Exploring S&P E-mini Pre-Open Market Dynamics

- Wednesday’s climb to the 5,700 round number marked a pivotal moment, heralding a downward reversal on the daily chart.

- Although the bulls had their shining moment on Wednesday, the climb to the peak was fraught with risks as it tested resistance with a climactic bar.

- The bears executed a well-timed reversal yesterday, following the late rally’s buy climax, hinting at a probable second leg down.

- Yesterday’s marked bearish reversal bar signals a higher likelihood of a downward spiral, with sellers anticipated if today displays a bull reversal bar.

- The robust July rally signals caution, indicating that today might not usher in optimal entry points for bearish positions.

- The potential bearish reversal looms as July’s strong buy climax in the late bull trend increases the peril of a downturn and a July low retest in the coming weeks.

- The bull trend’s crescendo on higher time frames raises the specter of a potential year-high as the market heads towards a possible peak over the ensuing months.

- Traders navigating the daily chart terrain should brace for constrained upward movement, foreshadowing a sideways trajectory with tests looming for the July low and the 5,500 mark.

- The bears may need an additional short entry before they can traverse down to the July low, considering the robust July rally.

Anticipated Scenarios on the Horizon

- The E-mini has registered an overnight uptick of 5 points during the Globex session.

- The 8:30 AM EST report unveiled a notable bull reversal bar on the 15-minute chart, characterized by a large doji, hinting at probable sideways action.

- In the U.S. trading session, the bulls aspire to drive a rally, yet the doji nature of the 8:30 report bar enhances the likelihood of sellers emerging, potentially testing the bar’s midpoint.

- Given the current weekly chart dynamics with a parabolic wedge top, the week’s closure below the open near 5,612 is a priority for the bears.

- With the daily chart displaying a microchannel trend, a robust bear-trend day is improbable for today’s market actions.

- Engage in patient trading today as trading range price actions are anticipated at the opening bell, offering no rush for entering trades.

- Following the rally on the 8:30 AM EST report bar, the odds lean towards a second leg up amidst a trading range, potentially accompanied by a substantial pullback for the bulls.

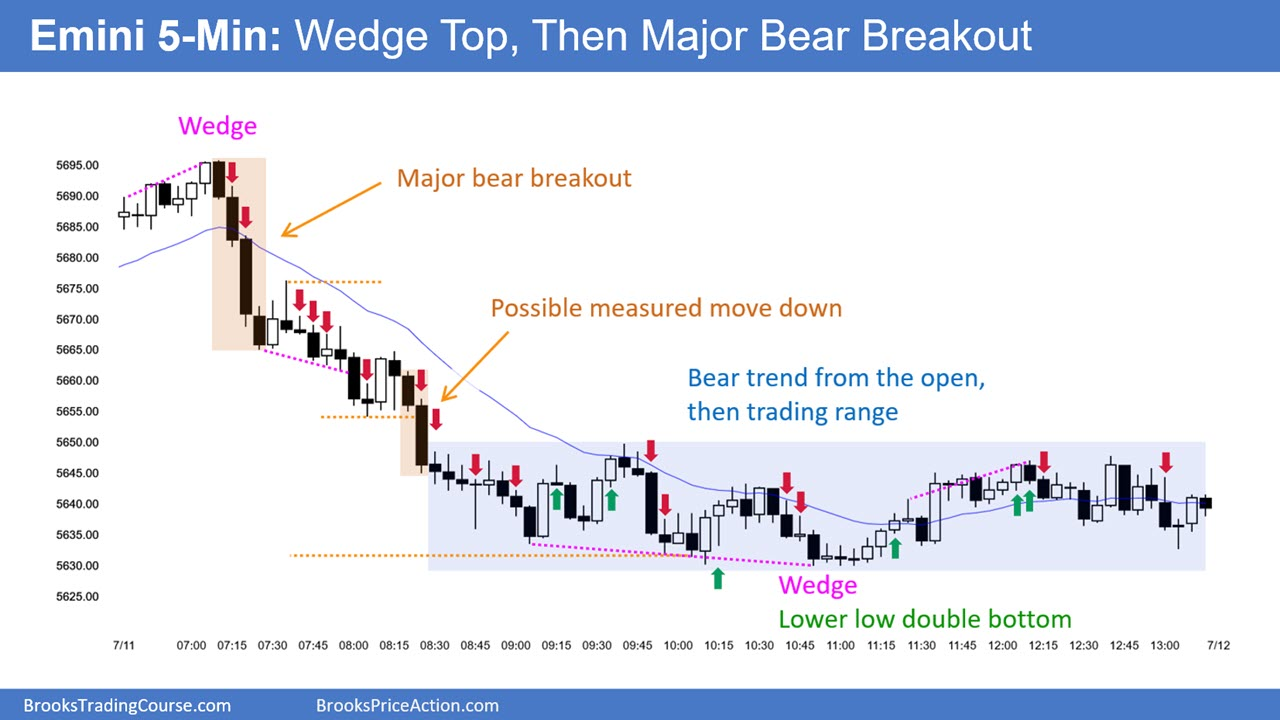

Insights into E-mini Setups from Yesterday

Yesterday’s viable stop-entry setups are under the lens, each delineated with green and red arrows indicating buy and sell entry points.

Patrons of the Brooks Trading Course and Encyclopedia of Chart Patterns unlock a treasure trove of detailed swing trade setups accumulated over nearly four years (refer to Online Course/BTC Daily Setups).

While most swing setups may not culminate in full-fledged trades, trader morale often plummets, leading to swift exits – either with small profits (scalp) or slight losses.

If risk levels seem daunting, opting for lower-risk trades or exploring alternate markets like the Micro E-mini might present viable alternatives.