When it comes to the latest advancements in the technology ecosystem, it’s fair to say that Dell Technologies Inc. DELL got lost in the wake of the stunning rise of quantum computing enterprises and other innovators related to artificial intelligence.

Nevertheless, it’s Dell stock that’s now flashing a bullish signal, warranting serious consideration for both options traders and buy-and-hold investors.

Fundamentally, Dell offers plenty of upside catalysts. Specifically, the company enables generative AI protocols by providing the infrastructure necessary for AI model development, training and deployment. Last year, company CEO Michael Dell stated that the surge in technological developments under the machine intelligence umbrella is accelerating much more so than other innovation cycles or waves.

See Also: Are Utilities The New Tech? Why Entergy, NiSource, Vistra Are JPMorgan’s Top Picks For 2025

Another factor bolstering Dell stock is the underlying financial performances. Over the past several quarters, Dell has consistently beaten its per-share profitability targets. While there have been a few misses in terms of quarterly revenue, generally speaking, the company exceeds expectations, thus providing confidence from a long-term investment perspective.

One element that admittedly may be distracting is recent unusual options activity. Earlier this week, large bearish-sentiment transactions hit the derivatives market. However, the majority of the dollar volume were for options that expire this Friday.

Potentially, with this distraction soon to be removed, Dell stock may move decisively higher.

Statistical and Technical Winds Favor Dell Stock

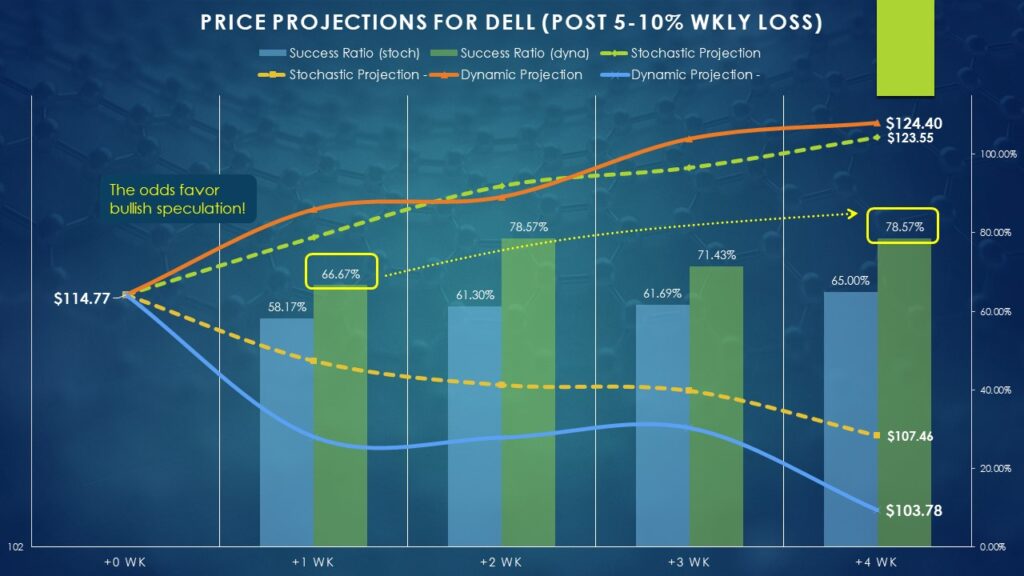

A key spark for investing in Dell is its upward bias. Over the past five years, there have been 169 four-week periods where the stock has returned a profit from the beginning of the period to the end. Only 91 four-week periods ended in a loss, meaning that outside of any other context, there’s a 65% chance that a long position in Dell will be profitable about one month later.

Rather than just calculating the odds stochastically — that is, aggregating all market events irrespective of context — traders can acquire more intelligence by calculating probabilities dynamically. Specifically, traders can better understand how the target security responds under unusual aberrations from typical market events through conditional analysis.

For example, for the business week ending Jan. 10, Dell stock lost 5.78% of value. On average, its weekly performance clocks in at 0.84%. Such an aberration in which Dell lost between 5% to 10% of value during a one-week period only happened 14 times in the past five years. Notably, out of this tally, there have been 11 instances (or 78.57%) when Dell posted a profit by the end of the fourth subsequent week.

It must be noted that the above dataset represents a very small sample. However, because Dell stock natively features a strong upward bias, it checks out that investors tend to buy the dip.

Finally, the discipline of technical analysis suggests that a strong positive wave is imminent. Primarily, DELL appears to be charting a bullish pennant formation, which is a type of continuation pattern. Essentially, a security enters a sideways consolidation channel before eventually rocketing higher.

Two Ways to Approach Dell Technologies

Armed with such a strong foundation, the simplest approach to DELL stock is to acquire shares in the open market. Experts predict that generative AI will eventually provide a $1 trillion boost to the U.S. economy alone. That’s a powerful message that can’t easily be ignored.

Of course, options provide tremendous leverage for short-term speculation. Using the intelligence acquired earlier, traders can strategically plot a bull call spread transaction. This trade involves buying a call and simultaneously selling a call at a higher strike price for the same options chain (i.e. expiration date).

The idea is for the security to reach or exceed the short-strike price. While the short call caps the upside reward, the credit received helps offset some of the debit paid for the long call. In other words, a bull call spread effectively discounts a net long position.

Statistically, four weeks following a weekly loss between 5% to 10%, positive outcomes (which again occur nearly 79% of the time) generate a median return of 8.39%. Based on last Friday’s close of $114.77, Dell could hit $124.40 by the options chain expiring Feb. 7.

Understanding this, aggressive traders may consider bull call spreads with a short (second) leg strike price of $124. As of this writing, the spread falling under this category with the biggest payout is the 120/124 call spread (buy the $120 call, simultaneously sell the $124 call).

Now Read:

Image: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.