Analyzing Recent Challenges and Positive Outlook

Despite a challenging year-to-date performance marked by a significant 14.5% decline, Ford stock enthusiasts have been caught in a storm of uncertainty. The root of this upheaval lies in the lackluster Q2 showing that triggered a sharp downturn for the stock.

Bank of America Analyst: The Bright Side of Things

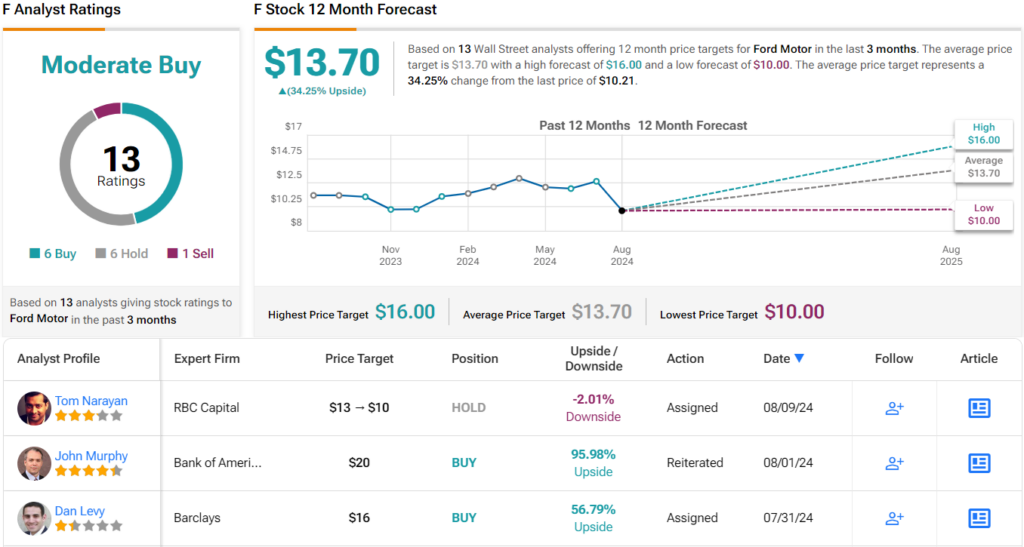

Bank of America’s John Murphy remains a steadfast optimist in the face of recent hardships. Acknowledging quality issues and launch execution missteps, Murphy is quick to point out Ford’s potential to enhance earnings through a focus on product cadence and incremental profit opportunities.

One standout example is the promising prospects of Ford Pro’s service and software offerings. Additionally, a subtler opportunity lies in utilizing Ford’s expertise in the retail sector, presenting avenues to consolidate the Core business and fortify earnings, cash flow, and the balance sheet for future investments.

Despite acknowledging challenges in the EV realm, Murphy attests to Ford’s progress in reducing associated costs, painting a bullish outlook for the stock. His enthusiastic Buy rating is accompanied by an ambitious price target of $20 – a staggering 97% upside potential in the next year.

RBC Analyst: A Cautious Divergence

On the other side of the fence, RBC’s Tom Narayan offers a more cautious perspective. He highlights investors’ growing preference for Ford’s competitor, General Motors, partly due to diverging capital return strategies.

While GM has aggressively executed share repurchases, Ford’s approach has been more restrained, leading to concerns about the stock’s valuation. Narayan opts for a Sector Perform (Neutral) rating and a price target of $10, suggesting that Ford’s current value is fully reflected in its stock price.

Consensus and Future Projections

Amidst this clash of opinions, market sentiments are mixed. With 5 Buy recommendations, 5 Holds, and 1 Sell, the consensus emerges as a Moderate Buy. However, the bulls are dominant in predicting future stock performance, with an average price target of $13.70 implying a substantial 34% return in the upcoming year.

Exploring Investment Opportunities

For investors seeking undervalued stocks, TipRanks offers insights and recommendations through its “Best Stocks to Buy” tool, aiding in making informed investment decisions.

Disclaimer: The views expressed in this analysis are those of the respective analysts. Readers are advised to conduct their independent research before making any investment decisions.