Emboldened investors are doubling down on small-cap stocks, fueled by rosy forecasts for the interest-rate-sensitive segment as the market braces for an impending Federal Reserve rate cut cycle.

July has emerged as a turning point, with small caps notably eclipsing their larger counterparts, especially in the tech domain which reigned supreme through the almost two-year bull run.

The Russell 2000 index has notched a nearly 9% surge month-to-date, juxtaposed with a 3.6% dive for the tech-heavy Nasdaq 100 as of July 25.

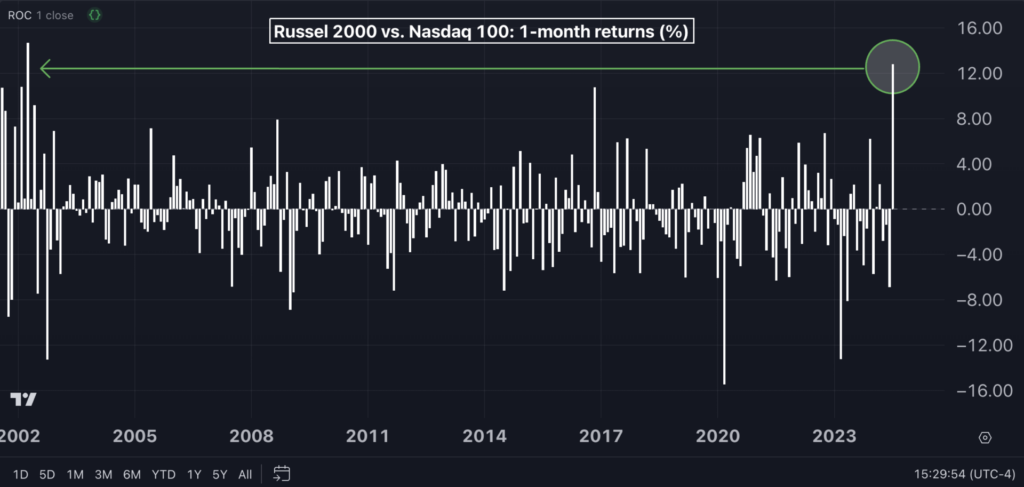

This chasm of about 13 percentage points in favor of the Russell 2000 over tech signals the golden hour for the “long small cap, short tech” strategy—marking its zenith since April 2002 and accentuating the vigor of the ongoing market rotation.

Chart: A Culmination of More Than 20 Years for the ‘Long Russell 2000, Short Nasdaq 100’ Strategy

Influx of Capital into Small-Cap ETFs

The stellar performance of small-cap stocks finds resonance in substantial inflows pouring into major small-cap-oriented ETFs.

The iShares Russell 2000 ETF (IWM), a heavyweight tracking the U.S. small-cap index, witnessed over $6 billion in net inflows this month, marking the most substantial influx of 2024, according to data from Etfdb.com.

Several other small-cap ETFs have also been magnetizing significant investor funds in recent times:

- iShares Core S&P Small-Cap ETF (IJR): $645 million in net inflows

- Avantis U.S. Small Cap Value ETF (AVUV): $553.28 million in net inflows

- Invesco S&P SmallCap Momentum ETF (XSMO): $350 million in net inflows

- SPDR Portfolio S&P 600 Small Cap ETF (SPSM): $188 million in net inflows

So far this year, the Vanguard Small-Cap ETF (VB) and the Pacer US Small Cap Cash Cows 100 ETF (CALF) have been the cynosure of investor attention, drawing in $3.1 billion and $2.9 billion, respectively.

An Alternative Outlook

Despite the robust performance of the Russell 2000 index and the significant inflows into small-cap ETFs, some pundits preach prudence.

“Investors and analysts are optimistic that the conclusion of the Federal Reserve’s tightening regimen will herald brighter prospects for smaller firms, especially those reliant on debt for sustenance. We harbor skepticism,” remarked seasoned Wall Street luminary Ed Yardeni in a missive.

Yardeni highlighted that larger entities, particularly in the tech sphere, enjoy a competitive edge that eludes their smaller peers.

Big tech giants boast sizable cash reserves, empowering them to fuel substantial capital investments and R&D budgets, thereby fortifying their competitive stance.

For instance, Alphabet Inc. stocks a cash hoard of $111 billion by last quarter’s close. Amazon.com Inc. and Microsoft Corp. hold cash war chests of $87 billion and $80 billion, respectively.

Such financial agility facilitates strategic acquisitions of smaller firms harboring pivotal new technology or business arms. Microsoft’s $10-billion bet on OpenAI, pioneers of ChatGPT, last year epitomizes this prowess.

Yardeni postulates that the high-growth, high-potential firms may have already aligned with large-cap entities or private equity financiers.

“This intimates that the stragglers may resort to trading in the S&P 400 and S&P 600, hinting that investors might pivot to larger-cap substitutes sooner rather than later,” he posited.