Enterprise-software stalwart Oracle Corp ORCL suffered significant volatility during Monday’s after-hours session following the release of disappointing financial results.

For its fiscal second quarter, the company posted adjusted earnings per share of $1.47, missing Wall Street’s consensus view of $1.48. Further, on the top line, sales of $14.06 billion fell short of the anticipated $14.11 billion.

What made the matter worse was that just ahead of the disclosure, ORCL stock printed what appeared to be a strong bullish wave. Specifically, Oracle shares were above their five, 20- and 50-day exponential moving averages.

To be fair, circumstances don’t appear auspicious. However, it’s also important to realize just how rare deeply negative sessions are for Oracle stock. In the trailing five years, there have been 1,238 trading sessions. Of this vast number, only 15 sessions saw a day-to-day loss of greater than 5%.

Of course, no one wants to incur deep red ink. Nevertheless, unless compelling evidence exists to suggest that a secular downturn is on the horizon, a bullish posture remains the more reasonable approach.

Also Read: Trump’s Tariff Storm: 3 Survival Strategies US Companies Are Using To Fight Back

Holding Firm to Empirical Data

While a strong temptation exists to read between the lines of Oracle’s rough Q2 earnings report, it may be better to trust the empirical data. Indeed, it’s this data that suggests ORCL stock commands an upward bias.

As multiple experts have demonstrated, the market itself exhibits an upward bias over extended periods. This framework very much applies to established entities like Oracle. Therefore, as a general approach, it’s prudent not to fight the tape, especially for blue-chip tech juggernauts.

Interestingly, over the past five years, the weekly performance of ORCL stock (as determined by the difference between Monday’s opening price and Friday’s close) indicates that on any given week, Oracle has about a 55% chance of delivering a positive return. Over the long run, the odds modestly favor speculators to win their wagers, assuming strict money management.

However, the aforementioned success ratio also translates to a failure rate of approximately 45%. That’s quite steep, meaning that a phase of misfortune could lead to ruin. Still, one of the underappreciated aspects of multi-leg options trades is that speculators can artificially modulate the parameters of success.

Deploying the Powerful Bull Call Spread

Rather than simply buying an Oracle call option — which can be pricey for many retail investors thanks to the stock’s three-digit price tag — a trader can simultaneously sell a call option at a higher strike price. The idea is that the credit received from the short call sale helps to offset the debit paid for the long call.

Granted, this approach translates to the maximum reward being limited by the threshold represented by the short call strike. On the positive side, a clear benefit of the bull call spread is that the breakeven point can be lowered, sometimes to below the current market price.

In other words, the option trader’s definition of success no longer needs to abide by common understanding; that is, a security that returns a figure greater than 0%. Instead, as an example, success can be defined as a weekly return greater than a half-a-percent loss.

Under this framework, the probability that ORCL stock will be at least somewhat successful jumps to over 60%. That’s obviously a superior hand than a 55%-win ratio, but it gets even better.

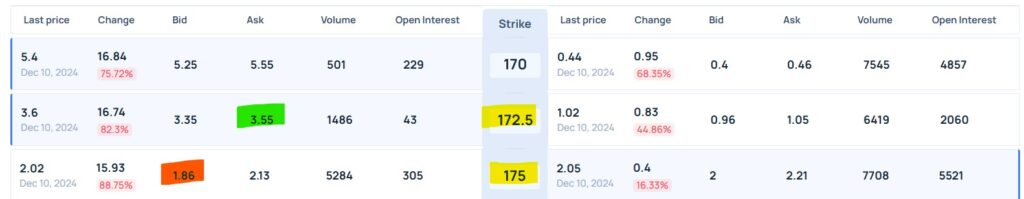

At this moment, the 172.50/175.00 bull call spread (that is, buying the $172.50 call and selling the $175 call) offers a maximum reward of $81 for every $169 at risk or a payout of 47.93%. Moreover, the breakeven price for this trade sits at $174.19, which is about 0.97% below the current market price.

If the threshold of success is defined as a weekly return of greater than a 0.97% loss, the probability of profit clocks it at around 65.5%. Just as well, ORCL stock doesn’t need to materially rise from here. It just needs to stay at or above $175 to collect the full reward.

Read Next:

Photo: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.