Piper Sandler set a $400 price target for Tesla Inc. TSLA following Tuesday’s Q1 earnings call.

What Happened: The investment bank confirmed the price target on Wednesday, with analyst Alex Potter reiterating an overweight rating on the stock despite Tesla’s poor performance in the latest quarter.

“In our preview last week, we predicted that (at best) Q1 would be a non-event. With the stock trading up slightly in the after-hours session, it appears our best-case scenario has materialized,” the investment bank said.

Piper Sandler also maintained that Tesla didn’t ‘hedge expectations’ by announcing plans for launching the robotaxis, as well as more affordable models. Referring to the robotaxi launch in June, the statement then mentioned how there were some “interesting catalysts” for the investors ahead.

However, the investment bank did mention that it would largely depend on how Tesla’s product launches, like the robotaxi and affordable models, materialize. “We reiterate our $400 price target,” Piper Sandler said.

Why It Matters: Piper Sandler isn’t the only one optimistic about Tesla, with Wedbush Investment’s Dan Ives also setting a price target of $350 on Tesla stock.

The analysts’ optimism stems from Elon Musk reiterating his commitment to the EV giant as the billionaire will scale back on his DOGE duties with the Trump administration.

The company also announced it will release an affordable model, which will be based on Tesla’s current line-up of vehicles like the Model S, Model Y, Model X, Model 3, and the Cybertruck.

However, analysts like Ross Gerber aren’t as optimistic about Tesla. Following the earnings call, the TSLA bull shared his thoughts on the social media platform X, calling it the “worst performance in Tesla’s history.”

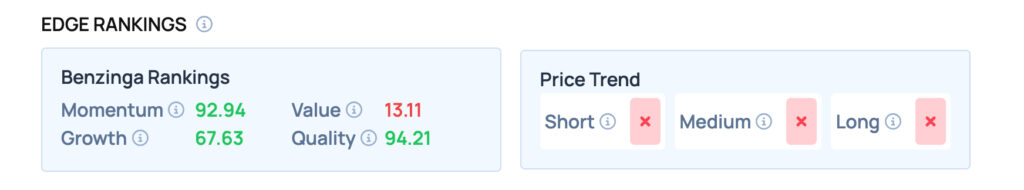

According to Benzinga Edge stock Rankings, Tesla scores well across all metrics except Value. For more such insights, sign up for Benzinga Edge today!

Read Next:

Image Via Shutterstock

Market News and Data brought to you by Benzinga APIs