage of options. Specifically, investors may want to consider the 350/360 bull call spread for the April 17 expiration date. This transaction involves buying the $350 call (at a $1,340 ask) and simultaneously selling the $360 call (at a $760 bid).

The above bull spread arguably makes rational sense because under baseline conditions, CYBR is projected to reach $367.52 over the next five weeks, more than enough to trigger the short call strike price at expiration. Under dynamic conditions of modest momentum, a five-week return could land CYBR at $369.75.

Running a Monte Carlo simulation using market realistic parameters based off CYBR’s pricing history reveals a median target of around $368. While these factors are no guarantee that CyberArk’s equity will respond as predicted, the sheer number of tailwinds could attract speculators to take the plunge.

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.