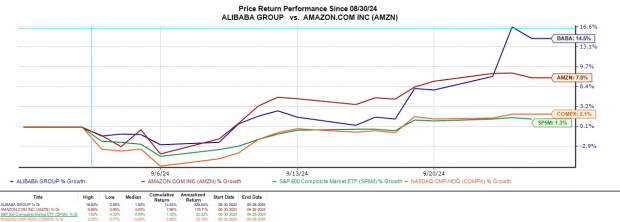

News of China’s economic stimulus has sparked a surge in Chinese equities this week, notably Alibaba, catching the attention of investors once more. Alibaba’s shares have surged by 14% this month, bringing the total gains for the year to an impressive 30%, outpacing the American e-commerce giant Amazon, which stands at 25%.

Given the positive momentum both Alibaba and Amazon have experienced in September, the debate around which e-commerce stock presents the better investment opportunity comes to the fore. This discussion is particularly noteworthy as the Zacks Internet-Commerce Industry, to which both companies belong, currently ranks in the top 27% among over 250 Zacks industries.

Image Source: Zacks Investment Research

Tale of Growth: Amazon’s Edge

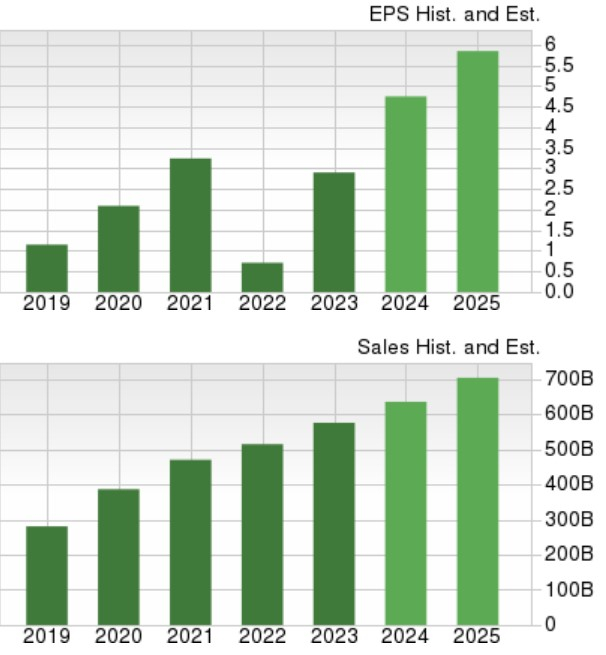

Examining the growth prospects of these retail giants, Amazon’s trajectory appears more enticing. Projections indicate a robust growth in annual earnings, with a 63% expected climb in fiscal 2024 to $4.74 per share compared to $2.90 in FY23. Moreover, FY25 is forecasted to witness another 23% increase.

The pivotal role played by Amazon Web Services (AWS) in the company’s expansion is evident, with total sales anticipated to rise over 10% in FY24 and FY25, nearing $700 billion. The dominance of Amazon’s AWS segment is evident from the 18% increase in sales during Q2, totaling $26.28 billion.

Image Source: Zacks Investment Research

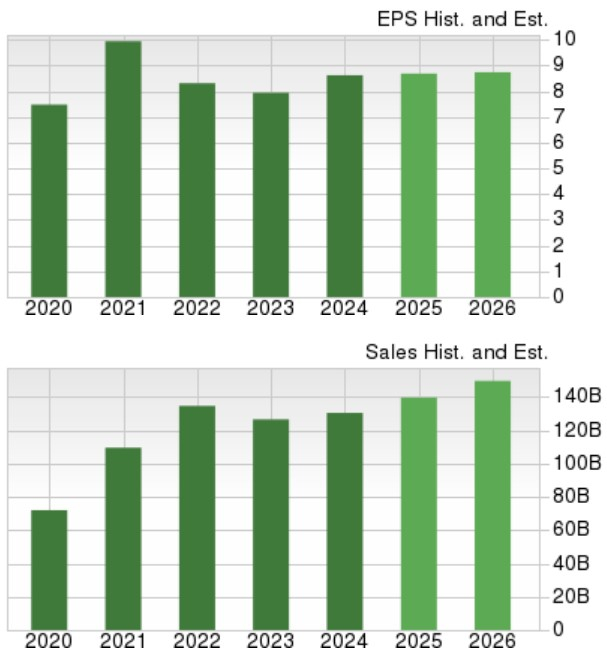

Alibaba, although diversified beyond e-commerce into cloud computing, has experienced a slowdown in earnings growth in recent times. While EPS growth is modest in FY25, anticipated to be up by around 1%, projections for FY26 indicate a marginal increment to $8.74 per share. On the upside, Alibaba’s top-line growth is forecasted to expand by 7% in FY25 and FY26, edging closer to $150 billion in annual sales.

Image Source: Zacks Investment Research

Value Proposition: Alibaba’s Appeal

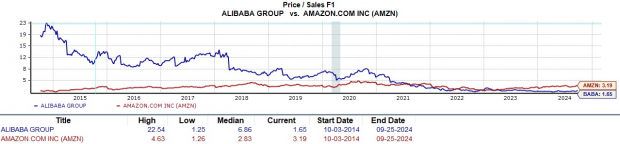

Despite Amazon’s promising growth outlook, value investors may find Alibaba’s stock more attractive. Even amidst the recent rally, Alibaba continues to trade at just 10.9X forward earnings, a substantial discount compared to the industry average of 28.7X. In contrast, Amazon’s forward earnings multiple stands at 40.5X, a notable premium over the S&P 500’s 24.2X.

Image Source: Zacks Investment Research

Furthermore, Alibaba boasts a price-to-sales ratio of less than 2X, while Amazon stands at 3.1X.

Image Source: Zacks Investment Research

Finances Unveiled: A Comparative Glance

Delving into the balance sheets, Amazon closed Q2 2024 with $89 billion in cash & equivalents, whereas Alibaba reported $68 billion.

Image Source: Zacks Investment Research

In terms of total assets and liabilities, Alibaba shines with $245.63 billion in assets compared to $102.18 billion in liabilities, while Amazon listed total assets at $554.81 billion and total liabilities at $318.37 billion.

Image Source: Zacks Investment Research

Final Thoughts

Currently, both Alibaba and Amazon carry a Zacks Rank #3 (Hold). Amazon may appeal more to growth investors, whereas value investors might lean towards Alibaba’s stock. While potential buying opportunities may emerge post the recent surge, these e-commerce stocks remain viable long-term investments.

Infrastructure Stock Boom to Sweep America

A massive initiative to revamp the dilapidated U.S. infrastructure is on the horizon. It’s a bipartisan, critical, and inevitable move that will see trillions invested and fortunes amassed.

The key question lingers – “Will you invest in the right stocks early when their growth potential is at its peak?”

Zacks has unveiled a Special Report to guide you in this endeavor, and it’s free today. Discover 5 companies poised to reap the most benefits from the monumental scale of construction, renovation, transportation, and energy transformation.

Disclaimer: No external links or promotional content included for optimal focus on financial analysis.