The Rise of Toyota Motor

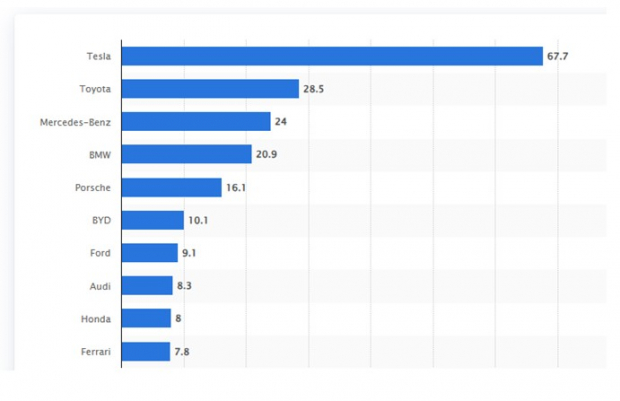

Toyota Motor, once overshadowed by Tesla in the electric vehicle market, has now emerged as a strong contender. The Japanese automaker’s transition from offering budget-friendly cars to high-end hybrid electric vehicles has been remarkable. Leveraging its reputation for reliability, Toyota boasts the second-highest brand value in the global automotive industry, trailing only Tesla. With a diverse lineup of 26 electrified vehicles, Toyota has captured 30% of the market share, propelling its stock to new heights.

Image Source: Statista

General Motors’ Resurgence

In the shadow of Tesla’s dominance, General Motors has quietly secured its position as the top-selling automaker in the United States. With a focus on profitability, GM’s stock presents an attractive value proposition, trading at just 4.3X forward earnings. The company’s strategic shift towards electric vehicles is evident in the delivery of 75,883 all-electric vehicles in 2023, positioning GM as a key player in the EV market.

PACCAR’s Competitive Edge

PACCAR, a leading truck manufacturer, has shown impressive growth in recent years. The company’s focus on hybrid and all-electric models for heavy-duty vehicles has set it apart in the industry. With a stock trading at a discounted multiple of 14.1X forward earnings, PACCAR offers investors an enticing opportunity. The company’s robust performance, with shares up 96% over the last three years, reflects its strong position in the market.

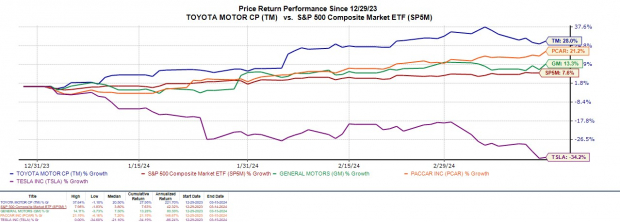

Blazing Year-to-Date Performances

Despite Tesla’s recent struggles, Toyota Motor, General Motors, and PACCAR have all delivered impressive year-to-date returns. Toyota’s stock has surged by 28%, while PACCAR and General Motors have seen gains of 21% and 13%, respectively. These performances have outpaced the S&P 500 and underscore the strength of these auto stocks in the current market environment.

Sealing the Deal

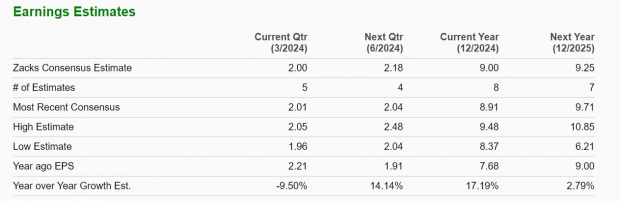

With positive earnings outlooks and attractive valuations, the momentum behind Toyota Motor, General Motors, and PACCAR is undeniable. Sporting a Zacks Rank #1 (Strong Buy) and boasting an “A” Zacks Style Score for Value, these hot auto stocks present a compelling investment opportunity in the ever-evolving automotive industry.

Unveiling Hidden Gems: Auto Stocks Poised for Early Price Surges

Beating the Odds

Through the lens of investors, the term “Most Likely for Early Price Pops” captivates attention, hinting at an opportunity to unearth hidden treasures amidst the bustling stock market. This concept isn’t new; it echoes back to 1988 when a carefully curated set of stocks outshone the market, boasting an impressive average annual gain of +24.2%. This enduring legacy serves as a beacon for today’s traders, indicating that value can emerge from unexpected corners of the market.

Timeless Insights

In the world of finance, history often repeats itself. The notion that certain stocks hold the potential for substantial early price escalations isn’t a fleeting trend – it’s a timeless strategy that savvy investors have leveraged for decades. These insights become a compass guiding investors through the turbulent waters of market volatility, offering a glimpse into the future by studying the patterns of the past.

An Ode to Industry Leaders

Among the select few that bear the “Most Likely for Early Price Pops” tag are stalwarts of the automotive industry. Companies like Toyota Motor Corporation (TM), PACCAR Inc. (PCAR), General Motors Company (GM), Tesla, Inc. (TSLA), and Nikola Corporation (NKLA) stand at the precipice of potential surges, poised to reward those who see beyond the surface. These industry leaders command attention, embodying a blend of tradition and innovation that defines the auto sector’s evolution.

Riding the Wave of Innovation

Automotive stocks are not merely tickers on a screen; they represent the pulse of innovation, the heartbeat of a dynamic industry on the cusp of transformation. Embracing electric vehicles, autonomous driving, and sustainable practices, these companies navigate the intersection of tradition and future, setting the stage for monumental shifts in the automotive landscape.

Embracing Opportunity

The allure of early price pops isn’t a mirage but a tangible opportunity for investors to partake in the growth stories of iconic auto brands. As the market ebbs and flows, presenting challenges and triumphs in equal measure, these stocks offer a beacon of stability and potential gains for those willing to navigate the currents of change and seize the moment.

To delve deeper into the promising trajectory of auto stocks and uncover the hidden gems within this sector, investors can take a closer look at the analysis available on Zacks.com, where insights into industry trends and stock performance await.

An investment in automotive stocks isn’t just a financial decision; it’s a journey through the annals of innovation, a testament to the resilience and adaptability of an industry that has stood the test of time. By recognizing the potential for early price surges, investors can align themselves with the pioneers of change, riding the wave of innovation toward a future shaped by progress and possibility.

Zacks Investment Research offers a gateway to unlocking the hidden potential of auto stocks, providing a roadmap for investors seeking to navigate the complexities of the market and emerge victorious in their quest for financial growth.