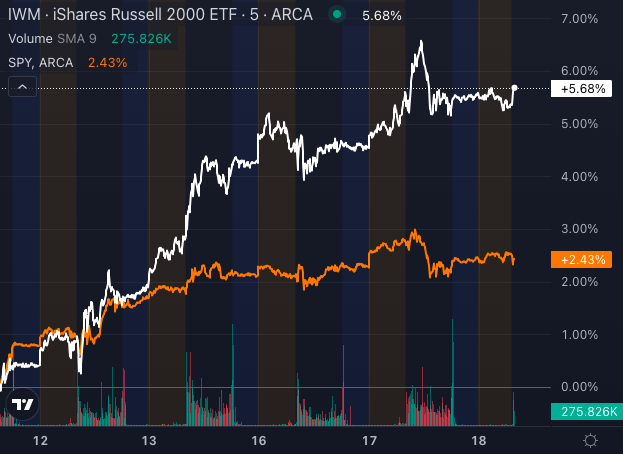

Small-cap stocks are bustling with fervor as they await the Federal Reserve’s proposed interest rate trim, relishing their moment under the spotlight. The Russell 2000 Index has boldly surged over 5% in the past week, overshadowing its larger-cap counterparts in the S&P 500 Index, which have managed a modest 2.5% gain.

Evidently, the small-cap fervor is evidenced as the iShares Russell 2000 ETF (IWM) outshines the SPDR S&P 500 ETF (SPY). Noteworthy contributors to the recent small-cap rally include stocks like IGM Biosciences Inc (IGMS), Intuitive Machines Inc (LUNR), and Applied Therapeutics Inc (APLT), boasting impressive gains of 59.33%, 38.62%, and 44.90%, respectively, over the last five days.

Investors appear bullish on the anticipation that the Fed will ease up, especially benefitting small-cap companies grappling with debts tied to flimsy interest rates. A potential rate cut would lower borrowing costs for these firms, potentially unlocking additional capital and alleviating the burden on companies with vulnerable balance sheets. As such, investors are salivating at the prospect of substantial returns in these smaller stocks.

Earnings, Economy Could Turn The Table

While the allure of cheaper borrowing excites investors, concerns loom over sluggish earnings and an uncertain U.S. economic climate. This uncertainty casts a shadow over the small-cap frenzy, questioning its sustainability if the economy fails to weather the storm.

For investors eyeing a piece of the action, exchange-traded funds like the IWM or the Vanguard Small-Cap ETF (VB) offer diversified exposure to small-cap stocks. These funds mirror small-cap index performance, eliminating the need to cherry-pick individual stocks for potential gains.

Yet, the burning question remains: how long can this jubilant rally persist?

Small Cap ETF Showing Strong Bullish Trend

The IWM, epitomizing small-cap stocks, displays a resolute bullish trend, with its share price perched at $219.23 above the five, 20, 50, and 200-day simple moving averages (SMAs).

Noteworthy, the eight-day SMA at $213.80, the 20-day SMA at $215.07, and the 50-day SMA at $214.41 collectively signal a bullish trajectory, underscoring the ETF’s robust upward momentum.

Despite this impressive bullish trend, the IWM encounters slight selling pressure, hinting at potential short-term volatility. Its position well beyond the 200-day SMA of $203.57 further bolsters a positive technical outlook, indicating sustained strength in the small-cap domain.

A substantial half-point cut by the Fed could thrust small caps into the limelight. Moreover, even a modest 25-basis-point cut could fuel the rally further, at least for the interim.

Inquisitive investors might want to monitor the SPDR S&P 600 Small Cap ETF (SLY) for a comprehensive exposure to small-cap companies poised to benefit from diminished rates.

Don’t miss the opportunity to dominate in a volatile market at the Benzinga SmallCAP Conference on Oct. 9-10, 2024, at the Chicago Marriott Downtown Magnificent Mile.

Get exclusive access to CEO presentations, 1:1 meetings with investors, and valuable insights from top financial experts. Whether you’re a trader, entrepreneur, or investor, this event offers unparalleled opportunities to grow your portfolio and network with industry leaders.

Secure your spot and get your tickets today!

Read Next:

Image created using artificial intelligence via Midjourney.