Oracle ORCL stands at a critical juncture as its stock trades at a price-to-earnings multiple of 36.7 times, significantly above its historical average of 26.8 times over the past decade, and the Zacks Computer-Software industry average of 35.32x. While the software giant’s aggressive pivot to cloud infrastructure and AI has driven impressive growth, the elevated valuation raises important questions for investors contemplating their next move in 2025.

Cloud Momentum Versus Rich Valuation

The company’s transformation from traditional database software to a cloud infrastructure provider has yielded remarkable results. Oracle reported fiscal 2025 fourth-quarter revenues of $15.9 billion, representing an 11% year-over-year increase, with cloud infrastructure revenues surging 52% to $3 billion. CEO Safra Catz projects even more aggressive expansion ahead, forecasting cloud infrastructure growth to accelerate from 50% in fiscal 2025 to more than 70% in fiscal 2026. This momentum has attracted major clients, including Meta and Chinese retailer Temu, while partnerships with the Cleveland Clinic and the UAE’s G42 for AI healthcare platforms demonstrate Oracle’s expanding reach beyond traditional enterprise software.

The Zacks Consensus Estimate for fiscal 2026 revenues is currently pegged at $66.6 billion, suggesting growth of 16.02% from the year-ago quarter’s reported figure. The consensus mark for fiscal 2026 earnings is pegged at $6.73 per share, up 0.1% over the past 30 days.

Oracle Corporation Price and Consensus

Oracle Corporation price-consensus-chart | Oracle Corporation Quote

The company’s involvement in the high-profile Stargate AI infrastructure initiative alongside OpenAI and SoftBank further validates its strategic positioning in the artificial intelligence revolution. Oracle plans to invest more than $25 billion in capital expenditures in fiscal 2026, more than triple its fiscal 2024 spending of $7 billion, reflecting management’s confidence in sustained demand.

Despite these growth catalysts, Oracle’s current valuation presents a compelling case for patience. The stock’s forward P/E ratio has expanded dramatically from its recent lows, now trading at levels not seen since the dot-com era. At 36.7 times earnings, Oracle commands a premium valuation that exceeds the sector average by a considerable margin. This elevated multiple leaves little room for error, particularly if growth rates fail to meet management’s ambitious projections or if broader market conditions deteriorate.

ORCL’s P/E Ratio F12M Ratio Depicts Premium Valuation

Image Source: Zacks Investment Research

Cloud Market Competition and Stock Performance

Oracle faces formidable competition in the cloud infrastructure market, where Amazon‘s AMZN AWS commands 30% market share, Microsoft‘s MSFT Azure holds 20% and Alphabet GOOGL-owned Google Cloud captures 13% in second-quarter 2025, per recent data from Synergy.

While Amazon continues dominating through AWS scale advantages, Microsoft benefits from seamless enterprise integration, and Google leverages AI expertise, Oracle differentiates through competitive pricing and superior database integration. The company’s recent partnerships with OpenAI and involvement in high-profile projects suggest that Oracle can carve a profitable niche despite trailing Amazon, Microsoft, and Google in absolute market share.

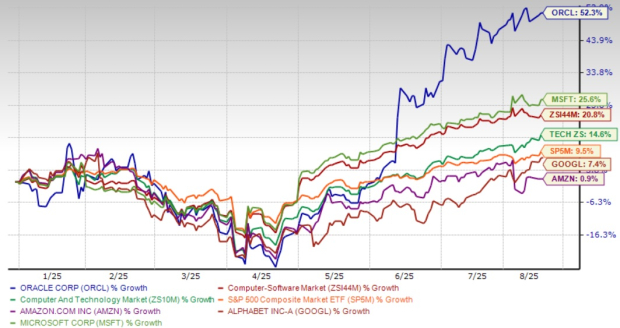

Shares of Oracle have gained 52.3% so far this year, outperforming the Zacks Computer and Technology sector’s growth of 14.6%. Shares of Microsoft, Google and Amazon have returned 25.6%, 7.4% and 0.9% year to date, respectively.

Year-to-Date Performance

Image Source: Zacks Investment Research

Strategic Position for Patient Investors

For existing shareholders, holding Oracle stock appears prudent given the company’s strong competitive position and robust growth trajectory. The recent 25% dividend increase to 50 cents per share quarterly provides additional income while investors wait for the growth story to unfold. The company’s remaining performance obligations of $138 billion offer substantial revenue visibility, supporting the long-term investment thesis.

However, new investors might benefit from exercising patience. Oracle’s fiscal third-quarter results in March 2025 disappointed investors when the company missed analyst expectations, demonstrating that execution risks remain despite favorable long-term trends. The stock’s poor year-to-date performance suggests market participants are already recalibrating expectations.

The combination of accelerating cloud growth, strategic AI partnerships, and massive infrastructure investments positions Oracle well for the future. Yet at current valuations, the stock offers a limited margin of safety. Investors should monitor upcoming quarterly results closely, particularly cloud infrastructure metrics and cash flow generation, to assess whether the premium valuation remains justified. For now, existing shareholders should maintain positions while prospective buyers await more favorable entry points that better balance Oracle’s undeniable growth potential with valuation discipline. Oracle currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

See our %%CTA_TEXT%% report – free today!

7 Best Stocks for the Next 30 Days

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Oracle Corporation (ORCL) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).