Key Takeaways

- Over the past six months, Tesla stock has outperformed the rest of the Magnificent Seven.

- Tesla also boasts the highest one-year earnings growth forecast among the group, excluding Nvidia.

- That being said, Tesla has a Zacks Rank #3 (Hold) rating, indicating mixed earnings revisions.

Looking back, Tesla (TSLA) often takes the most challenging and volatile path higher—but higher it goes. Over the past six months, Tesla stock has outperformed the rest of the Magnificent Seven, even though it was the worst performer during the first half of 2024.

Elon Musk’s alignment with now-President Trump may have given Tesla an edge. As the first mover among mega-cap tech CEOs, Musk set the tone, and now many of his peers have cozied up to the new administration.

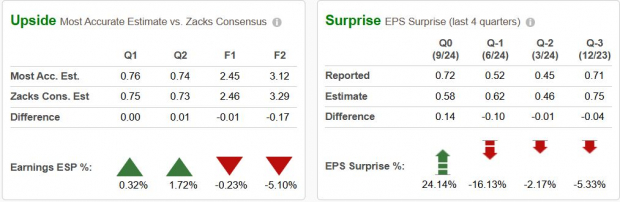

Tesla also boasts the highest one-year earnings growth forecast among the group—excluding Nvidia—and is the only company with a positive Zacks Earnings ESP, aside from Amazon. That being said, Tesla has a Zacks Rank #3 (Hold) rating, indicating mixed earnings revisions. Additionally, TSLA stock has languished in the last month, while Meta Platforms (META), Amazon (AMZN) and Alphabet (GOOGL) have been exploring new highs.

Image Source: Zacks Investment Research

Tesla: Volatile Stock and Volatile Earnings Results

Just as Tesla stock can go from doldrums to leader, so can its earnings results. Over the last four quarters, Tesla has beaten estimates once, by 24.14% and missed three times, by as much as -16.13%. This earnings volatility reflects broader challenges, including its first decline in vehicle delivery growth last year, pricing adjustments, and margin pressures.

Image Source: Zacks Investment Research

Tesla Key Growth Drivers and Challenges

Tesla’s Energy Generation and Storage business has emerged as its most profitable segment, with deployments growing at an impressive 180% CAGR over three years. The company’s charging division shows promise, with major automakers like Ford, GM, and Mercedes adopting Tesla’s North American Charging Standard across their 60,000+ connector network.

However, challenges loom. Tesla faces margin pressure amid economic uncertainty, and competition is intensifying. Its US EV market share has declined to 50% from 63% in 2022, while Chinese competitors like BYD and NIO continue to gain ground. In the autonomous vehicle race, Tesla’s Full Self-Driving system remains at Level 2, requiring human supervision, while competitors like Alphabet’s Waymo have been running regulated robotaxi pilots for years.

Tesla Stock Price Analysis

Tesla often trades in boom-and-bust patterns, marked by aggressive rallies lasting months or years, followed by sharp corrections and extended consolidations. Leading up to the presidential election, Tesla began gaining momentum, and after the election, it surged higher. Looking at the chart, it appears Tesla has taken three major legs higher since the summer, more than doubling in value.

This level of price appreciation in such a short time is significant. Recently, the stock has been consolidating, forming what resembles a bull flag. However, volatility in the stock has been rising, which can sometimes signal that a prolonged rally may be nearing its end.

That said, Tesla could continue to consolidate and reduce volatility before breaking higher again. Still, investors should keep in mind that the stock is up significantly and trades at an ultra-premium valuation of 125x forward earnings. A breakout in either direction, above or below the pattern could lead to a significant move.

Image Source: TradingView

Should Investors Buy TSLA Shares Ahead of Earnings?

Tesla’s significant price appreciation, combined with its mixed business developments, volatile earnings history, and ultra-premium valuation, presents a challenging setup for investors. While the company has strong growth drivers, such as its Energy Generation and Storage business and leadership in EV charging infrastructure, it also faces notable challenges, including margin pressures, declining US EV market share, and intensifying competition.

Given Tesla’s tendency for boom-and-bust price action and the potential for a significant move following earnings, caution is warranted. The stock’s lofty valuation of 125x forward earnings and recent consolidation pattern suggest that much of the optimism may already be priced in. Additionally, Tesla’s Zacks Rank #3 (Hold) rating, reflecting mixed earnings revisions, and further temper enthusiasm.

For investors considering Tesla, the upcoming earnings event may not be the ideal time to buy shares. A more prudent approach might be to wait for confirmation of improved fundamentals or a more favorable technical setup following the earnings release.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report