Software giant Oracle Corp ORCL easily represents one of the most important names in the broader technology sphere, although it doesn’t necessarily come off as such. Dominating enterprise IT infrastructure, particularly the bread-and-butter database segment, Oracle doesn’t command the consumer-facing footprint of Microsoft Corp MSFT or Apple Inc AAPL. Occasionally, though, being less heralded has its advantages.

Consider the volatility that has emerged in the market this year, thanks in large part to the economic policies of President Donald Trump. Analysts have sounded the alarm that recession risks due to the underlying tariffs have soared. True, recent upbeat signals from the corporate earnings season have buoyed sentiment but it’s quite possible that ORCL stock can make better use of the momentum swing.

That’s not to say that MSFT is a laggard. But because it’s so closely followed and traded, it can collect a lot of market froth, so to speak. Even a quick glance at its technical chart carries an air of ambiguity. It’s not trading on what a technical analyst would clearly define as a support level, leaving open the real possibility of further downside.

In contrast, ORCL’s bearish phase appears fully baked in, with the share price appearing much closer to a well-established horizontal support line at the $115 to $120 mark. This dynamic is an example of Oracle’s asymmetric risk-reward profile, where there is less downside risk from the unwinding of overhype. On the other end, traders have greater confidence that they’re buying into real momentum with less froth.

Most importantly, professional traders recognize this dynamic. Last week, Benzinga’s options scanner identified 3,500 sold June 20 puts via sweep transactions. Sweeps are basically aggressive, institutional money orders sent out across multiple exchanges simultaneously. Back-of-the-envelope math reveals a credit premium of around $2.25. Combined with extrinsic (time) value, there’s an implication that traders believe ORCL stock will not drop materially below the $115 level.

A Zen Approach To Understanding ORCL Stock Behavior

Unlike modern information systems, the Zen pathway to enlightenment doesn’t originate from the addition of data points, stimulation or external validation. Instead, it comes from removing outside distractions, attachments, even ego-driven thoughts. Fundamentally, Zen is a return to simplicity, the art of seeing rather than merely looking — and this process has strong implications for ORCL stock.

Rather than viewing the equity as a boundless, scalar spectrum of infinite possibilities, investors can instead analyze price action as behavioral state transitions, such as positive states and negative states. In this manner, data — especially recurring data — from years past can be catalogued and analyzed, to be deployed later for probabilistic insights.

The key advantage of this approach — known as discrete-event analysis — over traditional methodologies that rely on continuous-time signal processing frameworks, such as technical or fundamental analysis is, ironically, visibility.

Try using a continuous signal, such as the relative strength indicator, to model the future probabilities of ORCL stock using data from five years ago. It’s impossible because ORCL traded around $53 back then. Today, it’s around $126, so the vast delta within the scalar spectrum makes such analyses spurious.

However, as bounded, definite behavioral states, the sentiment — not the price point (which constantly fluctuates) — offers quantifiable, categorical value. In the case of ORCL stock, the equity printed a “2-8” sequence in totality over the past two months: only two weeks of upside married to eight weeks of downside.

It’s a rare phenomenon, having only materialized nine times in the trailing decade. The key, though, is that investors historically tend to buy the dips. In seven out of nine occurrences, ORCL stock popped higher in the subsequent week following the 2-8 sequence, with a median return (assuming the positive pathway) of 3.05%.

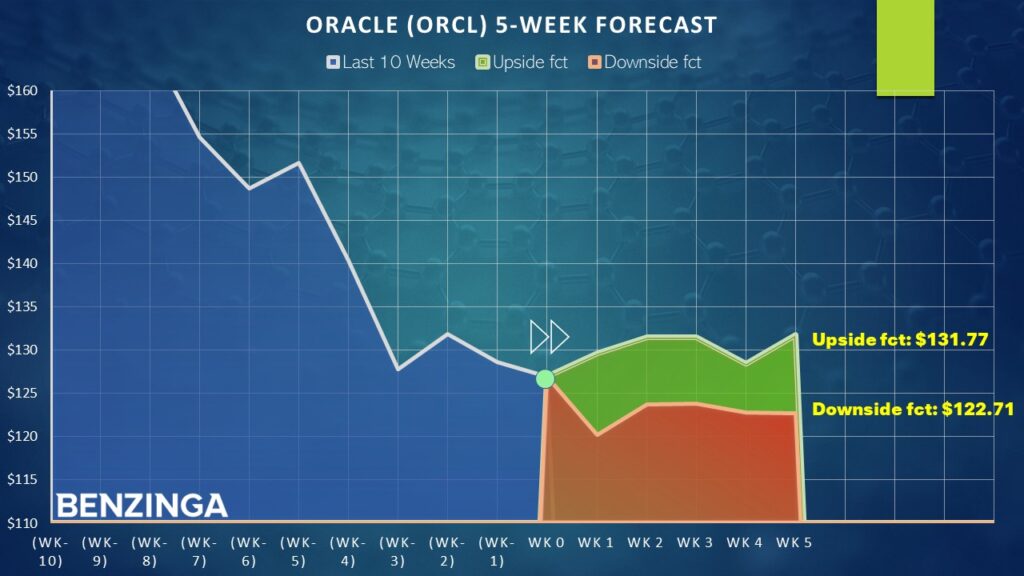

Should a recovery materialize, investors may see a choppy ride, with projections based on prior empirical data potentially guiding ORCL stock to settle at the $130 to $132 range over the next five weeks. However, the choppiness could see ORCL pop higher than these levels within the aforementioned period.

Crafting A Bullish Strategy For Oracle

For those who now want to step outside the Zen mindset and move toward the aggressive pathway, speculators may consider the 129/131 bull call spread expiring May 2. This transaction involves buying the $129 call (at a time-of-writing ask of $250) and simultaneously selling the $131 call (at a bid of $202), resulting in a net debit paid of $89.

Should ORCL stock rise through the short strike price of $131 at expiration, the maximum reward is $111, a payout of nearly 125%. Market makers clearly believe this call spread to be quite ambitious; hence, the high payout. Still, it’s more reasonable than meets the eye.

Based on a somewhat conservative projection of the discrete-event analysis mentioned earlier, ORCL stock should be able to clock $131.15 by May 2. After all, the equity was well above that price just last week.

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.