The AI Chip Mirage

For Morgan Stanley analyst Joseph Moore, the landscape of AI chip potential is akin to a shimmering oasis in the desert – promising, but perhaps not quite as vast as some investors imagine.

AMD Caught in the AI Crossfire

Moore’s lens zooms in on Advanced Micro Devices (AMD), citing that while the company is solid in its core markets, the luster of its AI aspirations is dimmed by sky-high expectations. The analyst dampens the fervor, expressing caution about AMD’s capacity to fulfill these lofty forecasts and maintain its premium valuation.

Nvidia’s Shadow Looms Large

Efforts to challenge AI chip emperor Nvidia may prove Sisyphean for AMD, as Moore highlights the impending competitive threat posed by Nvidia’s Blackwell GPU architecture. The analyst stresses that investors may have overlooked the strategic impact of this development, potentially casting a shadow over AMD’s ambitions.

AMD’s Uphill Battle

While AMD is viewed as a contender to erode Nvidia’s AI dominion due to its multi-cloud capabilities and anti-vendor lock-in allure, Moore postulates that Nvidia is swiftly fortifying its defenses. With intensified pricing strategies and an accelerated product roadmap, Nvidia’s counteroffensive may impede AMD’s progress in the AI arena.

AI: From Supporting Actor to Leading Role

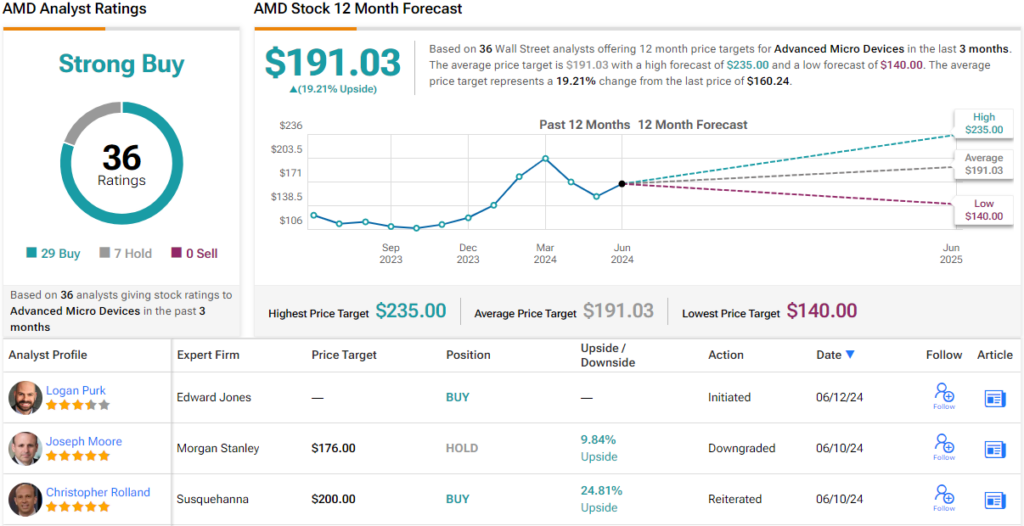

Moore recalibrates his outlook on AMD, transitioning from an Overweight to Equal-weight rating while maintaining a $176 price target. This modification reflects a 9.5% potential upside, as the narrative shifts from a core business resurgence catalyzed by AI to AI becoming the primary growth driver.

The Market Consensus

Market sentiment on AMD remains buoyant, with 29 Buy recommendations overshadowing 6 Hold ratings, culminating in a Strong Buy consensus. Analysts foresee an average price target of $191.03, indicative of a ~19% premium over the course of a year.

To navigate the market for stocks displaying compelling valuations, the discerning investor can explore TipRanks’ Best Stocks to Buy – a comprehensive resource of equity insights.

Disclaimer: This article reflects the views of the analyst and is intended for informational purposes only. It is vital to conduct thorough research before making any investment decisions.