The hottest trade of late hasn’t been in AI, instead, stocks of companies that are engaged in the production or servicing of rare earth minerals and elements have taken the spotlight.

While the market had been on edge amid reemerging trade war fears, “rare earth” stocks have gained more momentum from the increased tensions between the U.S and China.

To that point, the U.S.-China friction has intensified around rare earth minerals, which are critical for defense and tech industries, including for the production of electric vehicles and semiconductors.

Dominating the rare earth supply chain for quite some time, China’s tariff retaliation has also centered on tighter export restrictions for these essential commodities. In response, the U.S. has planned to ramp up domestic production and has even made direct investments in publicly traded mining and critical element producing companies.

These strategic investments led the initial surge in rare earth stocks with JPMorgan JPM recently adding to the optimism by announcing a $1.5 trillion “Security and Resilience Initiative” to help as well.

Keeping this scenario in mind, investors are certainly wondering if they should ride the rare earth stock’s trade wave.

The U.S. Government’s Direct Investments

Focusing on critical minerals and national security, the U.S. government has taken direct equity stakes in several mining companies, which have all seen their stocks soar well over +100% in 2025.

Lithium Americas – LAC

Stock Price & YTD Gains: $6, +135%

Although Lithium Americas LAC is a Canadian-based company, it has critical mineral projects in the U.S. that are essential to the nation’s ability to produce such rare resources. With the U.S. taking a 5% stake in Lithium Americas, the mining company’s Thacker Project in Nevada is on track to be one of the largest sources of lithium in North America. Notably, lithium is crucial for EV production and the excitement for Lithium America’s stock has taken off despite expectations of an adjusted loss of around $0.20 per share or more for the foreseeable future. Still, fiscal 2026 EPS estimates have remained slightly higher in the last 60 days landing LAC shares a Zacks Rank #3 (Hold) as the possibility of Lithium Americas being lifted above the probability line has become more likely.

Trilogy Metals – TMQ

Stock Price & YTD Gains: $6, +434%

Yes your seeing that right, this was a penny stock that has skyrocketed over +400% after trading under $1 earlier in the year. Also based in Canada, the U.S. has a 10% stake in Trilogy Metals TMQ to support the development of its Ambler mining district project in Alaska, which is rich in copper, cobalt, and geranium.

TMQ shares also land a Zacks Rank #3 (Hold) as earnings estimate revisions have remained unchanged over the last quarter but the metal exploration company is actually closer to posting positive EPS sooner than Lithium Americas.

MP Materials – MP

Stock Price & YTD Gains: $82, +427%

Headquartered in Nevada, MP Materials MP has long been on the radar as one of the more popular mining stocks. Producing rare earth materials in the Western Hemisphere, the U.S. has taken a 15% equity stake in MP Materials. That said, the rally in MP Materials stock appears to be overdone with MP shares trading over $80 after soaring more than +400% YTD. It might be a good time to take profits in MP as FY25 and FY26 EPS estimates are both lower in the last 60 days. Correlating with such, MP lands a Zacks Rank #4 (Sell).

MP Materials is projected to swing into the black next year and post positive EPS of $0.92 but estimates are down from $0.96 two months ago. Plus, this would still leave MP Materials at a very high forward P/E valuation despite moving further away from the speculative growth phase since going public in 2020.

USA Rare Earth Stock Soars on China’s Export Controls

Launching its IPO in March, USA Rare Earth’s USAR stock has attracted investors interest as one of the few companies aiming to produce rare earth magnets solely in the U.S., a key component in electric motors and military systems.

Furthermore, USA Rare Earth’s new CEO Babara Humpton has sparked investor sentiment after hinting that management is in close communication with the White House amid the Trump administration’s goal to cut China’s dominance over rare earth minerals. Fueling speculation about a potential government partnership, USAR shares have rallied more than +100% in the last month to over $30 and are now sitting on pleasant IPO gains of +70%.

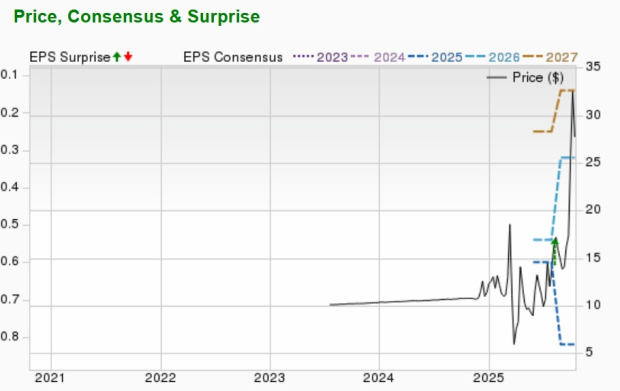

Image Source: Zacks Investment Research

USA Rare Earth is not yet profitable, but is projected to post a smaller adjusted EPS loss of -$0.32 in FY26 with FY25 estimates currently at -$0.82 per share. USAR has a Zacks Rank #3 (Hold) as FY26 EPS revisions are sharply up from projections of -$0.54 earlier in the quarter although FY25 EPS estimates are down from -$0.60.

Image Source: Zacks Investment Research

Cleaveland-Cliff’s Q3 Report

It’s noteworthy that Cleveland-Cliffs CLF has entered the rare earth stock trade after announcing a bold pivot into the space during its Q3 report on Monday morning. CLF surged more than +20% in today’s trading session to $16 a share as Cleaveland-Cliffs stated it would explore rare earth mineral production at its mining sites in Michigan and Minnesota.

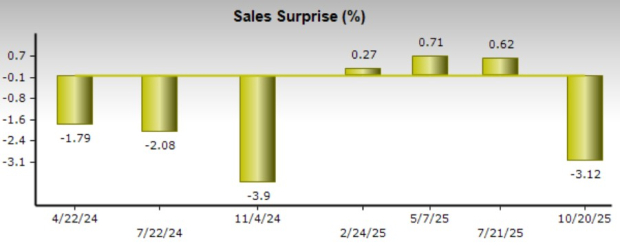

Able to exceed earnings expectations, Cleveland-Cliffs posted an adjusted loss of -$0.50 a share compared to Q3 EPS estimates of -$0.68. The EPS surprise was attributed to robust demand for its U.S.-produced steel thanks to President Trump’s 50% tariff on imported steel. However, Cleveland-Cliffs came short of Q3 sales estimates of $4.88 billion by 3% with CLF currently landing a Zacks Rank #4 (Sell). Hopefully a trend of declining EPS revisions for FY25 and FY26 will begin to turnaround, especially as Cleaveland-Cliffs is expected to be unprofitable for the time being.

Image Source: Zacks Investment Research

Conclusion & Final Thoughts

Not to doubt the emerging importance and relevance of these rare earth stocks, but there could certainly be better buying opportunities ahead as most of them are in the speculatory growth phase. Obviously, a higher risk tolerance will be needed for those who choose to invest in these rare earth companies but they make for a great watchlist of buy the dip targets.

#1 Semiconductor Stock to Buy (Not NVDA)

The incredible demand for data is fueling the market’s next digital gold rush. As data centers continue to be built and constantly upgraded, the companies that provide the hardware for these behemoths will become the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to take advantage of the next growth stage of this market. It specializes in semiconductor products that titans like NVIDIA don’t build. It’s just beginning to enter the spotlight, which is exactly where you want to be.

See This Stock Now for Free >>

Cleveland-Cliffs Inc. (CLF) : Free Stock Analysis Report

MP Materials Corp. (MP) : Free Stock Analysis Report

Trilogy Metals Inc. (TMQ) : Free Stock Analysis Report

Lithium Americas Corp. (LAC) : Free Stock Analysis Report

USA Rare Earth Inc. (USAR) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).