Despite posting strong Q2 results on Wednesday, Dollar Tree DLTR stock dipped 8% in today’s trading session, with the post-earnings selloff appearing to be attibuted to a combination of somewhat underwhelming guidance for the thrid quarter and profit-taking.

To that point, analysts have been concerned about margin pressure and the impact of tariffs ahead of the holiday season, although DLTR has been viewed as a defensive stock amid macroeconomic headwinds and is still up more than +35% year to date.

That said, investors may be wondering if it’s time to buy the dip in Dollar Tree stock after recently hitting a 52-week high of $118 a share in August.

Image Source: Zacks Investment Research

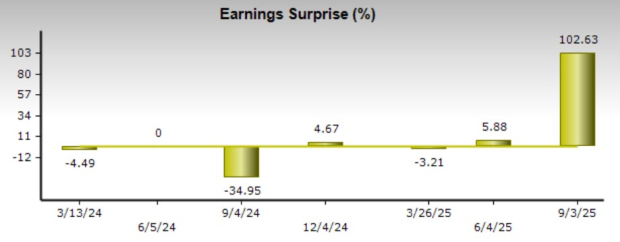

Dollar Tree’s Strong Q2 Results

Thanks to its strategic execution and consumer behavior shifts, Dollar Tree posted Q2 earnings of $0.77 per share, crushing EPS expectations of $0.38 by 102%. This came on Q2 sales of $4.56 billion, which comfortably exceeded estimates of $4.45 billion.

Notably, Dollar Tree opened 106 new stores during the quarter and converted 585 stores to its new multi-price format, which boosted customer engagement. Boosting its operational efficiency, the company also completed the sale of its ailing Family Dollar business in July, allowing full focus on its core Dollar Tree brand.

Image Source: Zacks Investment Research

Dollar Tree’s Favorable but Mixed Guidance

Optimistically, Dollar Tree raised its full-year revenue guidance to $19.3-$19.5 billion, up from its previous forecast of $18.5-$19.1 billion. Even better, Dollar Tree now expects full-year adjusted EPS to be between $5.32-$5.72, up from a previous range of $5.15-$5.65.

However, Dollar Tree’s earnings outlook for the third quarter underwhelmed analysts. Expecting Q3 EPS to be virtually flat year over year at $1.12, this missed Wall Street’s expectations of $1.33, with Dollar Tree citing higher discounts and input costs, along with tariff-related headwinds.

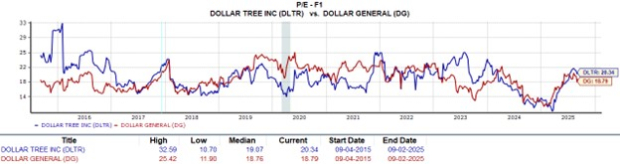

Monitoring Dollar Tree’s P/E Valuation

Following today’s dip to around $102 a share, DLTR trades at a 20.3X forward earnings multiple. Offering a discount to the benchmark S&P 500, Dollar Tree stock also trades beneath its Zacks Retail-Discount Stores Industry average of 22.3X forward earnings but is above industry peer and primary competitor Dollar General’s DG 18.7X.

Image Source: Zacks Investment Research

Bottom Line

While it may be tempting to bite on the post-earnings dip in Dollar Tree stock, there could still be better buying opportunities as the company’s outlook for Q3 echoed Wall Street’s concerns as the holiday shopping season approaches. For now, DLTR lands a Zacks Rank #3 (Hold).

Higher. Faster. Sooner. Buy These Stocks Now

A small number of stocks are primed for a breakout, and you have a chance to get in before they take off.

At any given time, there are only 220 Zacks Rank #1 Strong Buys. On average, this list more than doubles the S&P 500. We’ve combed through the latest Strong Buys and selected 7 compelling companies likely to jump sooner and climb higher than any other stock you could buy this month.

You’ll learn everything you need to know about these exciting trades in our brand-new Special Report, 7 Best Stocks for the Next 30 Days.

Download the report free now >>

Dollar Tree, Inc. (DLTR) : Free Stock Analysis Report

Dollar General Corporation (DG) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).