The recent volatility in the market has given investors a painful headache lately. That’s been especially true with all the back-and-forth tariff news, and Trump’s latest comments about Federal Reserve Chair Jerome Powell this week certainly didn’t help matters, either.

So, if you find yourself craving some stability, wanting to reduce the pain in your portfolio, I want you to remember something.

I think economist Ben Graham sums up the market perfectly here:

In the short run, the stock market is a voting machine. But in the long run, it is a weighing machine.

Simply put, the market in the short term is unpredictable. Just like how an election can devolve into a popularity contest, the same is true for the stock market in the short term.

The market oscillations can be driven by market/consumer sentiment and the news, rather than business results. But in the long term, a stock’s value will grow because of its superior fundamentals.

So, rather than focusing on more talk about tariffs and the latest news, I want to focus on the latter today.

In case you haven’t noticed, it is earnings season, and that’s where we should shift our focus right now. That’s what’s most important, especially if you own stocks with superior fundamentals. Those stocks should dropkick and drive your portfolio higher after good results.

Now, this week, there were a couple of Magnificent Seven stocks that released their earnings that many investors had their eye on: Tesla, Inc. (TSLA) and Alphabet, Inc. (GOOG).

So, let’s take a look at the results for these companies in today’s Market 360. I’ll explain if they’re good buys right now. Then, I’ll share where you can find fundamentally superior stocks this earnings season.

Tesla, Inc.

On Tuesday after the bell, Tesla’s earnings came in mixed. Yet shares went up 5% on Wednesday and have continued to soar – up nearly 18% as of this writing. So, what happened?

Let’s look at the numbers. Tesla reported first-quarter revenue of $19.34 billion, below expectations for $21.43 billion. That’s also down from the $21.3 billion reported in the same quarter a year ago. Adjusted earnings came in at $0.27 per share, well below the $0.44 per share that analysts were expecting.

It’s a horrific miss. Tesla even paused its 2025 guidance due to slowing demand and trade uncertainty. The company also blamed the latter for why sales have slowed down.

Despite this statement, Tesla’s shares still went up. CEO Elon Musk said in the earnings call that starting early next month, he will be spending more time at Tesla and less time at DOGE (Department of Government Efficiency).

What’s more, news broke on Thursday that the National Highway Traffic Safety Administration will ease self-driving regulations to help enable the adoption of self-driving vehicles. The move was seen as a huge plus for Tesla’s robotaxi efforts, which made investors happy.

Musk also said during Tesla’s earnings call that the company expects to be offering fully autonomous rides in Austin, Texas, in June, with other cities to follow this year.

Now, Musk has a history of setting overly ambitious timelines. But the bottom line is that, despite the awful earnings report, Tesla went up because Musk was on a charm offensive, for lack of a better word.

Alphabet, Inc.

After the close yesterday, Alphabet announced results that beat expectations. In its first quarter, it reported earnings of $2.81 per share on $90.2 billion in revenue. Analysts were expecting $2.01 per share on $89.1 billion in revenue. That also compares to earnings per share of $1.89 on revenue of $80.5 billion during the same period last year.

Google’s advertising revenue reached $66.8 billion, beating estimates for $66.4 billion. Google Cloud Platform revenue was $12.2 billion, just shy of estimates calling for $12.3 billion.

Speaking of clouds, one particularly dark cloud has been hanging over Alphabet’s head for the past year, which helps explain why the stock has underperformed.

The company has been in hot water with antitrust regulators over its search and advertising business. In fact, last week, a federal judge ruled that Google holds an illegal monopoly over the online advertising market.

That’s the second ruling against the company, folks. Ultimately, it could mean that Alphabet will have to sell off or reorganize either its advertising business or its search engine.

The bottom line is that the Justice Department is a little bit like the dog chasing the car. Now that it’s caught it, it doesn’t know what to do.

Still, investors cheered after Alphabet announced a dividend increase of 5% and authorized $70 billion in stock buybacks.

Meanwhile, CEO Sundar Pichai emphasized that Alphabet’s push for AI innovation and competitiveness remains essential for its growth. Here’s what he said:

We continue to see healthy growth and momentum across the business, including AI powering new features. In Search, we saw continued double-digit revenue growth. AI Overviews is going very well with over 1.5 billion users per month, and we are excited by the early positive reaction to AI mode. Our differentiated full-stack approach to AI continues to be central to our growth.

Should You Buy?

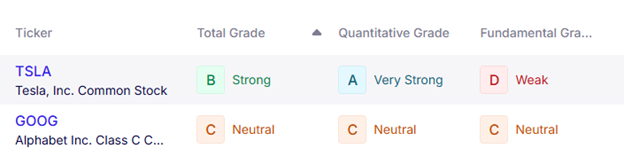

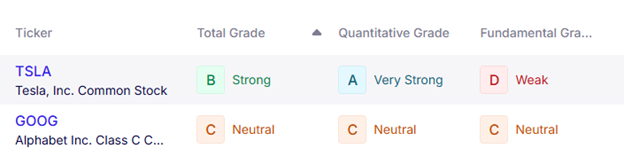

Now, after going through both Tesla and Alphabet’s earnings, let’s see if they’re buys right now. Here’s what my Stock Grader tool (subscription required) has to say:

Alphabet earns a Total Grade of “C”, as well as a C-rating for its Fundamental Grade and Quantitative Grade. That means if you own it, it’s a “Hold” right now. And if you’re looking to buy, you may want to hold off and simply keep an eye on it.

Tesla, meanwhile, receives a Total Grade of “B”, making it a “Buy.” However, despite its strong Quantitative Grade of an “A”, which means that it is experiencing strong institutional buying pressure, it earns a “D” for its Fundamental Grade.

The fact is superior fundamentals are key to a stock’s continued success, so I personally wouldn’t buy it.

Where to Find Strong Stocks This Earnings Season

So, where can you find stocks with superior fundamentals this season? Look no further than my Growth Investor service.

As I mentioned earlier, it’s important to keep your focus on earnings season amidst all the market noise.

And the reality is my Growth Investor stocks are characterized by 24% average annual sales growth and 81.1% average annual earnings growth. That compares to the S&P 500, which is expected to achieve an estimated 4.6% revenue growth and a 7.2% average earnings growth rate for the first quarter.

Now, earlier today, I released my May Monthly Issue with my Growth Investor subscribers with a brand-new buy that analysts are forecasting to have 32.4% sales growth and 49.7% earnings growth.

Click here to learn more about Growth Investor and gain immediate access to my latest Monthly Issue!

(Already a Growth Investor subscriber? Click here to log in to the members-only website.)

Sincerely,

Louis Navellier

Editor, Market 360

P.S. How did you like today’s issue? Have any questions about it? Send me an email to navellierfeedback@investorplace.com with the subject line “Market 360 Question/Comment.” I always love hearing from my subscribers!