Beta gauges the level of volatility in a stock concerning the overall market. The market, typified by the S&P 500 Index, possesses a beta of 1.0 by definition.

A beta exceeding 1.0 indicates heightened volatility compared to the broader market, while a beta below 1.0 signifies the opposite. Low-beta stocks come with various benefits for portfolios, notably defensive attributes.

When paired with high-beta stocks, they help to stabilize portfolios, thereby contributing to a well-balanced risk profile. Among the selection of low-beta stocks, Interactive Brokers (IBKR), Elevance Health (ELV), and Consolidated Edison (ED) stand out as prudent options for risk-averse investors.

Aside from reduced volatility, these three stocks boast a favorable Zacks Rank, highlighting the positivity shared by analysts. Let’s delve into each of them further.

Proven Performance of Elevance Health

Elevance Health functions as a health benefits company, guiding consumers and communities towards healthier living throughout their care journey. The company holds a promising Zacks Rank #2 (Buy), with earnings projections on an upward trend almost universally.

Investors found favor in ELV’s latest quarterly results, leading to a significant uptick in share value post-earnings. In terms of the key financials, Elevance surpassed the Zacks Consensus EPS estimate by 1% and posted sales marginally below anticipations.

Earnings saw a 12.5% year-over-year increase, while sales experienced a 1% uptick. Reflecting the company’s quarterly revenue is the chart below:

Image Source: Zacks Investment Research

Interactive Brokers’ Dominance over the S&P 500

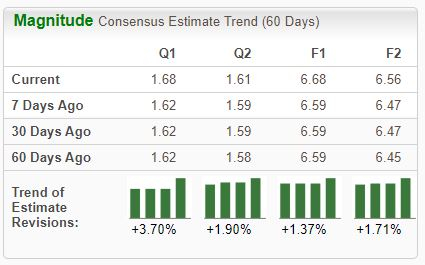

Interactive Brokers Group operates as a global electronic market maker and broker. Analysts have recently raised their expectations across the board, earning the stock a favorable Zacks Rank #2 (Buy).

The stock has notably outperformed the S&P 500 over the past two years, posting an impressive 125% surge compared to the market index’s 50% gain. Increased trading activities have notably boosted the company’s performance over recent years.

Image Source: Zacks Investment Research

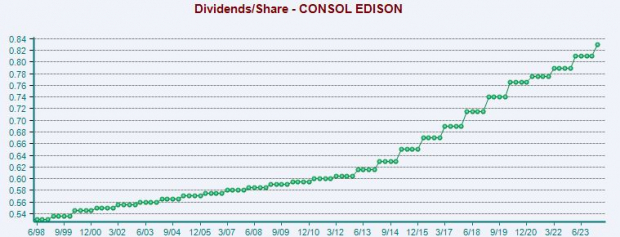

Consolidated Edison’s Consistent Rewards to Shareholders

Consolidated Edison, currently holding a Zacks Rank #2 (Buy), serves as a diversified utility holding firm with subsidiaries involved in both regulated and unregulated ventures. The company has excelled in earnings delivery, surpassing the Zacks Consensus EPS estimate by an average of 6% across its last four releases.

Investors focused on income might find ED’s shares appealing, boasting a solid 3.8% annual yield. Noteworthy is the company’s dividend growth, reflecting a modest 2% five-year annualized increase rate.

The company has historically demonstrated a shareholder-friendly essence, evident in the chart below:

Image Source: Zacks Investment Research

In Summary

Low-beta stocks present a myriad of advantages for portfolios, including defensive features and risk mitigation. When intertwined with high-beta counterparts, they contribute to a more balanced risk profile.

For investors inclined towards a conservative approach, the trifecta of low-beta stocks – Interactive Brokers IBKR, Elevance Health ELV, and Consolidated Edison ED – warrant serious consideration. Coupled with their reduced volatility, the favorable Zacks Ranks on all three signal analysts’ positive sentiment.