A Sign of Change Amidst Dismal Predictions

Back in the midst of October 2022, Sherwin-Williams, a prominent player in the world of paint and coatings, weathered a sharp decline of 45%. The air was heavy with recessionary worries, and hope seemed to be at an all-time low.

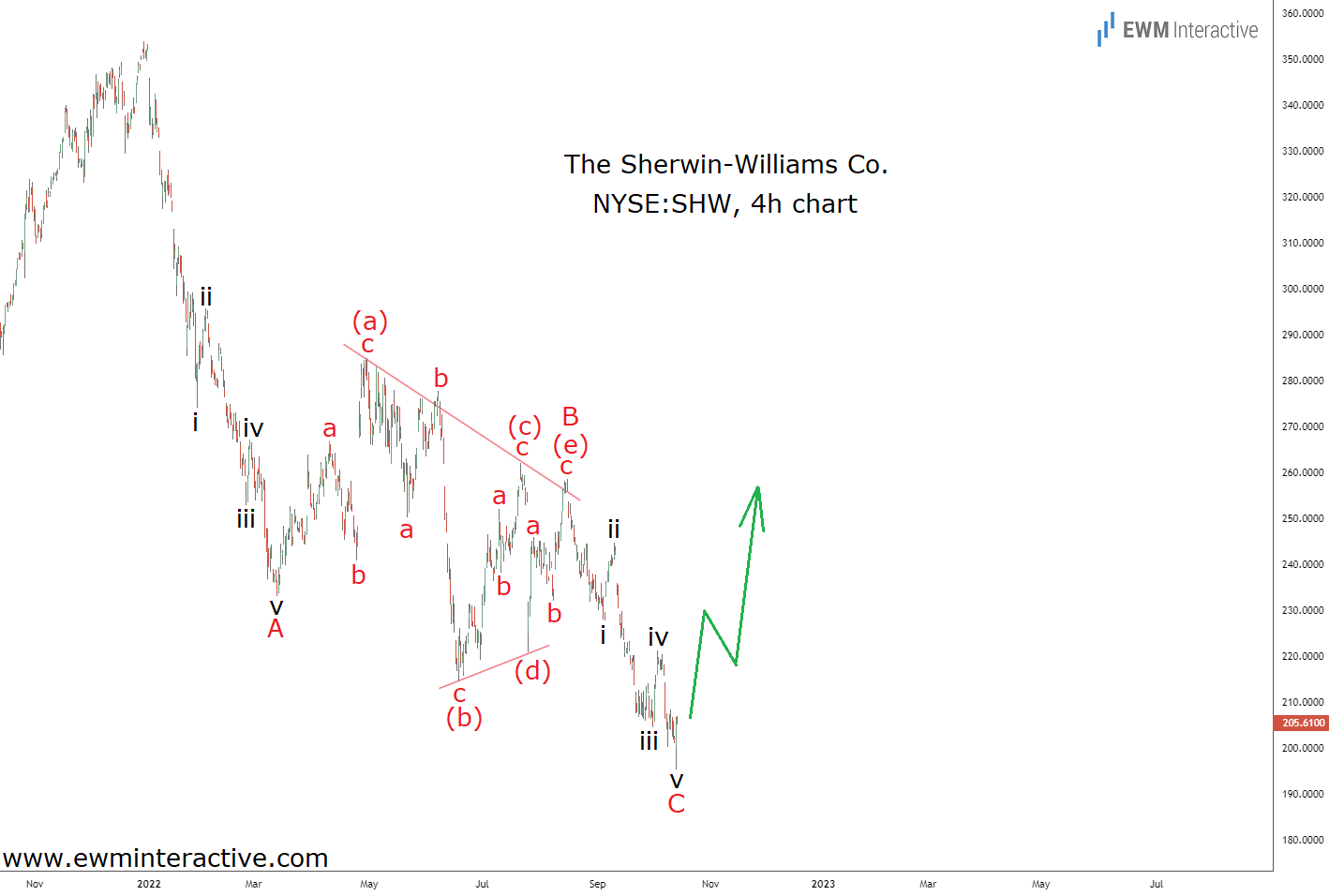

Strangely, a glimmer of optimism emerged as the decline showed intriguing patterns on the hourly chart. A closer look unveiled an Elliott Wave sequence that hinted at a potential turnaround, suggesting that Sherwin-Williams may have finally hit rock bottom.

An Uptrend Emerges from the Shadows

Zooming in on the 4-hour chart uncovered a classic A-B-C zigzag correction, complete with a triangular wave B and clear impulse patterns in waves A and C. As per Elliott Wave Theory, the end of a correction often paves the way for a return to the prior trend.

With all signs pointing to an uptrend before the decline, the probability of a bullish resurgence seemed high. The subsequent daily chart confirmed this narrative as Sherwin-Williams not only recovered but soared to a new peak.

Clouds Lurking Over the Bullish Sky

Despite the remarkable climb to an all-time high around $360 per share, Sherwin-Williams now faces two formidable obstacles on its upward trajectory. Firstly, with a forward P/E ratio of 31, the stock appears overvalued given its modest revenue growth.

Moreover, the recovery from $195 hints at a corrective structure, resembling a W-X-Y double zigzag. This could signal a looming (A)-(B)-(C) expanding flat correction in the works, with downside risks looming as wave (C) prepares to take the stage.

If this unfolds as projected, a five-wave downward impulse could breach previous lows, potentially dragging prices below $195. Amidst celebratory highs, it might be wise for Sherwin-Williams investors to exercise caution and consider reevaluating their positions.

Original Post