In volatile market times, investors seeking stability often gravitate towards dividend-yielding stocks. These companies, flush with free cash flows, embrace shareholders with generous dividend payouts.

For the latest insights from Wall Street’s most precise analysts, the Analyst Stock Ratings page on Benzinga is the place to be. Here, traders can sift through a treasure trove of ratings, organized by the esteemed accuracy of each analyst.

Below are the verdicts of the market’s sharpest minds on three high-dividend stocks in the financial sector.

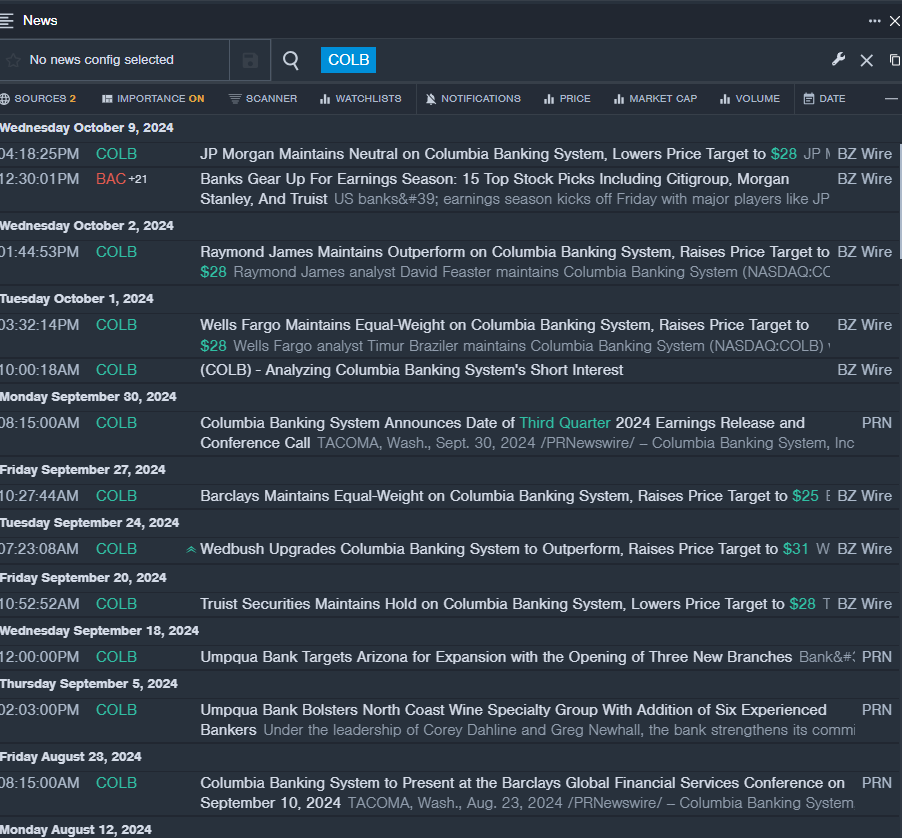

Magic in Columbia Banking System, Inc. (COLB)

- Dividend Yield: 5.19%

- JP Morgan analyst Steven Alexopoulos held firm with a Neutral rating but snipped the price target from $29 to $28 on October 9. This meticulous analyst commands an impressive 71% accuracy rate.

- Raymond James analyst David Feaster reiterated an Outperform rating and uplifted the price target from $26 to $28 on October 2, flaunting a commendable 68% accuracy rate.

- Latest Whisper: Keep your radar active for Columbia Banking System’s Q3 financial unveiling on Thursday, October 24, ahead of market commencement.

- Benzinga Pro’s real-time newsflash department will ensure you’re in the loop on all things COLB.

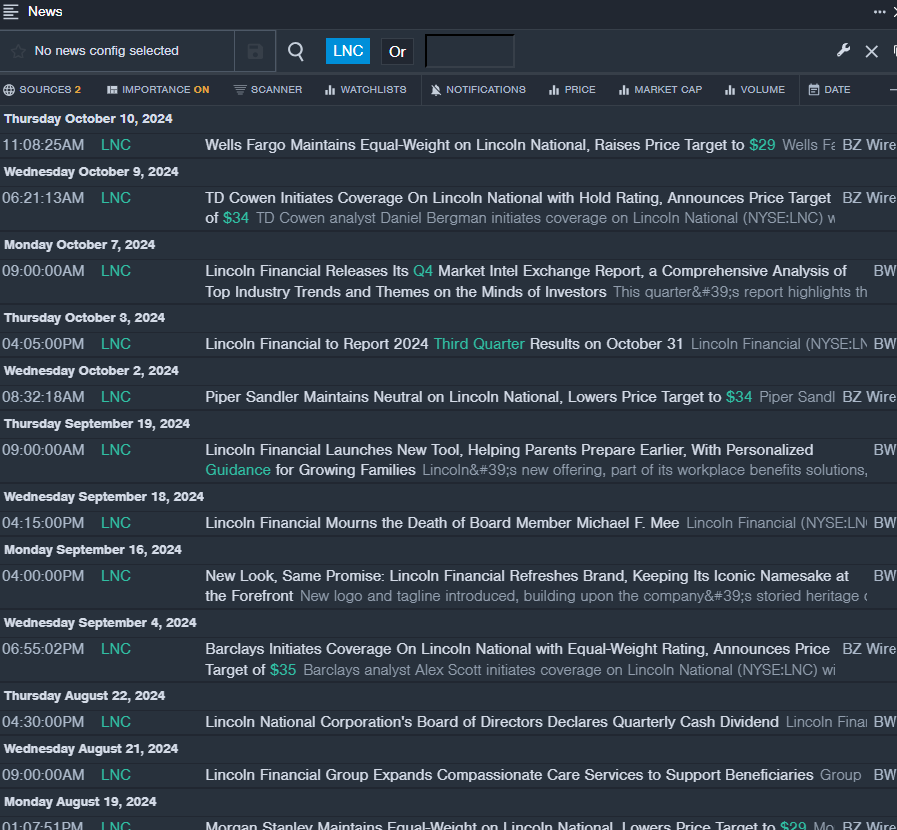

Heavenly Lincoln National Corporation (LNC)

- Dividend Yield: 5.35%

- Wells Fargo analyst Elyse Greenspan retained an Equal-Weight rating and upped the price target from $28 to $29 on October 10, showcasing a solid 68% accuracy.

- TD Cowen analyst Daniel Bergman initiated coverage with a Hold stamp and set a price target of $34 on October 9, bearing a respectable 66% accuracy rate.

- Trending Now: Anticipate Lincoln Financial’s third-quarter revelations on October 31.

- Stay informed with the latest from LNC through Benzinga Pro’s instantaneous newsfeed.

Golden Glimpses of Main Street Capital Corporation (MAIN)

- Dividend Yield: 7.86%

- Morgan Stanley analyst Devin McDermott elevated the stock from Underweight to Equal-Weight with a $24 price target on September 16, boasting an astute 80% accuracy rate.

- Barclays analyst Theresa Chen reaffirmed an Equal-Weight rating and lifted the price target from $21 to $22 on September 13, backed by a commendable 78% accuracy.

- Breaking News: Main Street disclosed a preliminary estimate of third-quarter net investment income ranging from 99 cents to $1.01 per share on October 15.

- For precious insights on MAIN stock trends, count on Benzinga Pro’s robust charting tool.

Seeking more guidance? Dive deeper into the realm of Market News and Data, all served hot and fresh from the Benzinga APIs kitchen.