Medical Properties Trust, Inc. (MPW), known as MPT, has recently finalized the sale of 11 healthcare facilities in Colorado to University of Colorado Health (UCHealth) for a substantial $86 million. This move aligns with MPT’s strategy to optimize its capital allocation.

The announcement spurred a 5.34% surge in MPW’s stock price during the regular trading session on Aug 15 at the NYSE, indicating a favorable market response.

The proceeds from this transaction will be directed towards debt repayment and bolstering the company’s overall financial position.

MPT adheres to a disciplined approach of recycling capital, selling off non-core assets to fund acquisitions of prime assets and beneficial development projects.

In a similar vein, back in July 2024, MPT divested seven freestanding emergency department (FSED) facilities and one general acute hospital in Arizona to Dignity Health for approximately $160 million.

Prior to that, in April 2024, the company completed the sale of its 75% interest in five Utah hospitals to a new joint venture for a substantial $886 million, alongside other divestitures in California and New Jersey, displaying a transformative commitment in its portfolio management.

This healthcare Real Estate Investment Trust (REIT), focused on acquiring and developing healthcare properties, is actively enhancing its portfolio diversification and reducing exposure to underperforming operators, aiming for a robust and sustainable income stream.

By executing liquidity transactions exceeding $2.5 billion since the start of the year until Aug 8, 2024, MPT has significantly fortified its financial footing, enabling it to meet immediate liquidity needs effectively.

Recently, the Birmingham-based REIT surpassed expectations with its second-quarter 2024 results, reporting Normalized Funds from Operations of 23 cents per share, beating the Zacks Consensus Estimate of 20 cents.

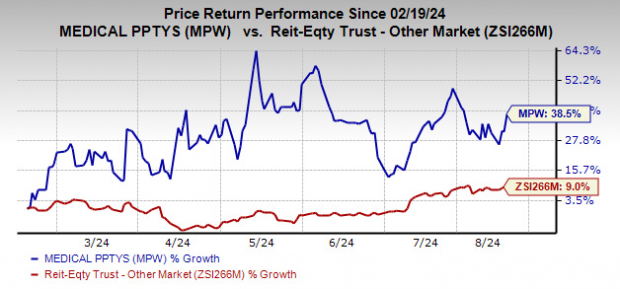

Over the last six months, shares of this Zacks Rank #1 (Strong Buy) company have soared by 38.5%, outpacing industry growth at a remarkable 9% rate.

Image Source: Zacks Investment Research

Diverse Opportunities in Healthcare REIT Sector

Aside from MPT, healthcare REIT sector offers promising investment avenues like CareTrust REIT (CTRE) and Sabra Healthcare REIT (SBRA).

The Zacks Consensus Estimate for CareTrust’s 2024 Funds from Operations (FFO) per share predicts an uptick to $1.47, showcasing a 4.3% rise from the previous year. CTRE is currently adorned with a Zacks Rank #1.

Similarly, Sabra is identified with a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for Sabra’s 2024 FFO per share stands at $1.41, indicating a solid 6% year-over-year growth projection.

Note: Earnings mentioned in this piece refer to Funds from Operations (FFO), a pivotal metric for evaluating REIT performance.