A recent ruling by a federal appeals court has sent shockwaves through the cryptocurrency world, particularly impacting the renowned global exchange, Binance. The court’s decision mandates Binance to face a putative class-action lawsuit initiated by a group of U.S.-based crypto investors. These investors allege that Binance permitted them to engage in transactions involving unregistered securities through specific cryptocurrencies, although the ruling refrains from definitive conclusions on the securities status of these tokens. Nevertheless, the implications reverberate significantly in the realm of securities litigation.

Legal Resurgence

The appeals court breathed new life into the aspirations of a class-action lawsuit against Binance, rebuking a district judge’s dismissal predicated on jurisdictional grounds and statute-of-limitations elapsing.

Significance Unveiled

Binance’s previous claim of being a stateless entity no longer holds sway, as confirmed by the appellate judges. The ruling underscores the applicability of domestic securities regulations even to transactions executed on non-U.S.-based exchanges, portending broader legal ramifications, including the SEC’s ongoing litigation against the exchange. Notably, the appellate court’s decision bears more weight as a precedent compared to a district court ruling.

Under the Legal Microscope

The verdict elucidates the premise that a crypto exchange, despite disavowing U.S. domicile, can fall under U.S. regulatory purview if substantial ties exist with the country. In the case of the putative class-action lawsuit targeting Binance, such connections proved adequate for a triad of judges to affirm the standing of crypto investors in pursuing legal recourse against the exchange.

Two pivotal facets of the ruling pertain to timeliness and extraterritoriality, crucial in navigating the complexities of transnational legal enforcement in the digital asset domain.

The judges’ application of the Morrison v. National Australia Bank precedent accentuates the essence of transactional locations, payments, and terms of service acceptance by users within the U.S, fortifying the plaintiffs’ claims originating from diverse U.S. states.

“First, Plaintiffs have adequately alleged that their claims involved domestic transactions because they became irrevocable within the United States and are therefore subject to our securities laws,” emphasized the judges, defying Binance’s stance as a decentralized exchange and disputing jurisdictional exemptions.

SEC Counteraction

Legal representatives from the SEC swiftly utilized the appellate ruling to counter Binance’s and founder Changpeng Zhao’s dismissal contentions in the regulator’s parallel lawsuit. The submission of the ruling as supplementary evidence bolsters the SEC’s stance vis-a-vis the exchange’s regulatory compliance.

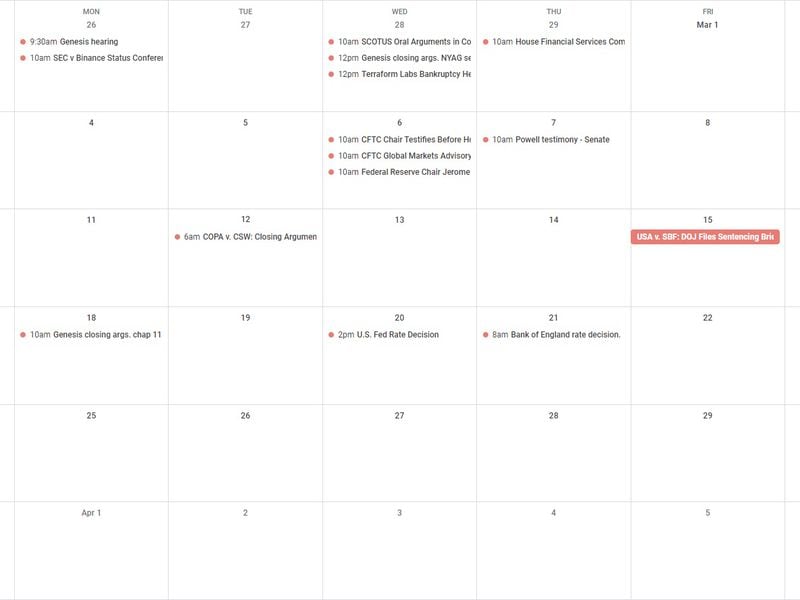

Tuesday

- 10:00 UTC (10:00 a.m. GMT) Attorneys representing the Crypto Open Patent Alliance kicked off closing arguments in their case against Craig Wright.

Friday

- The Department of Justice will file its own briefs on Sam Bankman-Fried’s sentencing.

- (The Wall Street Journal) Binance Head of Financial Crime Compliance Tigran Gambaryan and regional manager for Africa Nadeem Anjarwalla faced detainment by Nigerian authorities, amidst the country’s attribution of its local currency crisis to Binance and broader crypto influence.

- (The Daily Beast) Despite the current safety record of commercial flights, United Airlines recently confronted a string of unfortunate incidents, including engine malfunctions, tire detachment, and runway mishaps, showcasing a challenging operational week for the carrier.

If you have insights or suggestions for future discussions or any feedback to share, feel free to email me at nik@coindesk.com or connect with me on Twitter @nikhileshde.

You can also engage in group conversations on Telegram.

See you next week!