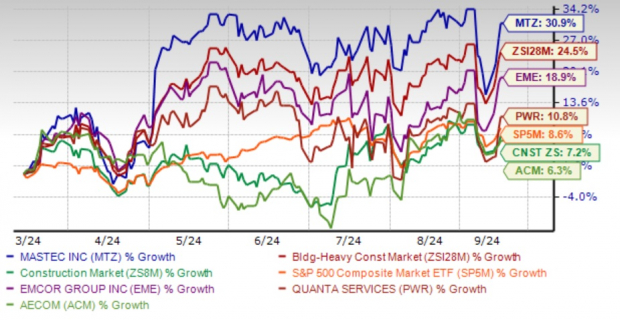

MasTec, Inc.‘s MTZ stock has surged approximately 31% in the past half-year, outperforming both the Zacks Building Products – Heavy Construction industry’s growth of 24.5% and the broader Construction sector’s rise of 7.2%. The company’s success also surpasses the S&P 500 index’s gain of 8.6%.

The infrastructure construction juggernaut thrives on the rising demand for power, enhanced data capacity, and faster network speeds. With strategic investments driving portfolio diversification, MasTec ensures readiness to meet the escalating global infrastructure demand. Furthermore, the company exudes optimism about its growth prospects for 2025 and beyond, backed by a robust pipeline and acquisition synergies.

Even in the realm of competition, MTZ’s stock has outpaced rivals like EMCOR Group, Inc. EME, Quanta Services, Inc. PWR, and AECOM ACM, who marked gains of 18.9%, 10.8%, and 6.3% respectively over the same period.

Image Source: Zacks Investment Research

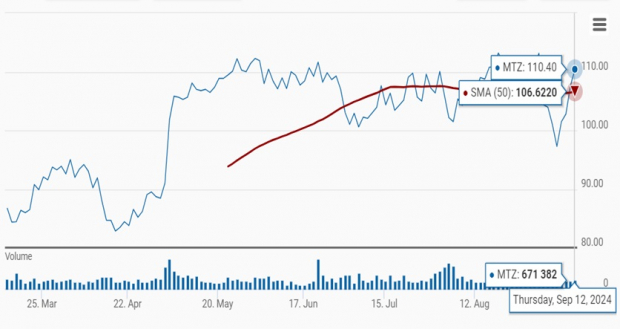

Technical indicators underscore MTZ’s robust performance, with the stock trading comfortably at $110.40 as of Thursday, surpassing its 50-day moving average of $106.62.

Image Source: Zacks Investment Research

Driving Forces Behind MTZ Stock’s Superior Performance

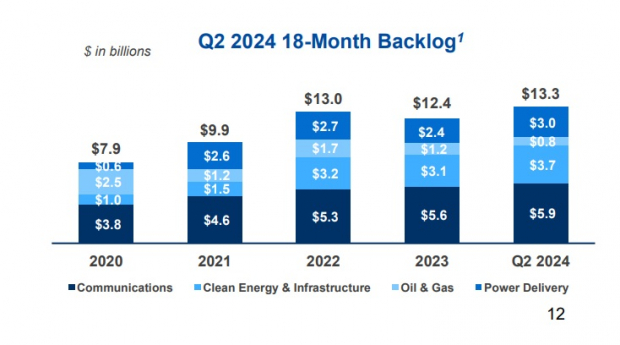

Bright Outlook for 2024: MasTec’s notable 18-month backlog of $13.3 billion offers a clear view into 2024. The company boosted its full-year guidance, anticipating consolidated revenues of $12.4 billion. Adjusted EBITDA is set to rise to $975 million, with adjusted earnings per share forecasted at $3.03. Noteworthy growth is expected in the Clean Energy and Infrastructure segment post-2024 as well.

Strong Backlog Sets a Solid Foundation: As of June 30, 2024, MasTec’s Clean Energy and Infrastructure backlog surged 10.3% year over year and 4.6% sequentially. The Power Delivery segment exhibits a 12% surge in backlog YoY and a 20% increase sequentially, driven by a major 700-mile high-voltage transmission project commencing in 2025, anticipating revenues of $300-$500 million annually until 2028.

The Communications segment also reports growth, yielding robust adjusted EBITDA margins and a positive sequential backlog uptick. Amid short-term power delivery segment pressures, a promising long-term outlook looms large. Renewables and infrastructure projects echo strong demand, envisaging a potential for double-digit revenue and earnings growth post-2025.

Image Source: MasTec Corporate Presentation

Expanding Communications Universe: Strengthening ties with prominent client AT&T fuels hope for MasTec, as AT&T broadens the horizons for MasTec’s wireless services. The forthcoming replacement of Nokia equipment with Ericsson spells promise for MasTec’s wireless domain. Projections indicate double-digit revenue growth in 2025 and a significant impact in the latter half of 2024.

Acquisitions and Strategic Investments: MasTec’s slew of strategic acquisitions and equities upholds its growth trajectory. An avid investor, the company sealed four acquisitions in 2023 and five in 2022. Furthermore, its equity investments in telecommunications entities prop up its construction services.

By Q1 2024, MasTec boasted $22 million in total investments, inclusive of pivotal stakes in Communication and Power Delivery entities. Noteworthy investments include a 75% equity in Confluence Networks, LLC, an undersea fiber-optic systems developer.

Key Indicators of MTZ’s Promising Growth Prospects

Analysts’ favorable stance is evident in recent upward revisions in earnings estimates. Forecasts for 2024 and 2025 have seen an uptick to $3.02 and $4.35 respectively over the last 60 days.

MasTec boasts a commendable history of earnings surprises. With the EPS beating consensus estimates in three of the last four quarters, and with an average surprise of 19.4%, the company maintains a VGM Score of A, signifying strong growth potential and possible market outperformance.

This optimistic outlook mirrors bullish sentiments from analysts, showcasing robust fundamentals and an expectation for continued outperformance in the immediate future.

Is MasTec a Wise Investment Decision Today?

Steering through the competitive non-residential services realm, MasTec emerges as a beacon. Its $8.75 billion market cap and leading position in infrastructure construction set it apart. Leveraging on converging trends, MasTec offers a roadmap to near and long-term growth, underpinned by a diversified portfolio with substantial growth opportunities across all segments.

The company’s Zacks Rank #2 (Buy) rating, supported by upward earnings estimates revisions, further solidifies its position as an attractive asset for investor portfolios today.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.