Market Optimism Soars with Record S&P 500 Close

As Thursday came to a close, Wall Street basked in the warmth of a rare sunny day, breaking the doldrums of recent afternoon fades. The aura of optimism stemmed from a welcome surprise—last week’s initial jobless claims figures had a sprinkling of magic that dispelled concerns of a looming unemployment crisis, often a harbinger of darker economic times.

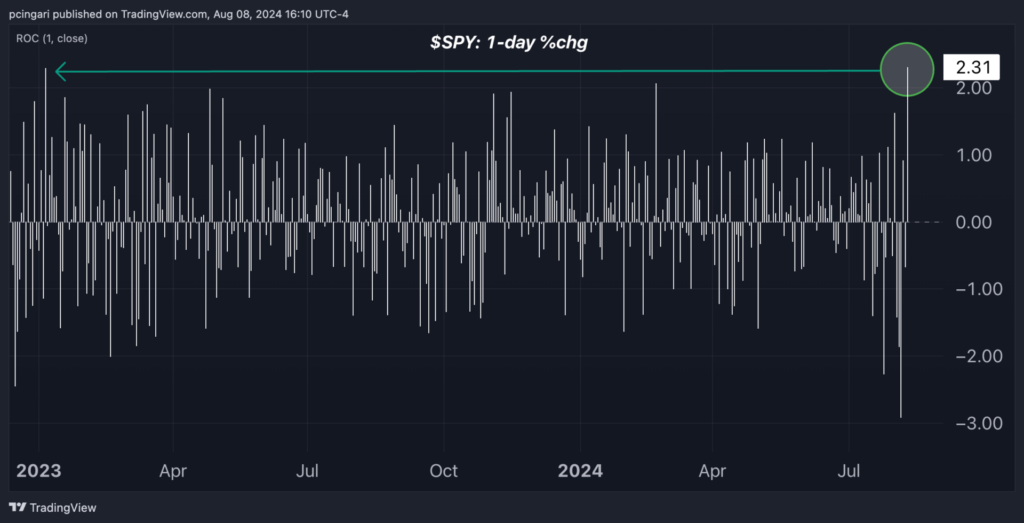

The renowned S&P 500 index, embodied in the SPDR S&P 500 ETF Trust, triumphantly closed with a 2.3% jump, a feat not seen since the halcyon days of January 2023.

In the tech-centric realm, the Nasdaq 100 index, represented by the Invesco QQQ Trust, danced eagerly to the tune of a 3.1% spike, marking its most jubilant performance since February 2023. While this surge was undeniable, it’s worth a pause—the Nasdaq 100 still lingers 5% shy of its last week’s commencement, yet has sprung 5.7% from Monday’s lows.

Under the tech banner, Arm Holdings plc and Marvell Technologies Inc. shone as the day’s standout stars, each boasting gains of 10.6% and 8.9%, respectively.

Not to be outdone, grandiose blue-chip stocks paraded with the Dow Jones Industrial Average ascending by a respectable 1.8%, while small caps gleamed with the iShares Russell 2000 ETF marking a 2.4% increase.

Visual Delight: S&P 500 Celebrates Best Day in 19 Months

Fed’s Barkin Paints a Rosy Picture Amid Labor Market Worries

The venerable Richmond Fed President, Tom Barkin, made a splashing entrance during a National Association for Business Economics (NABE) rendezvous on Thursday.

With a steady hand, Barkin reassured all amid whispers of a labor market catastrophe. He underlined the hesitance among employers, showing reluctance in both hiring and firing endeavors.

Peering into the jobless claims data, his discerning eyes spotted a landscape where layoffs weren’t blooming. Employers gripped by memories of recruitment woes from yesteryears clutched their employees closer.

Barkin envisioned the economy as a ship gently easing into calmer waters, paving the way for a slow, but steady, normalization of interest rates.

A keen observer of shifting tides, Barkin spotted alterations in consumer spending patterns. While the spending taps still flowed, a newfound selectivity lingered in the air. Businesses, twiddling with price tags, noticed a discerning clientele emerging.

“Consumers are in a spending mood, but their selections are deliberate,” Barkin mused on the evolving landscape of value-based purchasing decisions.

While a hint of subdued inflation lingered, the shadow of high prices loomed large. Barkin, unimpressed by the inflationary numbers, hinted at the presence of a more judicious consumer base, trimming sails in the face of lofty prices.

As Barkin navigated the treacherous waters of inflation, he raised alarms on potential future storms. Turmoil in the Middle East might brew storms that could buffet oil prices, while the specter of limited housing stock cast shadows.

The wizened sage Barkin left investors with a parting thought: vigilance in monitoring labor markets and the inflation thermometer will be the compass guiding the decision on rate cuts in the coming September days.

Read Now: