Electric vehicle giant Tesla TSLA hit headlines recently with an impressive third-quarter earnings report, sending its stock soaring in one of its biggest single-day gains in a decade. Last week, the Tesla stock jumped about 23% primarily due to margin improvement and an upbeat outlook (read: Tesla Records its Best Day in 11 Years: 5 ETF Winners).

Despite this surge, Wall Street remains divided over Tesla’s place in the “Magnificent Seven” — a group of market-dominating tech giants, including NVIDIA NVDA, Apple AAPL, Alphabet (GOOG, GOOGL), Amazon AMZN, Meta META, Microsoft MSFT and Tesla (read: Is Tesla’s Stock Pop Sustainable? TSLA ETFs in Focus).

As the third-quarter earnings season kicks off, the Magnificent Seven is anticipated to record 18.1% year-over-year earnings growth, with NVIDIA, Alphabet, Amazon and Meta among the top contributors to S&P 500 earnings growth, per FactSet, as quoted on Yahoo Finance.

Tesla’s Earnings Rebound Yet Leave Analysts Skeptical

Tesla’s third-quarter profits showed a 17% jump, a meaningful rebound after two quarters of decline. However, analysts remain cautious about Tesla’s long-term position among Big Tech, citing concerns that its fundamentals may be overhyped.

We would like to note that Tesla’s delivery numbers fell short of estimates in the past. Tesla has been losing market share to its rivals in both China and the United States, resulting in a notable slowdown in growth. This month itself we have seen Tesla’s unimpressive robotaxi event, which failed to meet expectations, raising concerns among ridesharing investors.

Valuation Concerns Add to Tesla’s Strained Standing

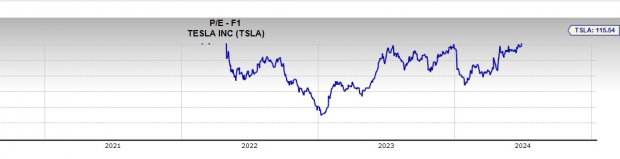

Tesla’s pricey valuation further complicates its status within the Magnificent Seven. Although higher growth tends to demand a higher valuation, with a forward price-to-earnings ratio of nearly 115.54, Tesla’s valuation far exceeds its tech peers.

Image Source: Zacks Investment Research

Analyst sentiment reflects this caution. Tesla currently has an average brokerage recommendation (ABR) of 2.96 on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell etc.) made by 39 brokerage firms. The current ABR compares to an ABR of 2.89 a month ago based on 38 recommendations.

Of the 39 recommendations deriving the current ABR, Strong Buy and Buy, respectively, account for 23.08% and 5.13%. It is the lowest approval rate within the Magnificent Seven.

Tesla’s Stock Price Target

Based on short-term price targets offered by 35 analysts, the average price target for Tesla comes to $206.22. The forecasts range from a low of $24.86 to a high of $310.00. The average price target represents a decline of 23.4% from the last closing price of $269.19 as on Oct. 25.

Could Netflix be a More Suitable Candidate?

As Tesla’s standing falters, streaming giant Netflix NFLX has emerged as a possible replacement, thanks to its strong earnings, subscriber growth, improving free cash flow and solid guidance. Year to date, Netflix stock has surged by 55%, trailing only NVIDIA and Meta among the Magnificent Seven.

Image Source: Zacks Investment Research

Wealth Enhancement Group’s Ayako Yoshioka believes Netflix is an appealing alternative due to its strong earnings and solid guidance. Bank of America loves its free cash flow strength, as quoted on Yahoo Finance. Same is the view of Portfolio Wealth Advisors’ Jesus Alvarado-Martinez.

With free cash flow reaching $2.19 billion in Q3, up from $1.89 billion a year earlier, Netflix’s cash flow has been rising steadily since the pandemic. Bank of America analyst Jessica Reif Ehrlich projects Netflix’s free cash flow to hit $8.9 billion in 2025 and $11.16 billion in 2026.

Broker Rating on Netflix Stock

Of the 40 recommendations deriving the current ABR of Netflix shares, 23 are Strong Buy and two are Buy. Strong Buy and Buy, respectively, account for 57.5% and 5% of all recommendations. The Netflix stock currently has a Zacks Rank #2 (Buy). The stock has an upbeat VGM Score of B. Netflix shares trade at a forward P/E of 37.88X versus 105.6X forward P/E possessed by the underlying Broadcast Radio and Television.

Image Source: Zacks Investment Research

Netflix-Heavy ETFs in Focus

Investors who believe that Netflix shares deserve a spot in the tech elite club may play the stock in the exchange-traded fund (ETF) form, too. Netflix-heavy ETFs includesingle-stock funds like T-Rex 2X Long NFLX Daily Target ETF NFLU and Direxion Daily NFLX Bull 2X Shares NFXL.

Other Netflix-heavy ETFs include MicroSectors FANG+ ETN FNGS (Netflix has a 9.18% weight), Invesco Next Gen Media and Gaming ETF GGME (NFLX stock has an 8.35% weight) and First Trust Dow Jones Internet Index Fund FDN (NFLX shares have an 8.32% weight).

Want key ETF info delivered straight to your inbox?

Zacks’ free Fund Newsletter will brief you on top news and analysis, as well as top-performing ETFs, each week.

Alphabet Inc. (GOOG) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

First Trust Dow Jones Internet ETF (FDN): ETF Research Reports

MicroSectors FANG+ ETN (FNGS): ETF Research Reports

Meta Platforms, Inc. (META) : Free Stock Analysis Report

Invesco Next Gen Media and Gaming ETF (GGME): ETF Research Reports