As Tesla gears up to reveal its Q2 earnings report, anticipation swells among investors worldwide. The EV giant is expected to report its Q2 deliveries this week, building excitement before the much-awaited “robotaxi day” on August 8th, poised to reshape Tesla’s narrative.

Despite facing a 12.6% year-to-date stock decline, Tesla continues to command a significant 12.91% weight in Cathie Wood’s ARK Innovation ETF. At its current price point of $208 per share, Wood envisions TSLA soaring to dizzying heights, reaching $2,600 per share by 2029.

A large part of this bullish forecast revolves around Tesla’s projected evolution into the realm of robotaxis, a segment expected to contribute 63% of the company’s revenue and 86% of its pre-tax earnings by 2029. Should the robotaxi piece be excluded, Wood sets a more conservative price target of $350 per TSLA share.

Forecasting a Notable Uptick in Tesla Deliveries for Q2

In Q1 ’24, Tesla delivered 386,810 EVs, with the majority being Model 3/Y. This represented a 20% decline from the prior quarter, but showcased an impressive 37.6% year-over-year increase for the full year 2023, amounting to 1,808,581 units.

Looking ahead to Q2 ‘24, analysts anticipate Tesla to deliver around 448,000 EVs, indicating a nearly 16% surge from the previous quarter. While some foresee a more conservative range, such as Wedbush’s Dan Ives suggesting figures between 415,000 – 420,000 units.

Various projections align around this range, with New Street estimating 425,000 units for the second quarter, and Barclays at 415,000. Optimism stems from an uptick in Tesla EV sales in China during May, where 72,573 units were sold—marking a 17% increase from the same period last year.

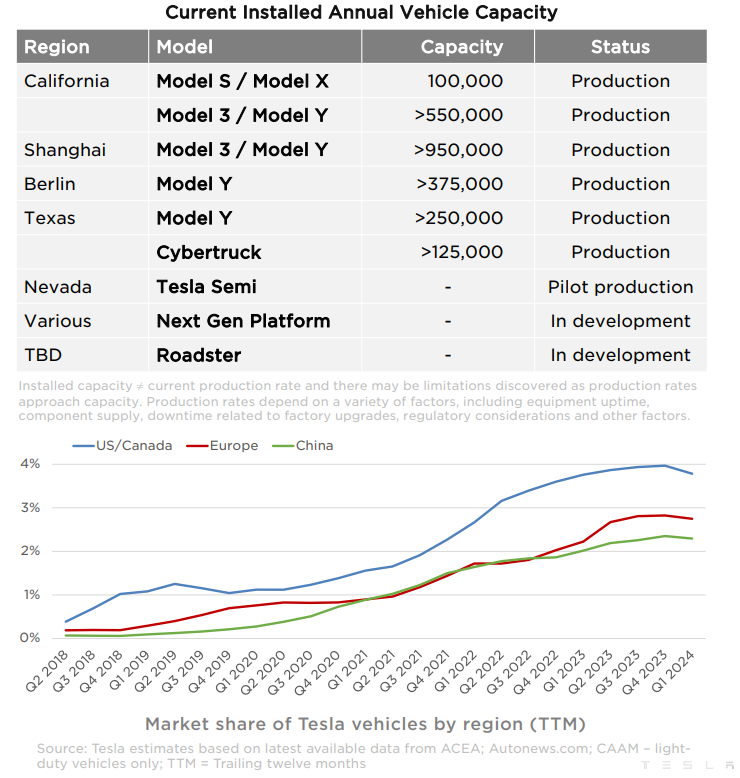

Amidst fierce competition and price pressures from BYD, Li Auto, XPeng, Nio Inc, and others, Tesla maintains an enviable second largest market share in China. BYD, particularly, endorsed by investing legend Warren Buffett, recorded three consecutive months of sales exceeding 300k units, selling 330,488 EVs in May alone.

The Dynamic Evolution of Tesla’s Narrative

Venturing into the robotics sphere with the Optimus humanoid robot, Tesla acknowledges that mass commercial deployment may not materialize by the decade’s close. Instead, Tesla’s foray into robotics primarily hinges on EVs themselves functioning as autonomous robotaxis.

Parallel to the rise of eVTOLs in the transportation landscape, China leads the charge with Baidu and Pony.ai spearheading autonomous mobility solutions. Forecasts suggest that by 2030, self-driving solutions could account for 60% of China’s ride-hailing market—paving the way for a $180 billion industry, as per IHS Markit projections.

According to ResearchAndMarkets, this trajectory propels the China Autonomous Vehicle Market’s Compound Annual Growth Rate (CAGR) to a robust 21.66% for the period spanning 2024 – 2030. Given Tesla’s dominance in the US and EU EV markets, the company stands as a prime candidate for capitalizing on this growth.

Tesla’s prominent position stems from the network effects derived from extrapolating driver data. While Tesla currently operates at SAE Level 2, the transition to Full Self-Driving (FSD), classified as SAE Level 4, mandates leveraging this data. Nevertheless, even as technical hurdles are addressed, regulatory challenges at the state and federal levels pose substantial hurdles. Elon Musk’s earlier FSD timing estimates, trailing actual progress by about eight years, hint at potential delays. Carnegie Mellon University’s Professor Philip Koopman suggests that a more realistic scenario spans a 10 – 20 year timeline.

Should Tesla’s upcoming “robotaxi day” on August 8th shatter these expectations, a monumental stock surge appears likely. Recent approvals for FSD testing in China hint at a more optimistic trajectory.

Exploring Cheaper Tesla EVs and the Tesla Energy Frontier

In case the robotaxi narrative encounters delays, Tesla shareholders can pin their hopes on the “Model 2” initiative. Formerly known as “Redwood,” this rumored $25k-priced vehicle aims to democratize EV access, targeting a mid-2025 release to tackle affordability obstacles in EV adoption.

The new Tesla hatchback will vie with competitors such as Volvo EX30, Renault 4, Fiat 500e, VW ID.2, and other players in the segment.

Amidst the EV and robotics ventures, Tesla Energy emerges as a lucrative growth avenue. The clean energy arm offers a range of products, including solar panels, inverters, powerwalls, and large-scale energy storage systems under the Megapack umbrella.

During Q1, Tesla Energy marked a milestone by deploying 4,053 MWh of energy storage, contributing to a 7% year-over-year revenue increase. In tandem, Tesla augmented its AI training compute operations by a staggering 130% in the quarter.

Analyzing Tesla’s Stock Price Trajectory

Despite a notable 674% year-over-year dip in free cash flow—from $2 billion in Q4 2023 to a negative $2.5 billion in Q1 2024—Tesla’s aggressive infrastructure outlay highlights its long-term strategic vision.

Forecasts from Nasdaq envision an average TSLA price target of $182.1 twelve months ahead, with an upper bound touching $310 per share. At present, TSLA hovers halfway between its all-time high of $409 in November 2021. The stock’s 52-week average price stands at $216, comfortably above the 52-week low of $138 per share.

Neither the author, Tim Fries, nor this website, The Tokenist, provide financial advice. Please consult our website policy prior to making financial decisions.