Pegasystems PEGA is set to report its second-quarter 2025 results on July 22.

The Zacks Consensus Estimate for second-quarter revenues is currently pegged at $368.77 million, indicating 5.02% year-over-year growth.

The consensus mark for earnings is currently pegged at 24 cents per share, unchanged over the past 30 days. This indicates a decline of 7.69% from the year-ago quarter’s reported figure.

PEGA’s earnings beat the Zacks Consensus Estimate in each the trailing four quarters, the average surprise being 94.01%. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Let us see how things have shaped up for the upcoming announcement.

PEGA’s Cloud ACV Likely to Grow in Q2

Pegasystems is experiencing strong growth in its cloud business, which is increasingly contributing to its subscription revenues. In the first quarter of 2025, Pega Cloud’s Annual Contract Value (ACV) jumped 23% year over year to $701 million, highlighting growing demand for its AI-enabled, cloud-native offerings.

First-quarter results reflected that the company remains on track to achieve its goal of 20% or more annual Cloud ACV growth. The momentum is likely to have continued into the second quarter as well. Strategic efforts to transition legacy workloads to Pega Cloud are gaining traction and this shift is expected to have positively impacted the quarter under review.

Record Free Cash Flow Expected to Aid PEGA in Q2

Pegasystems is expected to have benefited in the second quarter of 2025 from its strong cash flow performance, which is likely to have enhanced its flexibility for capital returns and supported investor confidence.

In the first quarter, the company generated $202 million in free cash flow, surpassing full-year 2023’s total of $201 million. This surge was fueled by accelerating ACV and expanding subscription billings. These factors are likely to have sustained healthy cash generation in the second quarter, positioning Pegasystems to optimize capital allocation and reinforce the scalability of its platform.

Unfavorable Forex to Hurt PEGA in Q2

Pegasystems’ second-quarter 2025 performance is likely to have been negatively impacted by unfavorable forex. Continued currency volatility is anticipated to have weighed on revenue and ACV growth in the quarter under review.

Additionally, “heightened anxiety” in Europe, where cautious client behavior has led to deferred spending, along with reductions in discretionary IT budgets, is anticipated to have further pressured ACV growth.

Pegasystems’ performance is likely to have faced pressure from intense competition in the AI-driven space, particularly from Salesforce CRM and Microsoft MSFT. Ongoing rivalry with Salesforce and Microsoft is anticipated to have challenged the company’s ability to defend market share, with the need to further differentiate its generative AI (GenAI) tools to mitigate potential margin pressures in the to-be-reported quarter.

GenAI Blueprint Adoption Drive PEGA’s Long-Term Prospects

PEGA is gaining traction with its GenAI strategy, led by its AI-powered, low-code tool, Pega Blueprint. Generating more than 1,000 new Blueprints weekly, the platform is helping clients modernize faster and close deals more efficiently, underscoring the company’s growing influence in the rapidly evolving automation landscape.

Pegasystems’ long-term collaboration with Amazon Web Services is expected to further accelerate its growth by driving cloud-based legacy system modernization. At the core of this alliance is the integration of Amazon’s AMZN Bedrock with the Pega Blueprint and Pega Platform, enabling clients to securely leverage top-tier large language models. This partnership strengthens Pega’s AI capabilities by enhancing the entire application lifecycle from design to deployment, while upholding enterprise-grade security and compliance. With robust demand for Blueprint and continued cloud adoption, the company is expected to deliver strong subscription and cloud revenue growth.

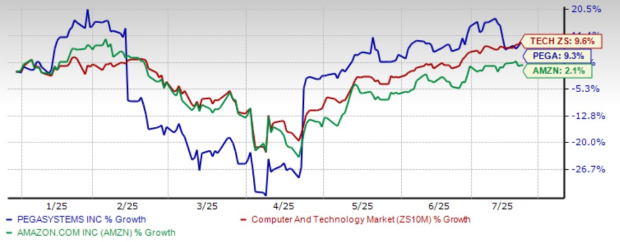

PEGA Shares Trailing Sector

PEGA’s shares have returned 9.3% year to date (YTD), slightly trailing the Zacks Computer and Technology sector’s gain of 9.6%. However, the stock has outpaced its collaborative partner Amazon, which returned 2.1% over the same period.

PEGA Stock’s Performance

Image Source: Zacks Investment Research

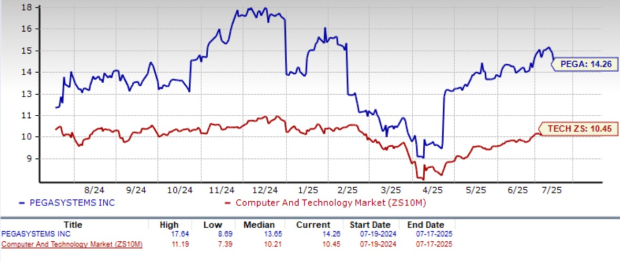

PEGA stock is not so cheap, as the Value Score of F suggests a premium valuation at this moment.

In terms of the Price/Book ratio, PEGA is currently trading at 14.26X, higher than the Zacks Computer and Technology sector’s 10.45X.

Price/Book Ratio

Image Source: Zacks Investment Research

Conclusion

Pegasystems is expected to have benefited in the second quarter of 2025 from strong Cloud ACV growth, robust free cash flow and rising GenAI Blueprint adoption. However, unfavorable forex, cautious European spending and stiff competition from Salesforce and Microsoft are likely to have tempered growth, potentially pressuring ACV and margins in the quarter under review.

Currently, PEGA sports a Zacks Rank #1 (Strong Buy), suggesting that it may be wise for investors to start accumulating the stock now.

You can see the complete list of today’s Zacks #1 Rank stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

Download Atomic Opportunity: Nuclear Energy’s Comeback free today.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Salesforce Inc. (CRM) : Free Stock Analysis Report

Pegasystems Inc. (PEGA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).