Perion Networks: A Gem Among Rocks

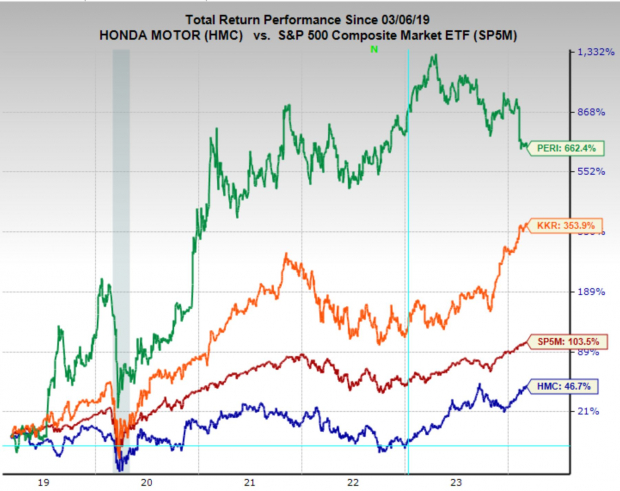

As the market rallies day after day, and valuations in the leading stocks begin to look stretched, picking up companies with discount valuations can ease the nerves. Investors who buy stocks trading below historic valuations enjoy a certain confidence that growth investors often have to swallow.

Image Source: Zacks Investment Research

Perion Networks

Perion Networks operates a global advertising technology (adtech) platform that connects advertisers with publishers and consumers. They specialize in helping advertisers reach targeted audiences through various channels, including display advertising, video advertising, and search advertising. PERI recently gained recognition for its growth in the connected TV (CTV) advertising space, which is a rapidly developing sector within the adtech industry.

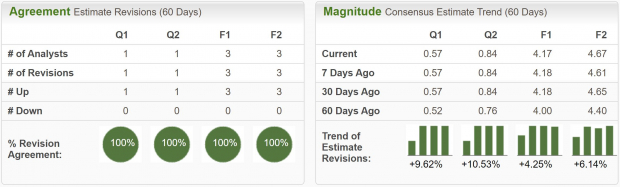

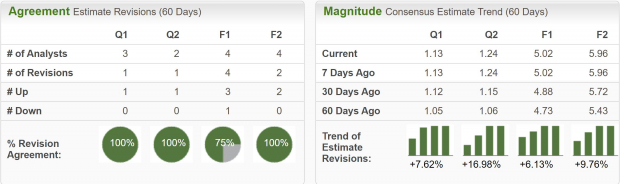

Perion Networks landed on the Zacks Rank #1 (Strong Buy) list just this morning after analysts upgraded this year’s earnings estimates. FY24 earnings estimates were revised higher by 1.2%.

Additionally, sales for this year are forecast to grow 17% YoY and next year by 10%.

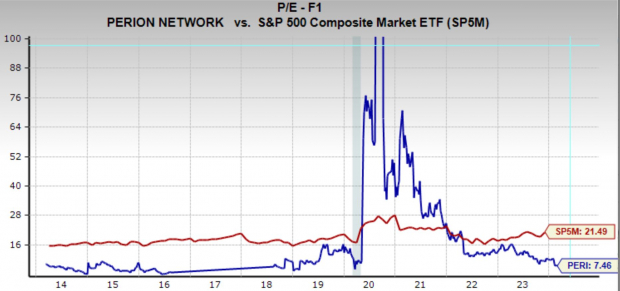

Image Source: Zacks Investment Research

PERI is currently trading at a one year forward earnings multiple of 7.5x, which is well below its 10-year median valuation of 11.2x. But that isn’t the only valuation method identifying a discount, the PEG Ratio, which includes earnings growth forecasts, also indicates a potential opportunity.

Perion Network’s EPS are forecast to grow at an incredible 22% annually over the next 3-5 years, giving it a PEG ratio of just 0.34, which would imply a deeply discounted valuation.

Image Source: Zacks Investment Research

Honda Motor Company: Revving Up Value

Since EVs have been garnering all the hype and buying over the last few years, traditional auto manufacturer stocks seem to have fallen out of favor. But for discerning investors this is creating a juicy opportunity.

Now that EV sales growth has begun to slow in the US, and hybrid car options have again gained popularity Honda Motor Company HMC may be an exceptional opportunity. Just take a look at how HMC has outperformed Tesla TSLA over the last nine months.

Image Source: TradingView

Furthermore, Honda Motor Company has a Zacks Rank #1 (Strong Buy) rating, indicating upward trending earnings revisions. Earnings estimates have been upgraded across timeframes, and sales are expected to expand 14% this year.

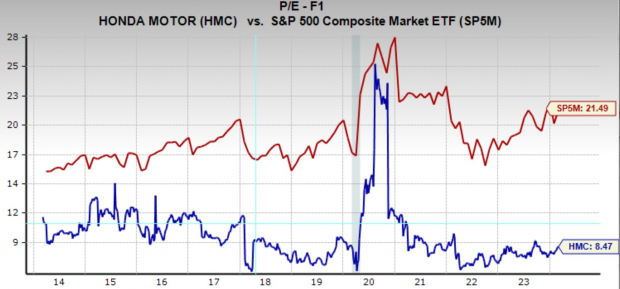

Image Source: Zacks Investment Research

Honda Motor Company is trading at a one year forward earnings multiple of 8.5x, below its 10-year median valuation of 9.1x. Although not a deep historical discount, HMC also has a PEG ratio indicating a deep value opportunity.

With EPS growth forecast of 20.8% annually over the next 3-5 years, HMC has a PEG ratio of 0.4.

Image Source: Zacks Investment Research

KKR & Co.: Riding the Wave of Private Equity

Over the last four months, private equity giant KKR & Co.KKR has been on an absolute tear, crushing the returns of the already strong broader market. Thanks to its private credit business, which has exploded in the last year thanks to banks that are hesitant to make loans, investors have piled into the stock.

And it doesn’t look like the rally will end any time soon.

Image Source: Zacks Investment Research

KKR & Co. has a Zacks Rank #1 (Strong Buy) rating as analysts have nearly unanimously revised earnings estimates higher across timeframes. KKR is also expected to grow its top line by 18% this year and 15% next year.

Unleashing the Potential: KKR & Co. Grows Amidst Value Concerns

KKR & Co. is not trading at a historical discount, with its forward earnings multiple of 21.2x currently above its 10-year median valuation of 14.4x. Despite this, the company’s business and profits are expanding impressively, painting a picture of growth amidst valuation challenges.

Looking Towards the Future

With EPS growth forecasts projecting a remarkable 27.2% annual increase over the next 3-5 years, KKR & Co. boasts a PEG ratio of 0.78, indicating a potential undervaluation compared to its growth prospects.

Analyzing the Bottom Line

For investors prioritizing value over growth, stocks like KKR & Co. present an intriguing opportunity. These equities warrant serious consideration for inclusion in investment portfolios, offering the promise of stability, steady returns, and long-term appreciation.