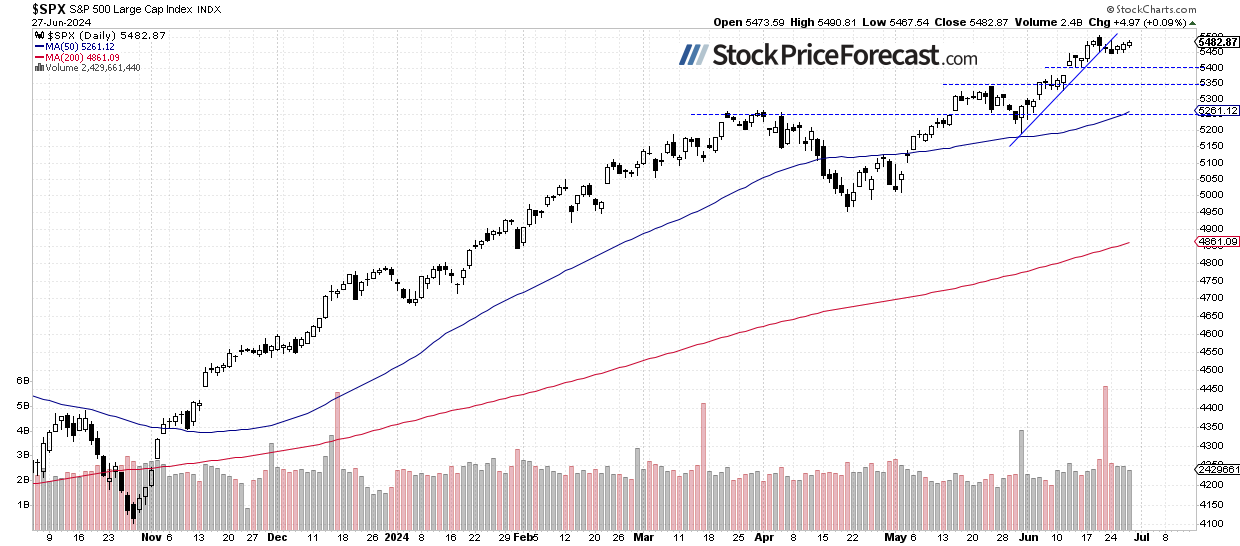

Despite the nudge yesterday, stocks remained relatively stagnant, closing just 0.09% higher as the market sustained its short-term consolidation after stepping back from last Thursday’s peak. The aura surrounding today’s opening suggests a 0.4% upward trajectory, as futures contracts hint at a favorable start. The Core PCE Price Index release aligns with predictions, inching up by +0.1% month over month. The S&P 500 retains its proximity to record highs, presenting a facade of a nearly flat correction within the uptrend.

Casting my gaze back to June, I had inscribed:

“For the last three months, the S&P 500 index swerved around fresh record highs, surpassing the 5,000 benchmark breached in February. It appears to be a consolidation within a prolonged uptrend, yet hints at a potential peaking pattern before a substantial medium-term correction. What lies ahead?

As the adage goes, ‘the trend is your friend,’ hinting at further advances down the road.

Nonetheless, a negative omen would be a dip below the 5,000 level, triggering concerns of a deeper correction and a bearish reversal.

I assess the odds of a bullish outcome at 60/40 – while contemplation of a downturn can’t be disregarded.

The market eagerly awaits cues from the Fed regarding potential interest rate adjustments, and towards the month-end, the forthcoming earnings season might dictate market dynamics.”

Wednesday kept the investor sentiment in a state of equilibrium, per the AAII Investor Sentiment Survey, with 44.5% of individual investors tilted towards optimism, juxtaposed with 28.3% inclined towards bearishness, up from the prior week’s 22.5%. The AAII sentiment serves as a counter indicator, where heightened bullish stances imply excessive contentment and minimal apprehension in the market. Conversely, bearish signals set the stage for market upswings.

The S&P 500 index maintains its lateral movement post breaking the upward trend line, an evident occurrence from the daily chart.

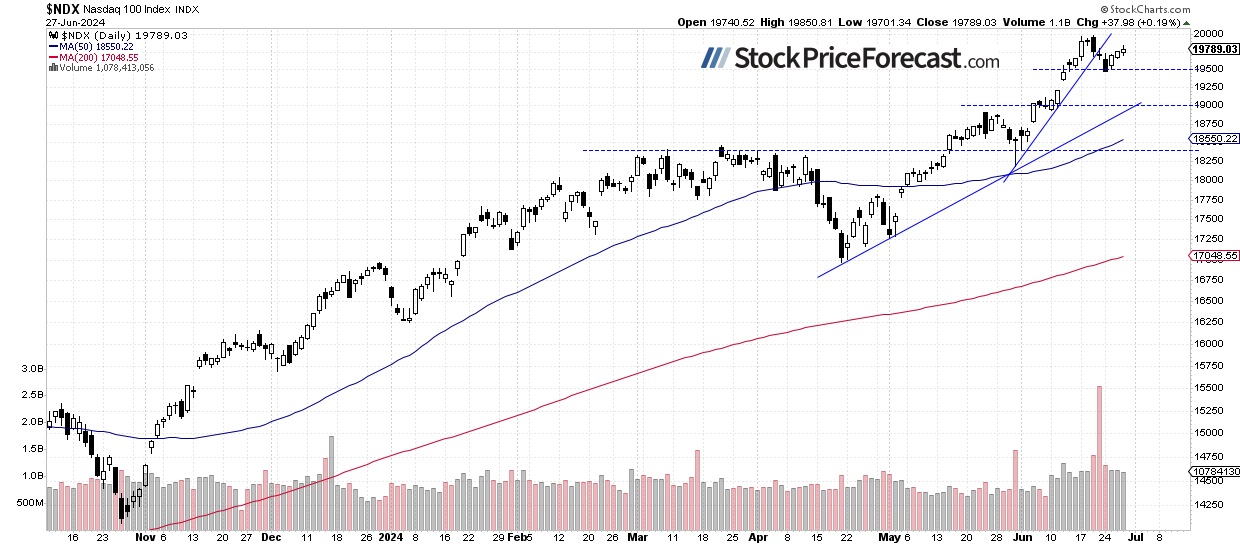

Nasdaq 100’s Resilient Bounce Back

The Nasdaq 100 experienced a fresh acme at 19,979.93 last Thursday, before a retracement leading to a lower closure. Post navigation through lower terrains on Friday and Monday, the market embarked on a rebound journey starting Tuesday, with yesterday’s pinnacle touching 19,850. The aura of this morning anticipates a 0.5% surge in Nasdaq 100, inching closer to the prior week’s summit.

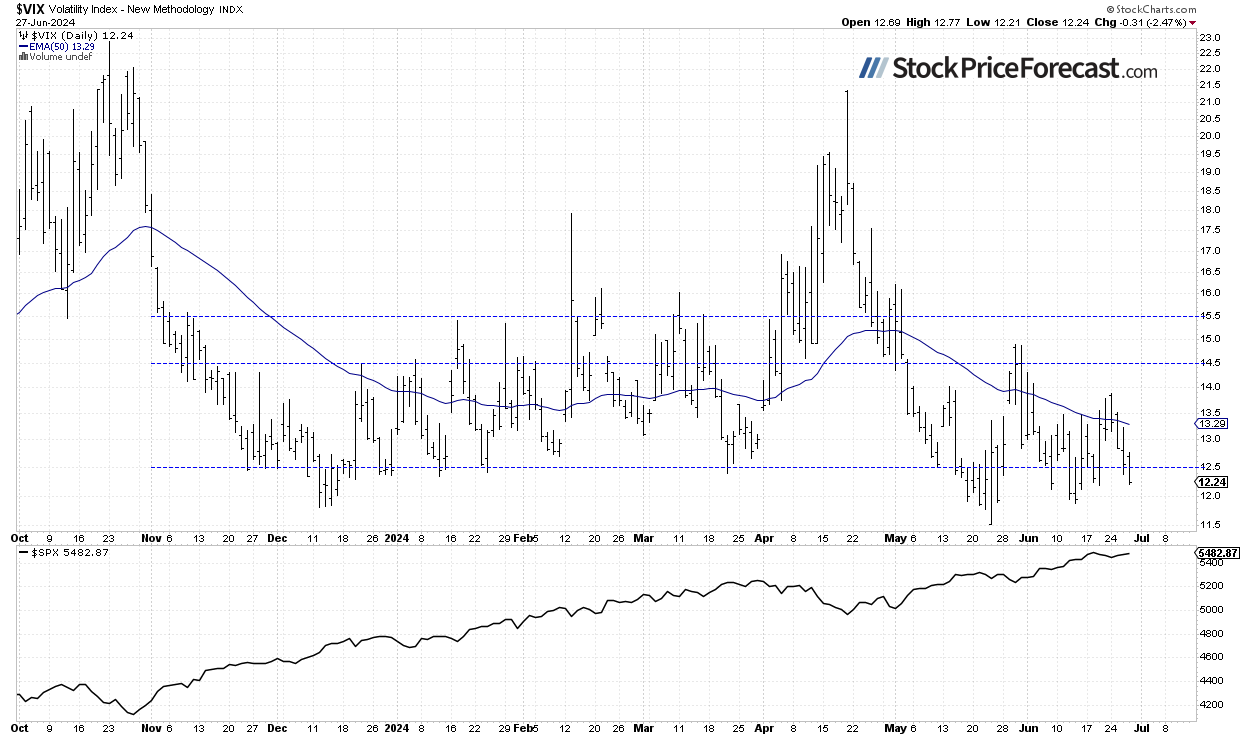

VIX Looms Around 12

The VIX, famously dubbed the ‘fear gauge,’ sources its readings from option prices. Late May bore witness to a new moderate at 11.52, before climbing back to the vicinity of 15 amidst correction apprehensions. Since last Thursday, it has consistently concluded above the 13 mark, signaling an upsurge in fear pervading the market. Recent days depict a VIX under 13, suggesting hopes of a stock correction conclusion. In a dramatic flair, yesterday brushed upon the 12-yard line.

History unveils a narrative where a plunging VIX symbolizes dwindling fear, aligning with market downturns. Conversely, surging VIX often parallels stock market regressions. Nevertheless, the lower the VIX, the higher the odds of a market turnaround.

Futures Contract Ventures Beyond 5,550

An exploration unfolds on the hourly chart of the futures contract, breaching a new summit of around 5,588 last Thursday. Thereafter, the market oscillated, tapping the support realm near 5,520. Present morning sees a flurry of trades, edging higher but still shy of the recent acme.

Summation

Today whispers of a 0.3% lift in the S&P 500 index. The recent days meandered through a sideways trajectory post last Thursday’s brief retreat, and today, aspires to clinch proximity to the peaks. The recent tapestry of trading action paints a picture of a meager correction within the uptrend.

For now, I hold a neutral stance on the short-term outlook.

Here’s a concise rundown:

- The reversal from a fresh summit last Thursday ushered the S&P 500 into an elongated consolidation mode throughout the week.

- Stock values persisted in ascending towards new altitudes, despite conflicting data and mounting uncertainties.

From my vantage point, the near future harbors a neutral air.