Sage Therapeutics, Inc. SAGE dropped a bombshell. Partner Biogen BIIB has waved the white flag on their joint pursuit of the investigational neurological asset, SAGE-324, post a phase II turmoil. The study investigating SAGE-324’s impact on essential tremor missed the mark come July.

Mark your calendars. The curtain call for this partnership will be on Feb. 17, 2025.

Now, after BIIB’s somber exit, Sage Therapeutics retains full custody and rights over SAGE-324. What comes next? Sage Therapeutics will pivot to explore other potentials lying within SAGE-324.

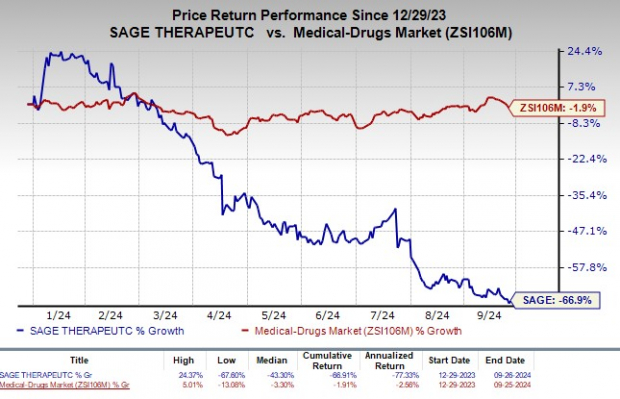

For Sage Therapeutics, the year has been turbulent. Share values have nosedived by 66.9%, putting them at odds with the industry’s meager 1.9% slump.

Image Source: Zacks Investment Research

The Treaty Comes to a Close

Summer brought a bleak day when Sage Therapeutics and Biogen unveiled the top-line results from the KINETIC 2 trial, where SAGE-324 was under scrutiny as a potential antidote to essential tremor. Alas, the study failed to showcase a significant dose-response correlation concerning the primary goal amid participants battling ET.

In light of this setback, both SAGE and BIIB agreed to pull the plug on any further progress concerning SAGE-324’s role in treating ET.

Noteworthy is the fact that Sage Therapeutics already markets Zurzuvae (zuranolone), an antidepressant, in collaboration with Biogen.

Zurzuvae, the pioneer and lone oral treatment intended for adults grappling with postpartum depression (PPD), received FDA approval in August 2023 and hit the markets commercially by December.

The revenue-sharing pact mandates Sage Therapeutics and Biogen to evenly split profits and losses in the US market. Beyond US borders, Biogen steers clear, hoisting the burden of product sales (excluding Japan, Taiwan, and South Korea), and shells out royalties to Sage Therapeutics.

Both entities are actively staking their claim in positioning Zurzuvae as the premier remedy and benchmark therapy for PPD-afflicted women.

Unfortunately, a spanner in the works arrived via an FDA-issued complete response letter concerning the new drug application (NDA) for zuranolone’s deployment in treating adults with major depressive disorder. The FDA pinpointed a lack of substantial proof testing the NDA’s effectiveness and hinted at the need for additional clinical trials.

Our protagonists at Sage Therapeutics are hard at work, devising a plan of action in response to this roadblock.

SAGE’s Zacks Rank: A Hold

Presently, Sage Therapeutics bears a Zacks Rank #3 denoting a “Hold” recommendation.

For investors eyeing the biotech landscape, two prized contenders are Krystal Biotech, Inc. KRYS and Fulcrum Therapeutics, Inc. FULC, which proudly flaunt a Zacks Rank #1 (“Strong Buy”) badge.

A revival from adversity shines on Krystal Biotech’s horizon with estimates for its 2024 earnings per share soaring from $2.09 to $2.38 over the past 60 days. As for 2025, the prediction swings from $4.33 to $7.31. This upbeat forecast has seen KRYS shares ascend by 43.8% year to date.

Meanwhile, Fulcrum Therapeutics recounts a trimming of its expected 2024 loss per share from $1.33 to 28 cents within the past 60 days. As for 2025, the anticipated loss has narrowed from $1.71 to $1.14. Despite the downtrend, investors have witnessed FULC’s earnings outstripping projections in all of the last four quarters, commanding an average surprise of 393.18%.

Market News and Data brought to you by Benzinga APIs