AMN Healthcare Services, Inc. AMN introduced an innovative technology suite, WorkWise, to the

world last week. This suite is poised to consolidate the company’s diverse technologies into a single,

transformative offering.

AMN Healthcare’s WorkWise promises to revolutionize workforce procedures by merging staffing demand

quantification with predictive scheduling, automated workforce management, and heightened clinician

engagement propelled by AI. By empowering healthcare systems to secure the right talent effectively while

managing costs efficiently, WorkWise aims to make a resounding impact.

The latest launch anticipates a substantial surge in AMN Healthcare’s Technology and Workforce Solutions

sector, anchoring its position in the ever-evolving domain of healthcare.

The Fall and Future Rise of AMN Stock Post WorkWise Unveiling

Upon the announcement on Oct. 2, the company’s shares wavered approximately 2.8% downward to reach $38.64 at

the close of the trading day.

While AMN has historically reaped rewards from its product unveilings, the current launch, although promising

top-line growth, elicited an overall decline in the stock since the revelation, with a slight uptick recorded

only in the most recent trading session.

AMN Healthcare presently boasts a market capitalization of $1.47 billion. With an earnings yield of 8.3%,

surpassing the industry average of 3.6%, the company displayed an impressive earnings surprise of 30.7% in the

last reported quarter.

The Impact of AMN Healthcare’s WorkWise Introduction

AMN Healthcare highlighted that WorkWise seamlessly integrates with healthcare organizations’ internal

systems. This strategic integration is primed to enable hospitals to optimize personnel across various job

categories (permanent, per diem, contract) by drawing talent from internal and external sources, thereby

reducing costs and accurately predicting staffing requirements. Leveraging automation and data analytics to

furnish insights and engender engaged talent networks, WorkWise is set to streamline workforce management and

expedite the staffing process.

The management at AMN Healthcare envisions WorkWise as a holistic solution with multifaceted capabilities

synergizing to combat intricate workforce challenges in the healthcare realm. Envisioned as a versatile

end-to-end solution adaptable to the evolving needs of hospitals and healthcare systems, WorkWise is slated

to bring transformative efficiency.

Industry Winds Favoring AMN’s Sails

As per a study by Grand View Research, the global healthcare workforce management system market hit a value of

$1.9 billion in 2023 and is expected to observe a CAGR of 13.2% from 2024 to 2030. Shifting paradigms toward

value-based reimbursements, coupled with the burgeoning adoption of telehealth technologies and AI-driven

analytics, are primed to steer the market’s growth.

Buoyed by these industry dynamics, the recent unveiling stands poised to propel AMN Healthcare’s trajectory

upward.

AMN Healthcare’s Trail of Trailblazing Launches

In another stride, August saw the debut of Strategic Partnership Solutions by AMN Healthcare, aimed at

revolutionizing language access programs in healthcare enterprises by offering comprehensive language services

and strategic guidance.

In July, the company unveiled Televate, a novel teletherapy platform geared towards broadening access to

therapy services for students nationwide.

AMN’s Stock Performance Saga

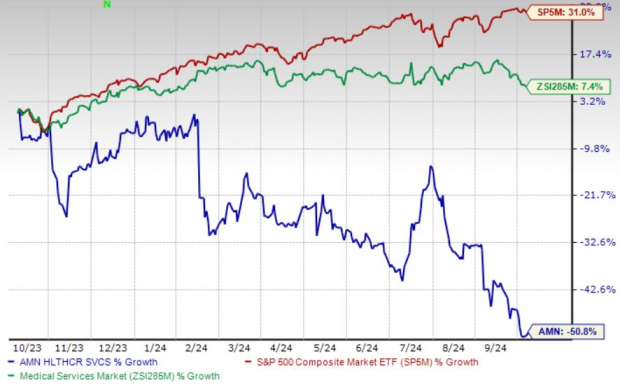

Over the past year, the company’s shares have dipped by 50.7%, a stark contrast to the industry’s 7.5% ascent

and the S&P 500’s impressive 30.9% growth.

Image Source: Zacks Investment Research

AMN Healthcare’s Zacks Rank & Noteworthy Picks

Presently, AMN carries a Zacks Rank #3 (Hold).

Within the broader medical landscape, some better-positioned stocks include DaVita Inc. DVA, Baxter

International Inc. BAX,

and Boston Scientific Corporation BSX.

DaVita, currently flaunting a Zacks Rank #2 (Buy), boasts an estimated long-term growth rate of 17.5%, with

earnings surpassing estimates in each of the trailing four quarters, averaging a 24.2% surprise.

Baxter, also adorned with a Zacks Rank of 2, sports a projected long-term growth rate of 10% and a track record

of outperforming earnings estimates in the last four quarters, the average being 3.7%.

Boston Scientific, maintaining a Zacks Rank of 2, projects a long-term growth rate of 12.6% and has consistently

outstripped earnings expectations in the past four quarters, with an average surprise of 7.2%.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.