Tesla: Should you Buy the Dip?

Zacks Rank #3 (Hold) stock Tesla (TSLA) shares dumped more than 5% Tuesday after news broke that an Elon Musk-led group of investors bid nearly $100 billion for a controlling stake in ChatGPT-parent OpenAI (Musk’s former non-profit, which has become for-profit). Long-term shareholders know that there is precedent for this situation. When Tesla CEO Elon Musk bid for social media giant Twitter (renamed X), shares were under pressure for weeks. Through the price action and a CEO compensation vote in mid-2024, Tesla shareholders and loyalists have made it clear over the years that despite Musk’s sometimes eccentric behavior, they want him at the helm of the leading EV-maker.

Below are three reasons the recent TSLA weakness is a juicy buying opportunity, including:

OpenAI/Musk Fears Are Overblown

Elon Musk’s $97 billion bid for OpenAI, previously valued at $40 billion, is likely a strategic move, not just a purchase attempt. Musk is exploiting OpenAI’s unusual non-profit/for-profit structure, potentially forcing them to adhere to “Revlon rules” to maximize shareholder value, like a traditional for-profit company. This challenges OpenAI’s mission-driven claims and exposes their true motivations while also creating legal pressure and raising questions about their acceptance of massive investments. Meanwhile, earlier in the week, Sam Altman made his intentions of not selling OpenAI straightforward, tweeting, “No thank you but we will buy Twitter for $9.74 billion if you want.”

Tesla RSI Below 35

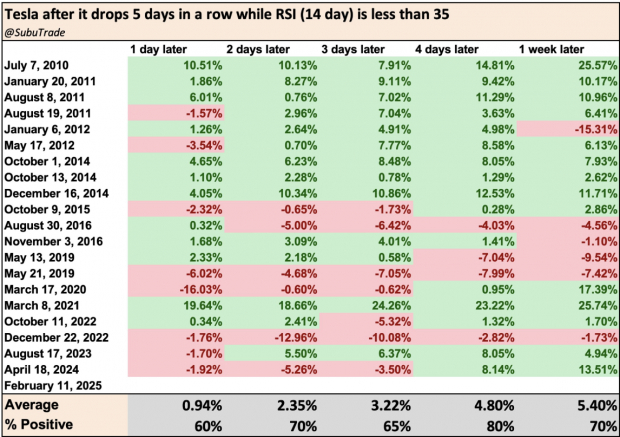

The Relative Strength Index (RSO) is a momentum indicator that measures the speed and change of price movements to identify overbought or oversold conditions in a stock. Yesterday, TSLA marked its fifth consecutive down day as the daily RSI plunged below 35. Historically, this rare combination of extremes has been very profitable for dip buyers, with shares gaining ground a week later 70% of the time with an average gain of 5.40%.

Image Source: (@SubuTrade)

Tesla Technical Analysis

TSLA shares are retreating to a high reward-to-risk confluence zone, including the 1.618 fib extension of the last technical breakdown and a retest of the December breakout zone (price support).

Image Source: TradingView

Bottom Line

Tesla’s recent price drop, triggered by Elon Musk’s bid for OpenAI, presents a potential buying opportunity. While concerns about Musk’s focus and the OpenAI situation exist, they appear overblown.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Tesla, Inc. (TSLA) : Free Stock Analysis Report