The wait is finally over. Donald Trump has staged a historic comeback, defeating Kamala Harris to win the 2024 U.S. election. Markets celebrated the news, closing at record highs amid optimism around Trump’s potential tax cuts and pro-domestic trade policies, aimed at revving up American manufacturing and boosting economic growth.

One stock riding high on this bullish sentiment and celebrating Trump’s resurgence is the electric vehicle (EV) trailblazer Tesla TSLA. Yesterday, shares of TSLA surged around 15% following Trump’s win, adding an impressive $20 billion to CEO Elon Musk’s wealth overnight.

As we know, tech tycoon Musk has played an influential role in Trump’s campaign, making sizable financial contributions and leveraging his social media presence to galvanize support. Trump reciprocated with high praise for Musk, referring to him as a “super genius” and a “new star” during his victory speech yesterday. According to reports, Trump has even hinted at offering Musk a role in a new government department — “Department of Government Efficiency.” Well, friendship with the President surely has its perks!

Given Musk’s rapport with the President-elect, Tesla may have some unique advantages under Trump 2.0, setting up for a potentially lucrative year ahead. So, should you place your bets on the stock now? Can Tesla reach the $500 mark next year? Let’s dive in to see how Trump’s return to the White House could shape Tesla’s future.

Trump’s Harsh Stance on EVs: How TSLA Might Remain Unscathed

Throughout his campaign, Trump expressed strong skepticism about EVs, promising to end the EV mandate on his first day in office and frequently stating that EVs “don’t work.” His administration could reduce or eliminate subsidies that support the EV industry, including the current $7,500 federal tax credit for EV purchases. However, Tesla’s strength lies in its ability to weather these changes due to its cost efficiency and economies of scale.

Tesla operates as one of the lowest-cost producers in the EV market, thanks to its extensive vertical integration—from battery manufacturing to software development—and its global Gigafactories that drive down production costs. As such, Tesla could emerge less affected by subsidy cuts than competitors like Rivian RIVN, which are yet to achieve profitability and may face hurdles in a subsidy-free environment. Tesla’s production efficiency, coupled with its high brand loyalty, provides it a strong foundation to maintain its growth and profits, even without the incentives that benefit other EV startups as well as traditional automakers like General Motors GM and Ford F, whose EV businesses are still incurring losses.

Trump’s Trade Policies: Advantage Tesla in the U.S. Market

Trump’s trade stance, particularly his tough approach toward China, could also boost Tesla’s position in the U.S. market. The U.S. currently imposes a 100% tariff on Chinese EVs, and Trump has warned of raising this to 200% for Chinese EVs manufactured in Mexico and imported to the United States. Such tariffs could create significant barriers for Chinese automakers like BYD Co Ltd. and Nio that aim to expand in the United States. With a dominant domestic production capacity and a leading position in the EV space, Tesla could capture a larger market share as Chinese EVs face these restrictions.

TSLA’s Energy Business Growth Amid Domestic Production

Despite Trump’s support for traditional energy, his pro-U.S. manufacturing policies could benefit Tesla’s energy business. Tesla’s Powerwall and Megapack, largely manufactured domestically, align with tax cuts and incentives aimed at boosting U.S.-based production. This could foster growth in Tesla’s energy division as demand for reliable, home-grown energy solutions rises. As it is, Tesla’s Energy Generation and Storage business segment stands out as its most lucrative, boasting the highest margins. The growth trajectory is expected to continue.

Regulatory Ease for TSLA’s Autonomous Driving and AI

A pro-deregulation stance under Trump could make the path for Tesla’s Full Self-Driving (FSD) technology smooth, reducing safety-related regulatory scrutiny. With over 1.3 billion miles logged by FSD users, Tesla’s autonomous data advantage could accelerate, enhancing long-term prospects. Although safety concerns persist, with reduced red tape and streamlined oversight, Tesla could make strides in perfecting its FSD technology, which it considers a critical revenue driver in the years to come.

Tesla Stock Displays Technical Strength

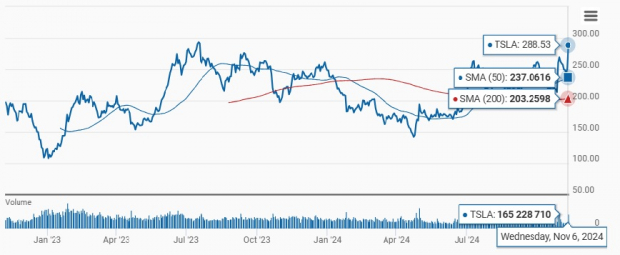

Tesla shares hit a new 52-week high yesterday. From a technical standpoint, TSLA is trading above both its 50-200-day moving averages, indicating bullishness. This technical strength reflects positive market sentiment and investor’s confidence in the company’s financial health and growth prospects. The stock carries a Momentum Score of B.

TSLA Trading Above 50 & 200- Day SMA

Image Source: Zacks Investment Research

Catalysts Boosting TSLA’s EPS Estimates

Tesla delivered earnings beat in the September quarter, breaking its streak of missing earnings estimates in the previous four quarters.

Tesla, Inc. Price, Consensus and EPS Surprise

Tesla, Inc. price-consensus-eps-surprise-chart | Tesla, Inc. Quote

Additionally, Tesla’s latest earnings report highlighted promising developments, such as increased Cybertruck production and a positive gross margin for the vehicle. The Cybertruck has ascended to become the third best-selling EV in the United States, after Tesla’s own Model Y and Model 3, reflecting strong consumer demand for the company’s unique offerings. With Musk forecasting overall vehicle growth between 20% and 30% next year, Tesla’s future looks promising, especially as gross margins start to improve.

Importantly, Musk has promised ride-hailing robotaxis in Texas and California, and a few other states by next year, pending regulatory approval. He has also promised an “unsupervised” FSD system next year. Agreed, much of Musk’s past autonomy predictions have not materialized, but Tesla’s steady progress in this field should keep investors optimistic.

The Zacks Consensus Estimate for Tesla’s 2024 and 2025 EPS has moved north in the past 30 days.

Image Source: Zacks Investment Research

TSLA: A Long-Term Buy for Strategic Investors

Tesla’s 2025 growth hinges largely on three main factors — vehicle delivery growth, margin improvement and expansion of its AV and AI strides. And while Trump’s presidency may not prove to be too fruitful for the broader EV industry, Tesla seems well placed to gain from his reign.

Its strong market position and ability to thrive in a less subsidized environment give it a significant advantage. Moreover, with potential tariffs further insulating Tesla from Chinese competition and favorable domestic manufacturing incentives, Tesla is well-poised to leverage these shifts.

So, is the stock worth buying at current levels? For long-term investors, the answer is yes. While knee-jerk trading reactions, like yesterday’s 15% surge, can introduce volatility, short-term fluctuations shouldn’t overshadow Tesla’s solid long-term growth potential. In fact, any dip would present an opportunity to increase exposure to a company that is primed to benefit from Trump’s pro-manufacturing, pro-deregulation policies.

To answer whether Tesla can reach $500 mark by 2025, though it may seem too ambitious at the moment (TSLA shares closed at $288.53 yesterday), it surely won’t be impossible, considering Tesla’s historical performance. Not to forget, Tesla is entering its next growth phase, driven by expanding market presence and advancements in technology. Whether or not it reaches this price point by 2025, Tesla’s trajectory under the Trump administration positions it for significant long-term growth, making it a stock worth adding to your portfolio now.

TSLA stock currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Free Today: Profiting from The Future’s Brightest Energy Source

The demand for electricity is growing exponentially. At the same time, we’re working to reduce our dependence on fossil fuels like oil and natural gas. Nuclear energy is an ideal replacement.

Leaders from the US and 21 other countries recently committed to TRIPLING the world’s nuclear energy capacities. This aggressive transition could mean tremendous profits for nuclear-related stocks – and investors who get in on the action early enough.

Our urgent report, Atomic Opportunity: Nuclear Energy’s Comeback, explores the key players and technologies driving this opportunity, including 3 standout stocks poised to benefit the most.

Download Atomic Opportunity: Nuclear Energy’s Comeback free today.

Ford Motor Company (F) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Rivian Automotive, Inc. (RIVN) : Free Stock Analysis Report