As Qualcomm Inc QCOM and Arm Holdings PLC ARM gear up to release their earnings Wednesday, the two semiconductor giants face bearish technical pressures but diverge in their growth paths.

Qualcomm: Navigating Challenges Amid Bearish Technicals

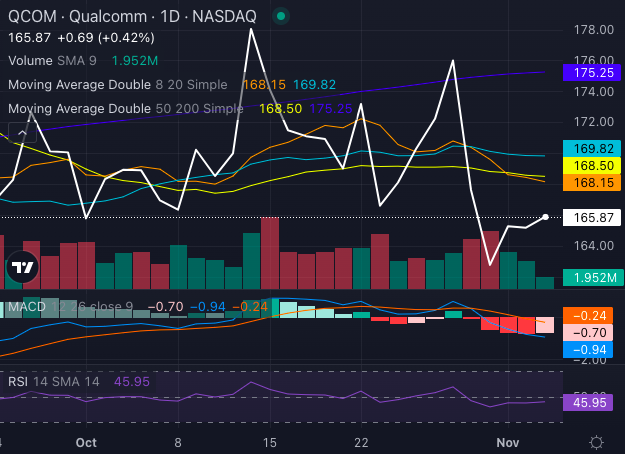

Qualcomm, a mainstay in mobile chipsets, faces strong bearish signals.

Chart created using Benzinga Pro

QCOM stock is trading at $165.87, well below its eight, 20, and 50-day simple moving averages. Analysts expect fourth quarter EPS of $2.56 on revenue of $9.91 billion, but the stock’s recent bearish signals from technical indicators suggest caution.

QCOM’s MACD (Moving Average Convergence/Divergence) is -0.94, and its RSI (Relative Strength Index) is 45.95, indicating a neutral condition with limited immediate upside potential due to bearish momentum.

Qualcomm’s expansion into automotive and IoT markets showcases its strategic shift, but near-term pressures from regulatory concerns and competition—particularly from Apple Inc‘s AAPL modem push—continue to cloud investor sentiment.

Read Also: AMD’s AI Data Center Business Booms: CEO Says It’s ‘Closed A Good Part Of That Gap’ With Nvidia

Arm Holdings: Bullish Hints Despite Near-Term Pressures

Arm, with its IP-licensing model and strong YTD performance, shows resilience amid bearish trends.

Chart created using Benzinga Pro

Trading at $139.89, ARM stock is below short-to medium-term SMAs (eight-day at $145.69, 20-day at 148.79, and 50-day at $141.22), signaling a bearish trend prevailing. Moreover, its MACD is a negative 0.23, which reinforces the bearish trend.

However, the 200-day SMA provides support at $131.04, signaling potential long-term strength.

Analysts forecast that the second quarter EPS will be 26 cents on revenue of $808.37 million.

Unlike Qualcomm, Arm’s royalty-based model shields it from manufacturing woes, positioning it for growth in high-demand areas like AI, data centers, and IoT.

Different Risks, Different Rewards

While both stocks have bearish technical signals, Qualcomm’s cyclicality contrasts with Arm’s steadier IP-driven model. Investors eyeing Qualcomm may anticipate a comeback in 5G and automotive, while Arm’s appeal lies in its growth as a diversified IP giant.

This earnings season will be pivotal for both, but the charts suggest caution.

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs