Reporting impressive third-quarter results after market hours on Thursday, Amazon’s AMZN stock has jumped more than +7% in Friday’s trading session.

To the delight of investors, the e-commerce giant has prioritized its probability amid its lucrative expansion into other business ventures. This makes it a worthy topic of whether it’s time to buy into the post-earnings rally in Amazon’s stock with AMZN trading near its 52-week high of $201 a share.

Image Source: Zacks Investment Research

AWS Boosts Amazon’s Q3 Results

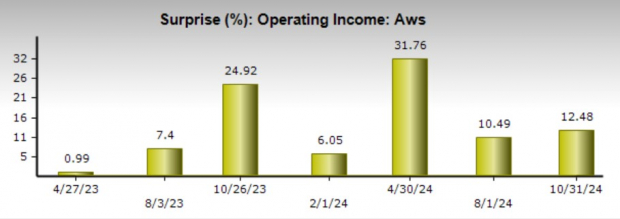

As the world’s largest cloud provider, Amazon Web Services (AWS) was a primary catalyst for Amazon’s strong Q3 results. AWS segment sales came in at $27.45 billion, spiking 19% year over year despite missing estimates of $27.57 billion.

That said, Amazon’s operating income for AWS beat estimates of $9.28 billion by 12% and soared nearly 50% from $6.97 billion in Q3 2023 to a whopping $10.44 billion.

Image Source: Zacks Investment Research

Overall, Amazon’s Q3 sales rose 11% to $158.87 billion while Q3 EPS of $1.43 popped 68% from $0.85 per share in the comparative quarter. This surpassed the Zacks Sales Consensus of $157.07 billion by 1% and crushed the EPS Consensus of $1.14 by 25%.

Amazon has exceeded sales estimates in three of the last four quarters it has reported and has surpassed earnings expectations for eight consecutive quarters. Even better, Amazon has posted an average EPS surprise of 25.85% in its last four quarterly reports.

Image Source: Zacks Investment Research

Monitoring Amazon’s Valuation (P/E)

With Amazon’s Q3 results helping to reconfirm projections of double-digit top and bottom line growth in fiscal 2024 and FY25, monitoring the tech behemoths’ valuation may be imperative when gauging more upside.

At current levels, AMZN trades at 39.3X forward earnings which is not an overly stretched premium to the benchmark S&P 500’s 24.2X. Amazon’s forward P/E valuation is above four of its Magnificent 7-themed big tech peers but does trade below Nvidia NVDA and Tesla TSLA at 47.1X and 109.9X respectively.

Image Source: Zacks Investment Research

Bottom Line

For now, Amazon’s stock lands a Zacks Rank #3 (Hold). Despite a sharp post-earnings rally, investors may still be rewarded for holding Amazon’s stock at current levels, especially those with long-term positions.

Furthermore, earnings estimate revisions could certainly trend higher for Amazon in the coming weeks which would more than likely lead to a buy rating among the Zacks Rank.

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report