Zacks Thematic Investing Screens lets you dive into 30 dynamic investment themes shaping the future. Whether you’re interested in cutting-edge technology, renewable energy, or healthcare innovations, our investment themes help you invest in ideas that matter to you.

For those interested in viewing the investment themes, please click here >>> Thematic Screens – Zacks Investment Research.

Let’s take a closer look at the Artificial Intelligence investing theme and analyze a few stocks that the theme returned, such as Broadcom AVGO, NVIDIA NVDA, and Palantir PLTR.

Artificial Intelligence

Artificial Intelligence (AI) refers to the technology that enables computers and machines to simulate human intelligence and problem-solving capabilities to perform the cognitive functions usually associated with human minds.

This investment theme features diverse companies involved in AI, ranging from creators of software and hardware that power AI to those applying and utilizing this technology through automation, diagnostics, cognitive tasks, and more.

Nvidia Remains Prime Pick

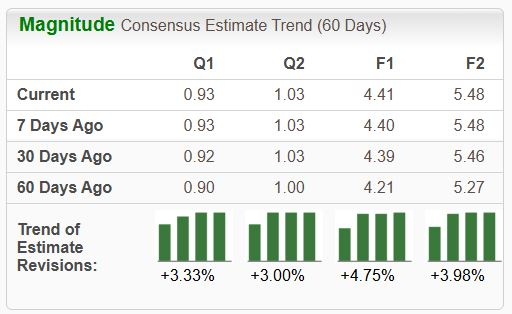

Nvidia continues to be a prime selection among those seeking AI exposure, with its Data Center results regularly shocking investors over recent periods thanks to red-hot demand. The stock continues to sport a favorable Zacks Rank #2 (Buy), sporting a bullish near-term earnings outlook.

Image Source: Zacks Investment Research

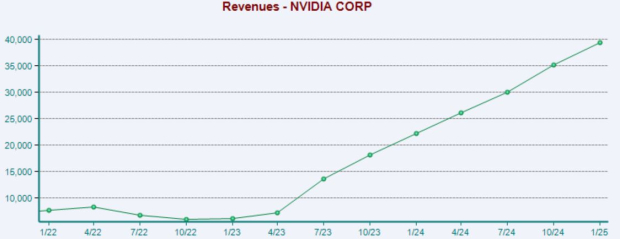

The sales growth here has been remarkable for Nvidia, as we can see below. Impressively, the company has posted triple-digit year-over-year sales growth rates in five of its last six periods, with the one exception being a 93% growth rate.

Image Source: Zacks Investment Research

Palantir Continues to Impress

Palantir builds software that empowers organizations toeffectively integrate their data, decisions, and operations. The company maintains a bullish outlook for its current fiscal year, with analysts revising their earnings expectations well higher over the past year.

Image Source: Zacks Investment Research

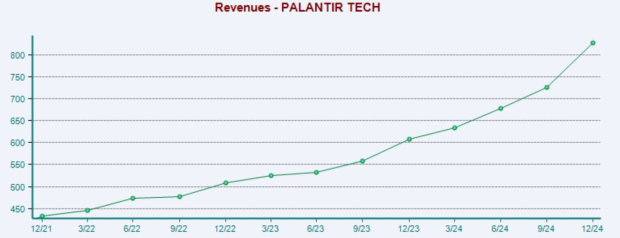

Palantir’s latest set of results came in strong, exceeding headline expectations and posting serious growth. Sales of $828 million shot 36% year-over-year and, more impressively, 14% sequentially.

Palantir also closed a record-setting $803 million of U.S. commercial total contract value (TCV), which shot 130% higher year-over-year and 170% sequentially. U.S. results were jam-packed with positivity, with Commercial and Government revenue growing by 64% and 45%, respectively.

Below is a chart illustrating the company’s sales on a quarterly basis.

Image Source: Zacks Investment Research

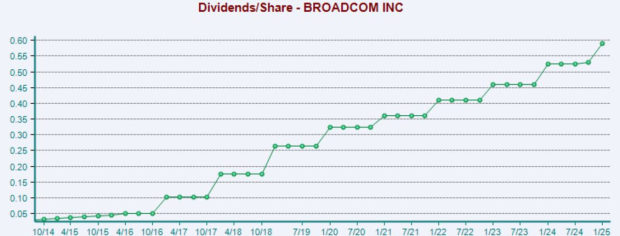

Broadcom Pays Investors

Broadcom has quickly risen to the top concerning AI players, with its latest set of quarterly results confirming robust demand. Its FY24 just ended, with annual revenue of $51.6 billion reflecting a new record and growing 44% year-over-year on the back of strong demand for its solutions.

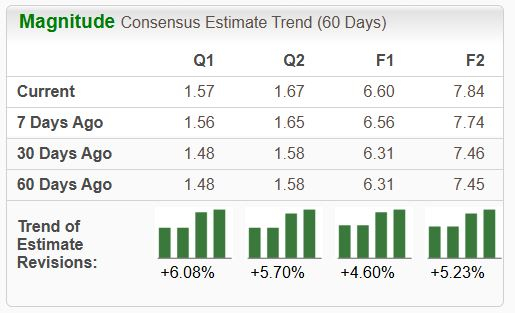

The stock currently sports a favorable Zacks Rank #2 (Buy), with its earnings outlook shifting bullishly across the board following its latest set of strong quarterly results.

Image Source: Zacks Investment Research

And shares could interest those with an appetite for income paired with AI exposure, with the company sporting a shareholder-friendly 12.3% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

Bottom Line

Zacks Thematic Screens lets you dive into 30 dynamic investment themes shaping the future. Whether you’re interested in cutting-edge technology, renewable energy, or healthcare innovations, our themes help you invest in ideas that matter to you.

Upon running the Zacks Artificial Intelligence Thematic screen, all stocks above – Palantir PLTR, NVIDIA NVDA, and Broadcom AVGO – were returned.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.9% per year. So be sure to give these hand picked 7 your immediate attention.

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Palantir Technologies Inc. (PLTR) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).