Anticipating PepsiCo’s Q3 Earnings

PepsiCo, Inc. will unveil its third-quarter earnings results before the market opens on Tuesday, Oct. 8.

Analysts are predicting earnings of $2.30 per share for the quarter, a rise from $2.25 in the same period last year. Revenue is expected to reach $23.85 billion, up from $23.45 billion a year ago, as per data from Benzinga Pro.

Notably, PepsiCo recently announced its acquisition of Garza Food Ventures LLC, known as Siete Foods, for $1.2 billion.

Despite this news, PepsiCo’s shares experienced a slight 0.5% drop to close at $167.21 on Monday.

Wall Street Insights

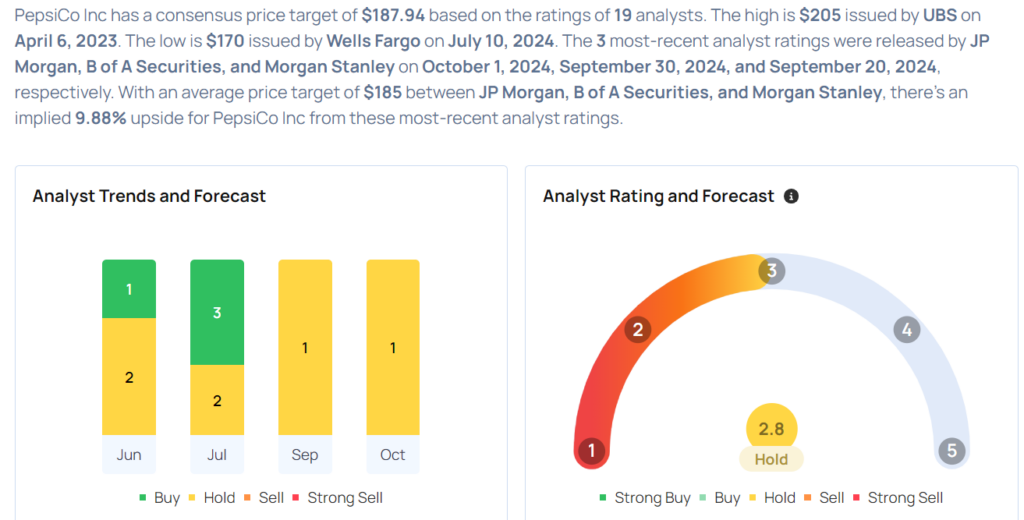

Let’s delve into how top analysts from Benzinga rated the company recently.

- B of A Securities analyst Bryan Spillane maintained a Buy rating but adjusted the price target from $190 to $185 on Sept. 30, boasting an impressive 68% accuracy rate.

- Morgan Stanley analyst Dara Mohsenian downgraded the stock from Overweight to Equal-Weight with a price target of $185 on Sept. 20. This analyst holds a commendable 73% accuracy rate.

- Barclays analyst Lauren Lieberman sustained an Overweight rating while reducing the price target from $187 to $186 on Oct. 4, demonstrating a 61% accuracy rate.

- Wells Fargo analyst Chris Carey retained an Equal-Weight rating and lowered the price target from $175 to $170 on July 10, with a reliable 65% accuracy rate.

- TD Cowen analyst Robert Moskow stayed with a Buy rating but decreased the price target from $200 to $190 on July 3, showing a solid 66% accuracy rate.

Analysts’ Perspective on PEP Stock

If you’re considering investing in PepsiCo, take note of what analysts are advising.

Market News and Data: Benzinga APIs