Walmart WMT shares have been standout performers this year, handily outperforming not just the broader market indexes and peers like Target TGT but also the likes of Amazon AMZN and most of the Magnificent 7 group members.

With the company on deck to report quarterly results on Thursday, February 20th, it will be interesting if the stock can maintain its performance momentum after the results. Walmart shares reacted favorably to each of the last four quarterly results, with the stock up more than +20% since the last release on November 19th.

The chart below spotlights Walmart’s impressive performance. The chart tracks the one-year performance of Walmart shares (up +84.9%) relative to the S&P 500 index (+22.6%), Amazon (+34.8%) and Target (-12.5%).

Image Source: Zacks Investment Research

Walmart will kick off the Q4 reporting cycle for the ‘conventional’ retailers this week, with the rest of the group coming out from the following week onwards.

The Walmart report will set the tone for the rest of the retail space, as it will give us a good sense of the health of household finances and consumer spending trends.

For example, one persistent spending trend in the post-Covid period has been consumers prioritizing spending on discretionary services like travel, leisure, dining out, and hospitality and spending far less on discretionary goods categories, including big-ticket items like appliances, furniture, etc.

The very notable underperformance of Target shares in the first chart we shared is a direct result of this weak demand for discretionary merchandise, a product category to which Target is heavily exposed to.

Unlike Target, Walmart has a much heavier indexing to groceries and other staple and must-have product categories that enjoy a relatively more stable demand backdrop through the economic cycle. Walmart’s value orientation and well-executed digital strategy have been key to gaining grocery market share by attracting higher-income households.

Walmart’s growing share of higher-income grocery spending notwithstanding, the retailer still has substantial exposure to lower-income consumers who have been under a lot of financial stress due to the cumulative effects of inflation. Walmart has thus far been able to offset weakness from lower-income consumers by attracting more higher-income households through its efficient digital offerings.

Walmart’s growing e-commerce isn’t just a means to attract higher-income households, as it also opens up avenues for other higher-margin revenue streams like advertising and third-party fulfillment.

Walmart is expected to report $0.64 in EPS on $179.3 billion in revenues, representing year-over-year changes of +6.7% and +3.4%, respectively. Trends in Walmart’s non-grocery business have been anemic lately, though management had pointed to some early signs of stabilization in a few discretionary product categories at the last two earnings calls. Any signs of strengthening within discretionary merchandise will also have positive read-throughs for Target.

With respect to the Retail sector 2024 Q4 earnings season scorecard, we now have results from 17 of the 33 retailers in the S&P 500 index. Regular readers know that Zacks has a dedicated stand-alone economic sector for the retail space, which is unlike the placement of the space in the Consumer Staples and Consumer Discretionary sectors in the Standard & Poor’s standard industry classification.

The Zacks Retail sector includes not only Walmart, Target, and other traditional retailers but also online vendors like Amazon AMZN and restaurant players. The 17 Zacks Retail companies in the S&P 500 index that have reported Q4 results already belong mainly to the e-commerce and restaurant industries, though we have many restaurant companies on deck to report results this week as well.

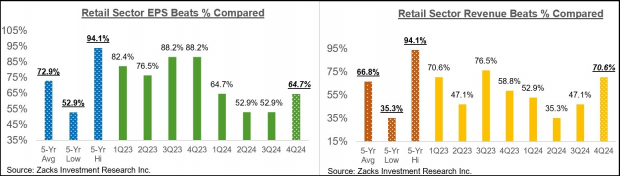

Total Q4 earnings for these 17 retailers that have reported are up +47.1% from the same period last year on +8.6% higher revenues, with 64.7% beating EPS estimates and only 70.6% beating revenue estimates.

The comparison charts below put the Q4 beats percentages for these retailers in a historical context.

Image Source: Zacks Investment Research

As you can see above, the EPS beats percentages for these online players and restaurant operators are tracking above what we had seen in the last two quarters for this same group of companies, but the Q4 EPS beats percentage of 64.7% is tracking below the 20-quarter average of 72.9% for this group of companies. The group’s performance on the revenues side is a lot better, with the Q4 revenue beats percentage not only tracking above what we had seen in other recent periods but also above the historical average.

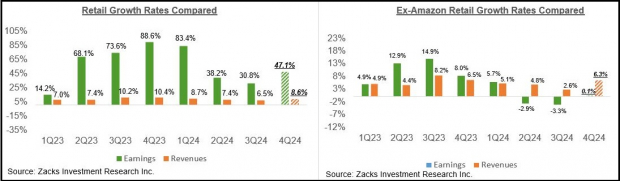

With respect to the elevated earnings growth rate at this stage, we like to show the group’s performance with and without Amazon, whose results are among the 17 companies that have reported already. As we know, Amazon’s Q4 earnings were up +86.9% on +10.5% higher revenues, beating EPS and top-line expectations.

As we all know, the digital and brick-and-mortar operators have been converging for some time now, with Amazon now a decent-sized brick-and-mortar operator after Whole Foods and Walmart being a growing online vendor. As we noted in the context of discussing Walmart’s coming results, the retailer is steadily becoming a big advertising player thanks to its growing digital business. This long-standing trend got a huge boost from the Covid lockdowns.

The two comparison charts below show the Q4 earnings and revenue growth relative to other recent periods, both with Amazon’s results (left side chart) and without Amazon’s numbers (right side chart).

Image Source: Zacks Investment Research

As you can see above, earnings for the group outside of Amazon are essentially flat on a +6.3% top-line gain, which points to margin pressures for the group.

Q4 Earnings Season Scorecard

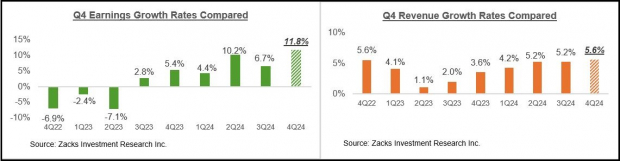

Through Friday, February 14th, we have seen Q4 results from 384 S&P 500 members, or 76.8% of the index’s total membership. Total earnings for these companies are up +11.8% from the same period last year on +5.6% higher revenues, with 77.3% beating EPS estimates and 65.1% beating revenue estimates.

The comparison charts below put the Q4 earnings and revenue growth rates relative to other recent periods for the same group of index members.

Image Source: Zacks Investment Research

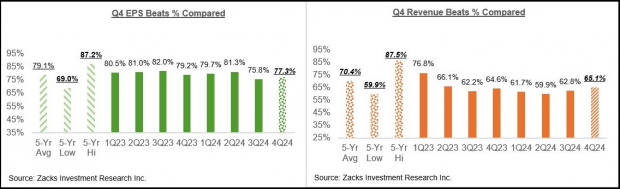

The comparison charts below put the Q4 EPS and revenue beats percentages relative to other recent periods for the same group of companies.

Image Source: Zacks Investment Research

Key Earnings Reports This Week

We have almost 400 companies on deck to report results this week, including 43 S&P 500 members. In addition to the aforementioned Walmart release, we have a number of the major Chinese Tech players on deck to report results this week, including Alibaba, Baidu, and Sohu.com. We also have many restaurant operators reporting results this week, including Cheesecake Factory, Shake Shack, Texas Roadhouse, and others.

The Earnings Big Picture

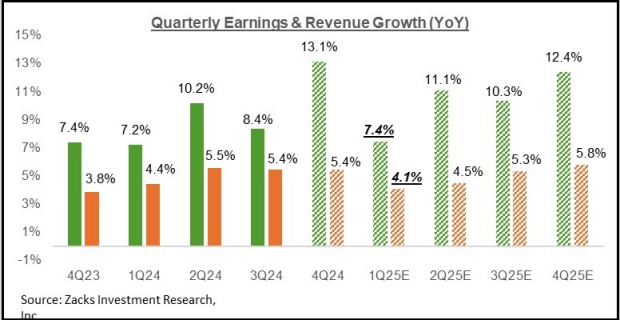

The chart below shows the Q4 earnings and revenue growth expectations in the context of where growth has been in the preceding four quarters and what is expected in the coming four quarters.

Image Source: Zacks Investment Research

Excluding the contribution from the Mag 7 companies, Q4 earnings for the rest of the S&P 500 index would be up +8.3% on +4.5% higher revenues.

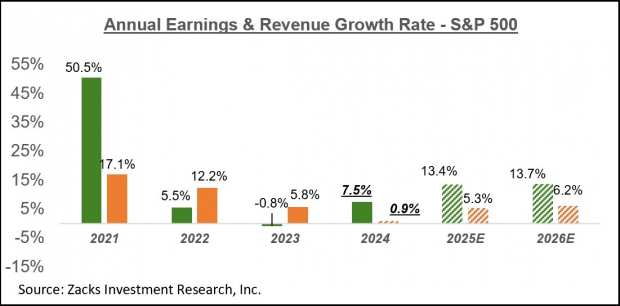

The chart below shows the overall earnings picture on a calendar-year basis, with double-digit earnings growth expected in 2025 and 2026.

Image Source: Zacks Investment Research

For a detailed look at the overall earnings picture, including expectations for the coming periods, please check out our weekly Earnings Trends report >>>> Breaking Down the Current Earnings Outlook

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.3% per year. So be sure to give these hand picked 7 your immediate attention.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report