Billed as a free speech haven, video-sharing platform Rumble Inc RUM has always offered an interesting, albeit somewhat controversial business.

From an investment perspective, however, RUM stock has been unambiguously choppy. Further, the security features a negative bias. Nevertheless, under extreme selling pressure, behavioral dynamics shift from fear to greed, making Rumble an enticingly speculative wager.

Last month, the social media specialist inked a strategic investment deal with a blockchain enterprise. That announcement quickly skyrocketed RUM stock. Soon enough, though, questions emerged about the valuation of the underlying company. The business doesn’t generate earnings and its sales growth has noticeably slowed in recent quarters. Not surprisingly, investors took issue with the heightened risk profile and bailed out.

The results have been ugly, to say the least. For the business week ending Jan. 10 (comparing Monday’s open to Friday’s close), RUM stock lost 19.65%. At the time of writing, it’s down more than 6% as the bulls desperately attempt to cling to the $10 support level. Still, once this week’s tug-of-war is in the books, there may be a solid chance that RUM stages a recovery attempt.

Behavioral Shifts Under Pressure Bode Well for RUM Stock

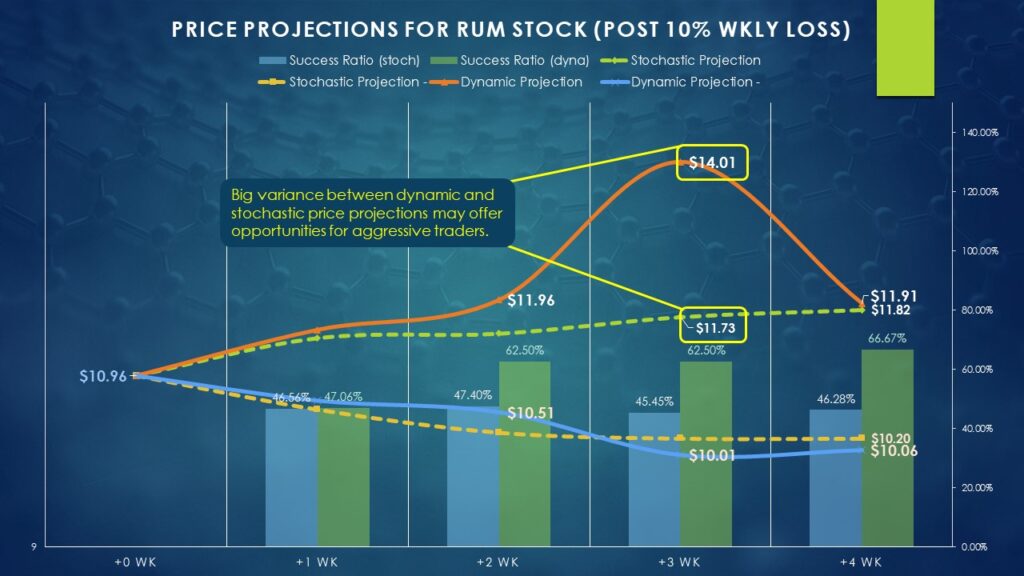

As stated earlier, RUM stock features a negative bias. For example, on a sequential week-to-week basis, there’s about a 47% chance that an investor will see a positive return. When viewed on a four-week basis, the odds of a positive return dip slightly to 46%. Therefore, without any other context, it’s best to avoid excessive long exposure to Rumble stock.

However, this framework changes dramatically when the security faces substantial selling pressure or extreme fear. Statistically, following a one-week loss of 10% or greater, RUM stock tends to rise by the end of the fourth subsequent week, with the odds of a positive return reaching 66.7%.

To be fair, applying conditional or dynamic probabilities dramatically limits the size of the dataset. Nevertheless, a clear trend can be established. Historically, whenever RUM stock lost any value for the week, the chances of the conclusion of the fourth subsequent week posting a positive return rises to 50.5%. For 5% losses or worse, the stats improve to 53.5%. Thus, the greater the loss, the greedier the market becomes.

Notably, the fourth subsequent week following a 10% weekly drop produces a median return of 8.68% when the response itself is positive. However, in the third week, the median positive return soars to 27.83%. For whatever reason, the bulls historically wait until the third week following an extreme-fear event before placing their chips on the table.

It’s also worth noting that the first week following an extreme-fear event offers no predictive insight. Therefore, traders may consider sitting out the current week.

Several Call Spread Ideas Beckon

Using last Friday’s closing price of $10.96 as an anchor point, traders can plot their options strategies. Arguably the most aggressive trade available will target the third week following a 10% weekly loss. Given the median positive return of 27.83%, RUM stock could possibly reach $14.01 by the options chain expiring Jan. 31. Interestingly, this target corresponds with a key technical resistance level.

To no surprise, market makers are currently offering gargantuan payouts for bull call spreads with the short (second leg) strike price of $14. At the moment, the biggest payout stems from the 12.50/14.00 call spread (buy the $12.50 call, simultaneously sell the $14 call).

On any given three-week period, RUM stock features a median positive return of 7.01%. This stochastic projection implies an upside target of $11.74. More conservative speculators could potentially split the difference between stochastic and dynamic price projections and aim for a bull call spread (again expiring Jan. 31) that features a short leg strike of $12.50.

Finally, traders who want to wait out the early noise in RUM stock may target the options chain expiring Feb. 7. Here, the dynamic price projection calls for an 8.68% median positive return, meaning that RUM may reach $11.91. In that case, an 11/12 bull call spread offers a big payout and a relatively lengthy runway for the hypothesis to pan out.

Read Next:

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.