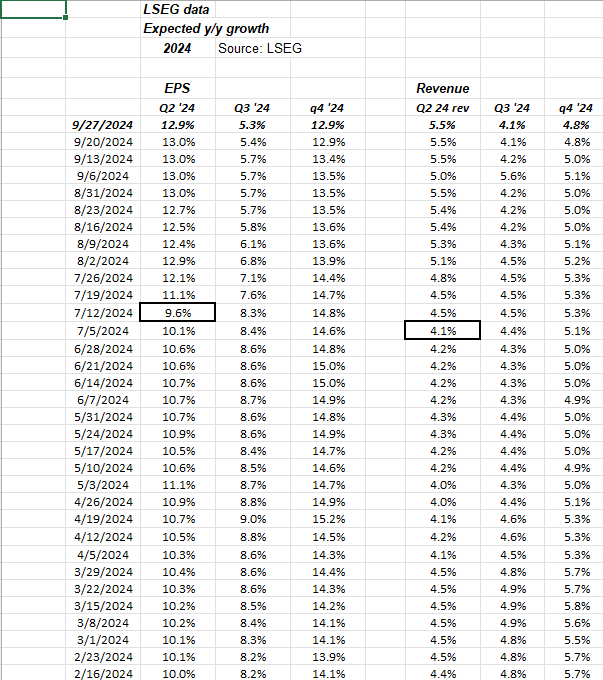

Let’s take a closer look at how the earnings per share (EPS) and revenue growth for Q3 and Q4 of 2024 have evolved since early in 2024.

While the spreadsheet remains internal, the data is regularly updated on a weekly basis and is sourced from LSEG.

Anticipate a bottoming out of Q3 EPS and revenue growth for the S&P 500 within the next two weeks, followed by an uptick as Q3 ’24 financial results start to roll in.

One significant shift between Q2 ’24 and Q3 ’24 EPS growth is expected to be in the energy sector, where a drop of 20% is foreseen as Q3 ’24 earnings come to light. Currently, energy is projected to experience an EPS decline of -20% and a revenue drop of -3.7% in Q3 ’24.

A noteworthy challenge for the energy sector in Q3 ’24 is its tough comparison to Q3 ’23, when EPS plummeted by 33% and revenue by 17%. Despite typically serving as an easy benchmark to surpass, the Q3 ’24 numbers foresee no rebound.

As of now, technology leads the pack with an expected year-over-year EPS growth of 15% for Q3 ’24.

Insights on S&P 500 Data:

- The forward 4-quarter estimate dipped to $257.47 this past week from the previous week’s $258.76 and the initial quarterly projection of $261;

- The PE ratio based on the forward estimate stands at 22.3, compared to last week’s 22x and the initial quarter’s 21.6x;

- The S&P 500 earnings yield decreased to 4.48% from 4.54% last week, showing a continuous decline since the peak near 4.87% on 8/2/24;

- This quarter, a notable change in the S&P 500 quarterly earnings results was the decrease in “upside surprise” from 4.6% to below the robust levels of the previous five quarters.

Following Tuesday’s quarterly roll, it is expected that the forward 4-quarter estimate for the next week will be close to $267 per share. This adjustment will reflect the transition to Q4 ’24 – Q3 ’25, as opposed to the current period of Q3 ’24, moving towards Q2 ’25.

Over the next few quarters, the “expected” forward 4-quarter estimates are as follows:

- Q3 ’24 – Q2 ’25: $257.47

- Q4 ’24 – Q3 ’25: Approximately $267 (subject to slight changes by the following Friday, 10/4)

- Q1 ’25 – Q4 ’25: $277.28 (calendar ’25)

Notice the anticipated $10 rise per quarter as we progress forward.

Let’s observe how these estimates evolve as Q3 ’24 earnings reports are unveiled.

Key Takeaways:

Examining the year-to-date performance, the deceleration in the top 10 mega-cap companies in the S&P 500—such as those excluding, , and —indicates subtle shifts occurring beneath the surface of the index.

Facing challenging comparisons in Q3 and Q4 ’24 against 2023, the technology sector, particularly, may see struggles—given the strong growth of 15% in Q3 ’23 and 24% in Q4 ’24.

While it seems unlikely that technology will experience a downturn as severe as the one observed from March 2000 to early 2023, high PE names tend to undergo PE compression when growth moderates, even slightly. Microsoft, for instance, remains 10% or $40 below its peak.

Of particular interest this week is the developments in China.

Examining EEM and VWO reveals significant increases this week in year-to-date returns: Where VWO’s YTD return was +11.05% as of last week, increasing to +18.31% this week, EEM’s YTD return shifted from +9.41% to +16.72%.

It’s worth noting that China accounts for approximately 30% of the market capitalization in the emerging market benchmark and ranks as the world’s second-largest economy based on annual GDP growth.

Personally, I hold the opinion that China presents unattractive investment opportunities, given its pseudo-capitalist structure. The presence of state-owned enterprises acts as a significant warning sign.

Disclaimer: This article does not provide financial advice; all information shared is based on personal opinion. Past performance does not guarantee future results. The S&P 500 EPS and revenue data is sourced from LSEG unless specified otherwise. Investing comes with risks, including potential loss of principal, even over short periods. Readers are encouraged to evaluate their risk tolerance and adjust investment strategies accordingly.

Thank you for your readership.